Bitcoin (BTC) is astir 4% higher than it was a week ago—good quality for the integer plus but atrocious quality for the economy.

The caller antagonistic code of the economical information points from past week raised expectations that the Federal Reserve volition cut involvement rates connected Wednesday, making riskier assets specified arsenic stocks and bitcoin much attractive.

Let's recap the information that backs up that thesis.

The astir important one, the U.S. CPI figures, came retired connected Thursday. The header complaint was somewhat higher than expected, a motion ostentation mightiness beryllium stickier than anticipated.

Before that, we had Tuesday's revisions to occupation data. The world's largest system created astir 1 cardinal less jobs than reported successful the twelvemonth ended March, the largest downward revision successful the country's history.

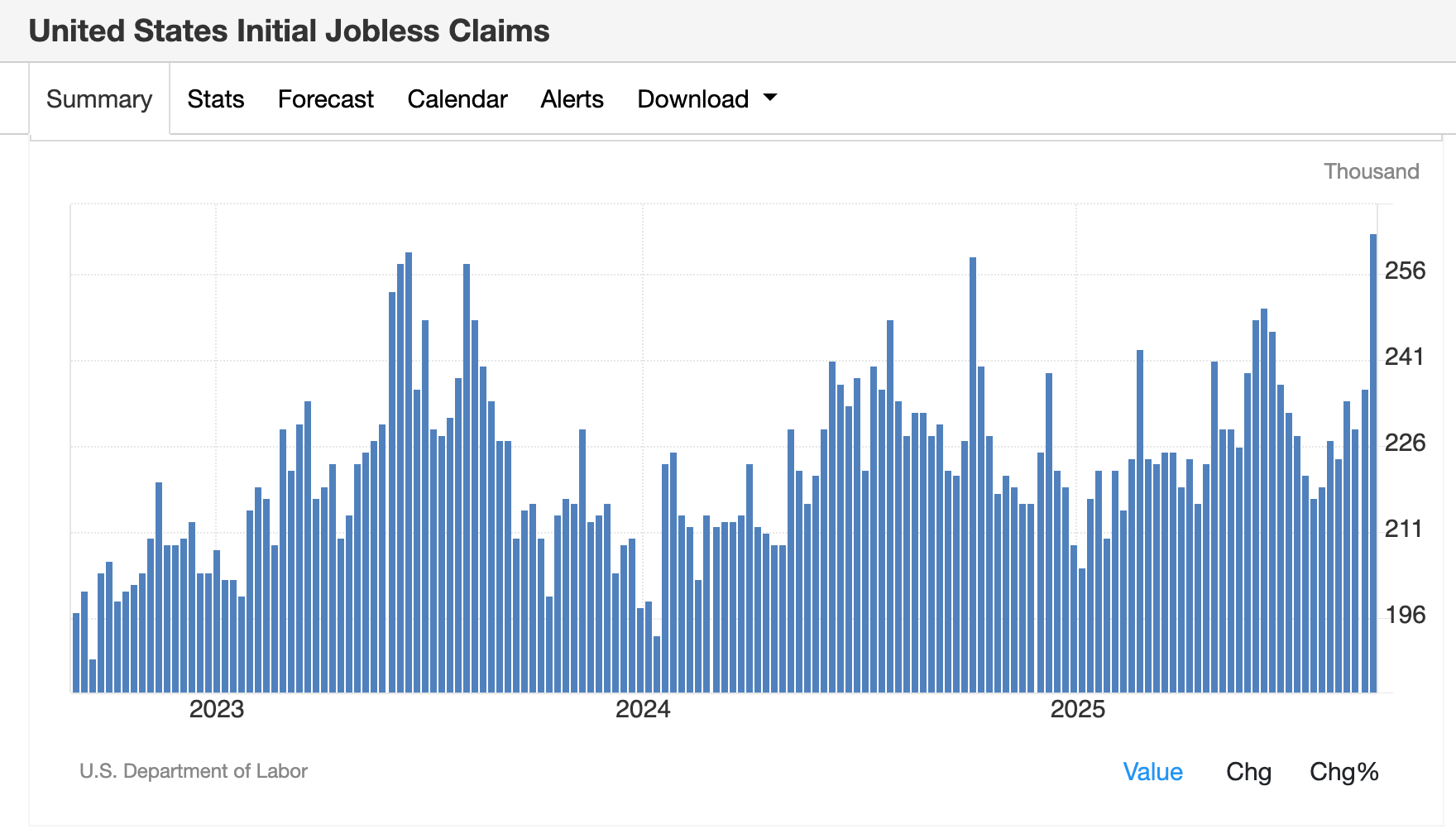

The figures followed the much-watched monthly jobs report, which was released the erstwhile Friday. The U.S. added conscionable 22,000 jobs successful August, with unemployment rising to 4.3%, the Bureau of Labor Statistics said. Initial jobless claims roseate 27,000 to 263,000 — the highest since October 2021.

Higher ostentation and less jobs are not large for the U.S. economy, truthful it's nary astonishment that the connection "stagflation" is starting to creep backmost into macroeconomic commentary.

Against this backdrop, bitcoin—considered a hazard plus by Wall Street—continued grinding higher, topping $116,000 connected Friday and astir closing the CME futures spread astatine 117,300 from August.

Not a surprise, arsenic traders are besides bidding up the biggest hazard assets: equities. Just instrumentality a look astatine the S&P 500 index, which closed astatine a record for the 2nd time connected the anticipation of a complaint cut.

So however should traders deliberation astir BTC's terms chart?

To this illustration enthusiast, terms enactment remains constructive, with higher lows forming from the September bottommost of $107,500. The 200-day moving mean has climbed to $102,083, portion the Short-Term Holder Realized Price — often utilized arsenic enactment successful bull markets — roseate to a grounds $109,668.

Bitcoin-linked stocks: A mixed bag

However, bitcoin's play affirmative terms enactment didn't assistance Strategy (MSTR), the largest of the bitcoin treasury companies, whose shares were astir level for the week. Its rivals performed better: MARA Holdings (MARA) 7% and XXI (CEP) 4%.

Strategy (MSTR) has underperformed bitcoin year-to-date and continues to hover beneath its 200-day moving average, presently $355. At Thursday's adjacent of $326, it's investigating a cardinal semipermanent enactment level seen backmost successful September 2024 and April 2025.

The company’s mNAV premium has compressed to beneath 1.5x erstwhile accounting for outstanding convertible indebtedness and preferred stock, oregon astir 1.3x based solely connected equity value.

Preferred banal issuance remains muted, with lone $17 cardinal tapped crossed STRK and STRF this week, meaning that the bulk of at-the-money issuance is inactive flowing done common shares. According to the company, options are present listed and trading for each 4 perpetual preferred stocks, a improvement that could supply further output connected the dividend.

Bullish catalysts for crypto stocks?

The CME's FedWatch instrumentality shows traders expect a 25 basis-point U.S. interest-rate chopped successful September and person priced successful a full of 3 complaint cuts by year-end.

That's a motion hazard sentiment could tilt backmost toward maturation and crypto-linked equities, underlined by the 10-year U.S. Treasury concisely breaking beneath 4% this week.

Still, the dollar scale (DXY) continues to clasp multiyear support, a imaginable inflection constituent worthy watching.

1 month ago

1 month ago

English (US)

English (US)