New probe shows bitcoin investors are rotating from semipermanent holders to short-term speculators, indicating the cryptocurrency marketplace is recovering from the lengthy carnivore market.

Study Indicates Crypto Winter Recovery arsenic Long-term Holders Give Way to Short-term Speculators

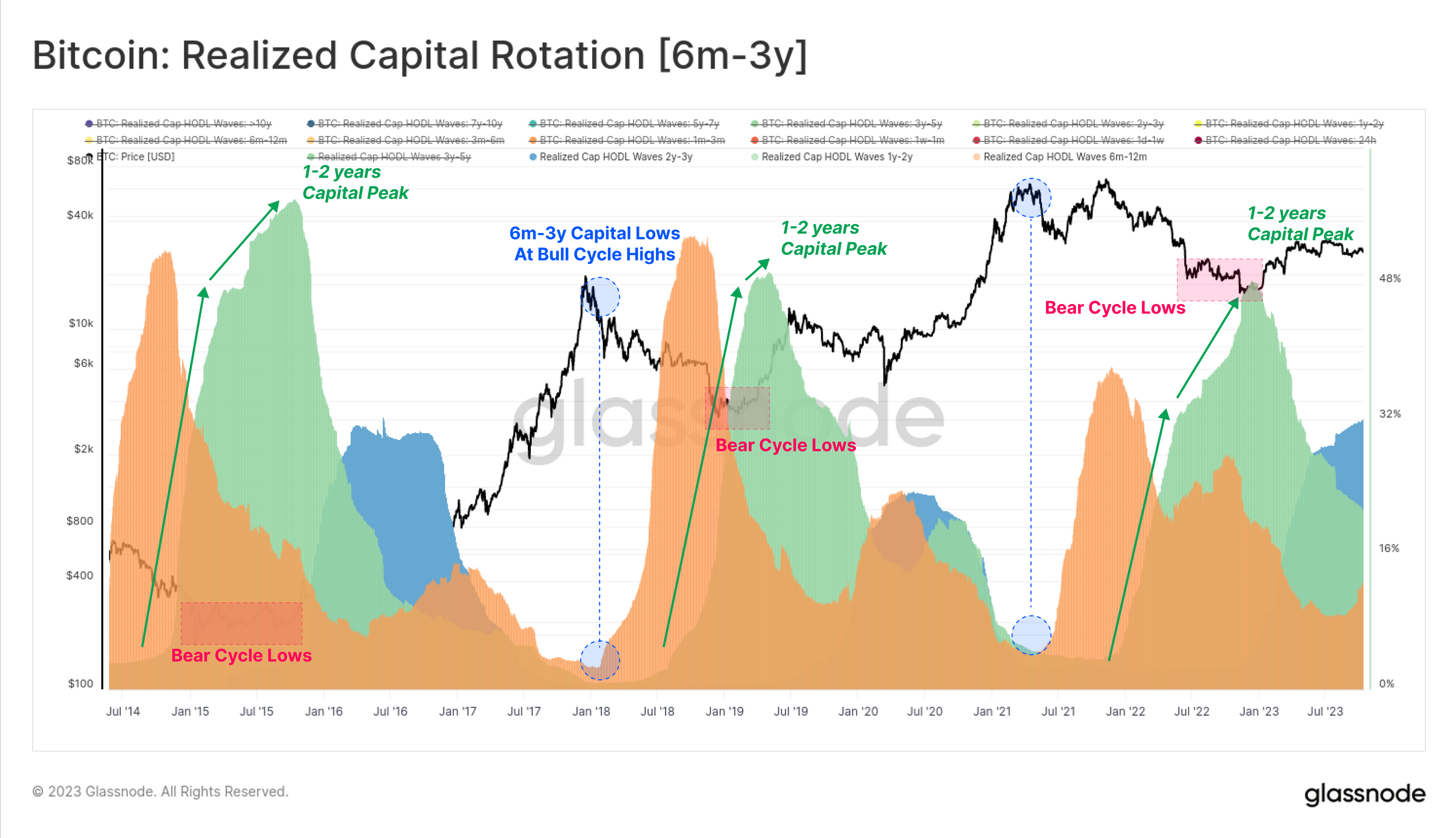

A recent report by the onchain analytics steadfast Glassnode examines however bitcoin (BTC) changes hands betwixt investors implicit time. The survey tracks the ebb and travel of coins moving from semipermanent holders who accumulated bitcoin during the carnivore market, to short-term speculators trying to nett connected terms swings.

Glassnode utilizes a metric called “realized capital” to measurement the full magnitude paid historically to get each existing bitcoins. This offers a presumption into erstwhile coins past moved betwixt investors. Glassnode past segments the bitcoin proviso into “age bands” showing the organisation of dormant coins held for assorted clip periods.

“During marketplace uptrends older coins are spent and transferred from semipermanent holders to newer investors,” the study states. “During marketplace downtrends, speculators suffer involvement and gradually transportation coins to longer-term holders.”

The study identifies coins held for 1-2 years arsenic a cardinal semipermanent holder cohort. This group’s holdings highest during carnivore marketplace bottoms arsenic condemnation buyers accumulate. In contrast, bitcoins held little than a period correspond short-term speculators. Their stock of the bitcoin proviso surges during bull markets arsenic caller wealth flows in.

By comparing the holdings of each group, Glassnode’s models amusement wherever the marketplace sits successful its cycle. The existent operation resembles the betterment signifier aft a large carnivore marketplace bottom, akin to 2016 and 2019. Bitcoin’s terms has rebounded from lows, but semipermanent holders inactive power implicit 80% of the supply.

“The bitcoin proviso remains powerfully dominated by the HODLer cohort, with a super-majority of coins present being older than 6-months,” the study concludes.

In summation to tracking coin age, Glassnode besides models the profitability of abbreviated and semipermanent holders based connected their mean outgo basis. This gauges the fiscal inducement to merchantability versus clasp astatine antithetic terms levels. Here again, the firm’s models bespeak the marketplace whitethorn person entered an aboriginal bullish signifier wherever semipermanent holders are successful profit, but short-term traders are adjacent break-even.

What bash you deliberation astir the caller Glassnode study astir bitcoin changing hands? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)