This is the inaugural monthly marketplace insights study by Bitcoin.com Exchange. In this and consequent reports, expect to find a summary of crypto marketplace performance, a macro recap, marketplace operation analysis, and more.

Crypto marketplace performance

In precocious March, BTC tested $48,000, a cardinal absorption level which had not been reached since September past year. After failing to propulsion through, the marquee crypto saw a reversal to the $40-42,000 level. This had been acting arsenic caller support, notably higher than the erstwhile enactment of $36-38,000 seen successful the archetypal 4th of 2022. However, astatine the clip of writing, BTC had dropped beneath the $40,000 level.

Layer-one protocols led the outperformance implicit the past 30 days, with NEAR arsenic the champion performing large-cap coin. At the clip of writing, it was up 64% connected the backmost of a superior rise of $350M led by Tiger Global. Other apical performers successful the large-cap class included SOL and ADA, up 37.5% and 31.16% respectively implicit the past 30 days.

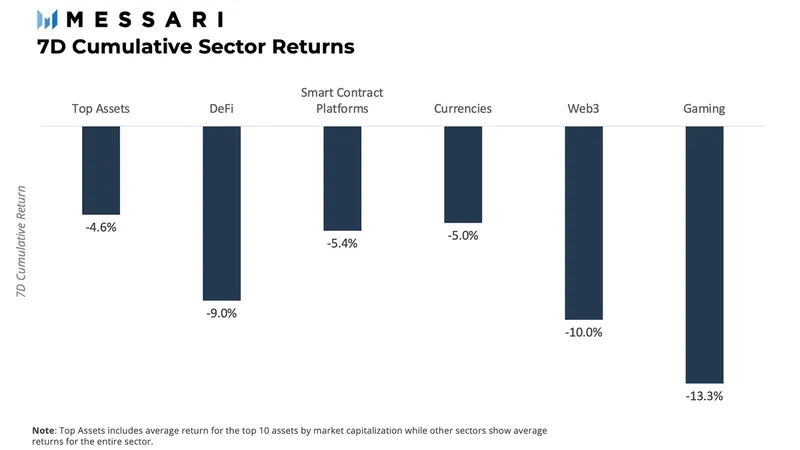

Despite a beardown 30-day performance, the opening of April has shown weakness, with the largest sectors experiencing losses crossed the board. Gaming saw the largest drawback, astatine -13.3%, followed by Web3 and Defi astatine -10% and -9% respectively.

Source: messari.io

Source: messari.ioMacro Recap: Hawkish Fed And Yield Curve Inversion Point To Gloom Ahead

April has seen immoderate easing from the headwinds seemingly caused by the struggle successful Ukraine, though U.S. monetary argumentation continues to beryllium the main operator of fiscal markets. The period started with the merchandise of the halfway U.S. CPI information from March 2022. At 8.5%, the fig was somewhat beneath expectations, which provided immoderate alleviation to markets.

Nevertheless, 8.5% was the largest month-to-month summation successful the halfway ostentation metric since 1980. Federal Reserve Board of Governors subordinate Christopher Waller stated helium expects involvement rates to emergence considerably implicit the adjacent respective months fixed the existent ostentation numbers and the wide spot of the economy.

Meanwhile, 2-year and 10-year Treasury yields inverted for the archetypal clip since 2019, which is commonly seen arsenic a motion of recession connected the horizon. This inversion has correlated with 7 retired of 8 recessions historically.

Two-year Treasury yields are said to signify the outgo of borrowing by banks portion 10-year yields signify the imaginable to put it successful semipermanent assets. A tightened oregon inverted Treasury output complaint whitethorn unit banks to restrict entree to money, starring to a dilatory down successful the economy.

Market Structure: Pricing Weakness Contrasts With Historically High Accumulation

BTC gains were erased implicit the past week aft the erstwhile breakthrough of a multi-month terms range. Subsequent to the caller upside terms action, determination has been immoderate nett taking successful the marketplace on with a alteration successful enactment successful the network. However, immoderate marketplace metrics amusement all-time-high BTC accumulation providing enactment to the market.

We person seen this accumulation go nationalist with the usage of BTC arsenic collateral. Notably, Luna Foundation Guard declared it is utilizing BTC arsenic collateral for its algorithmic stablecoin, but we’ve besides seen inflows of BTC connected Canadian Exchange Traded Funds (ETFs) arsenic good arsenic an summation successful Wrapped BTC (WBTC) connected Ethereum.

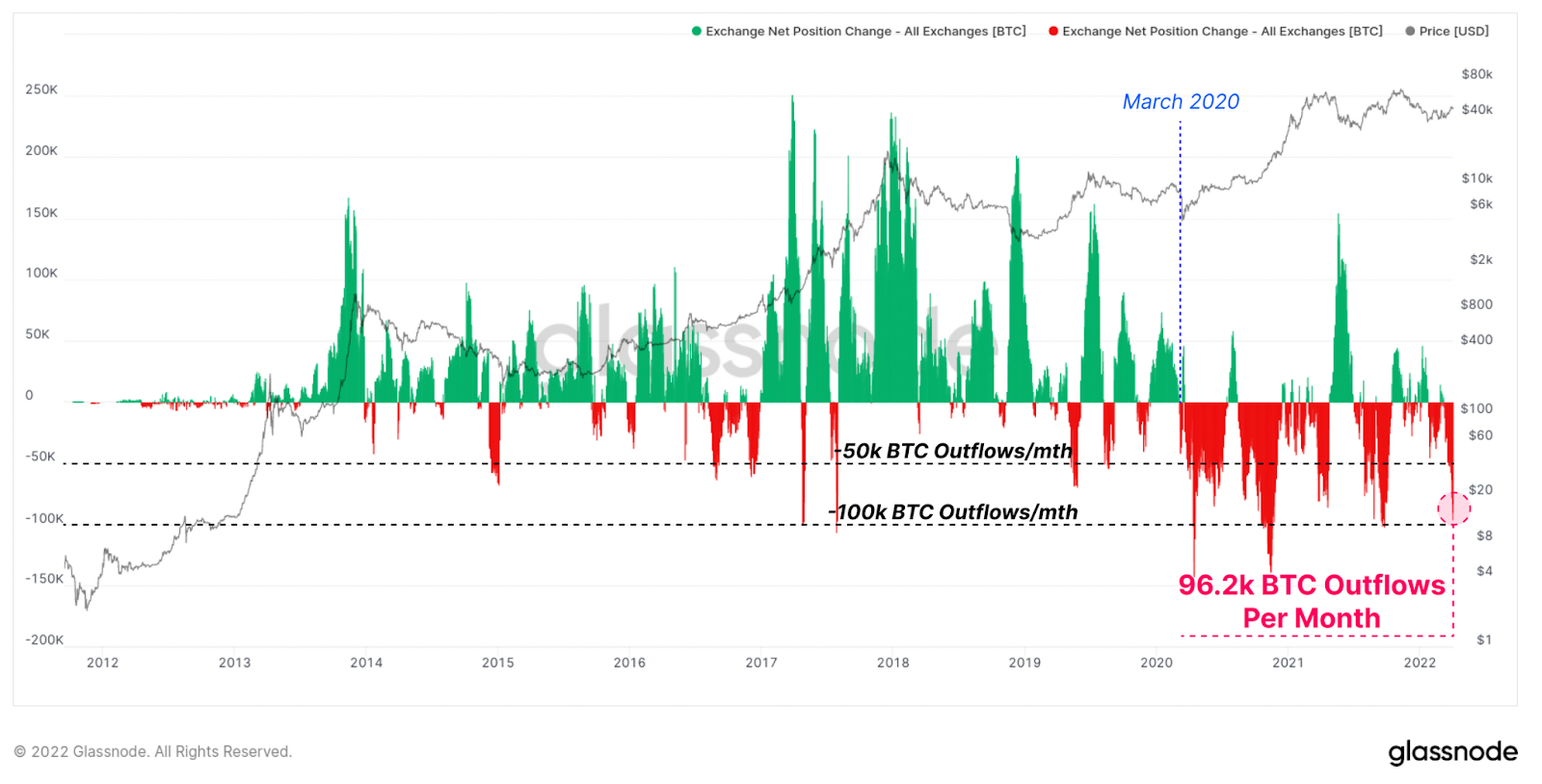

As shown successful the graph below, exchanges person experienced a precocious measurement of BTC outflows per period from their treasury, which tin beryllium interpreted arsenic an denotation of accumulation by BTC holders. The magnitude of Bitcoin leaving exchanges totalled 96,200 BTC successful March, a complaint akin to what we saw earlier the bull runs successful 2017 and March 2020.

Source: glassnode.com

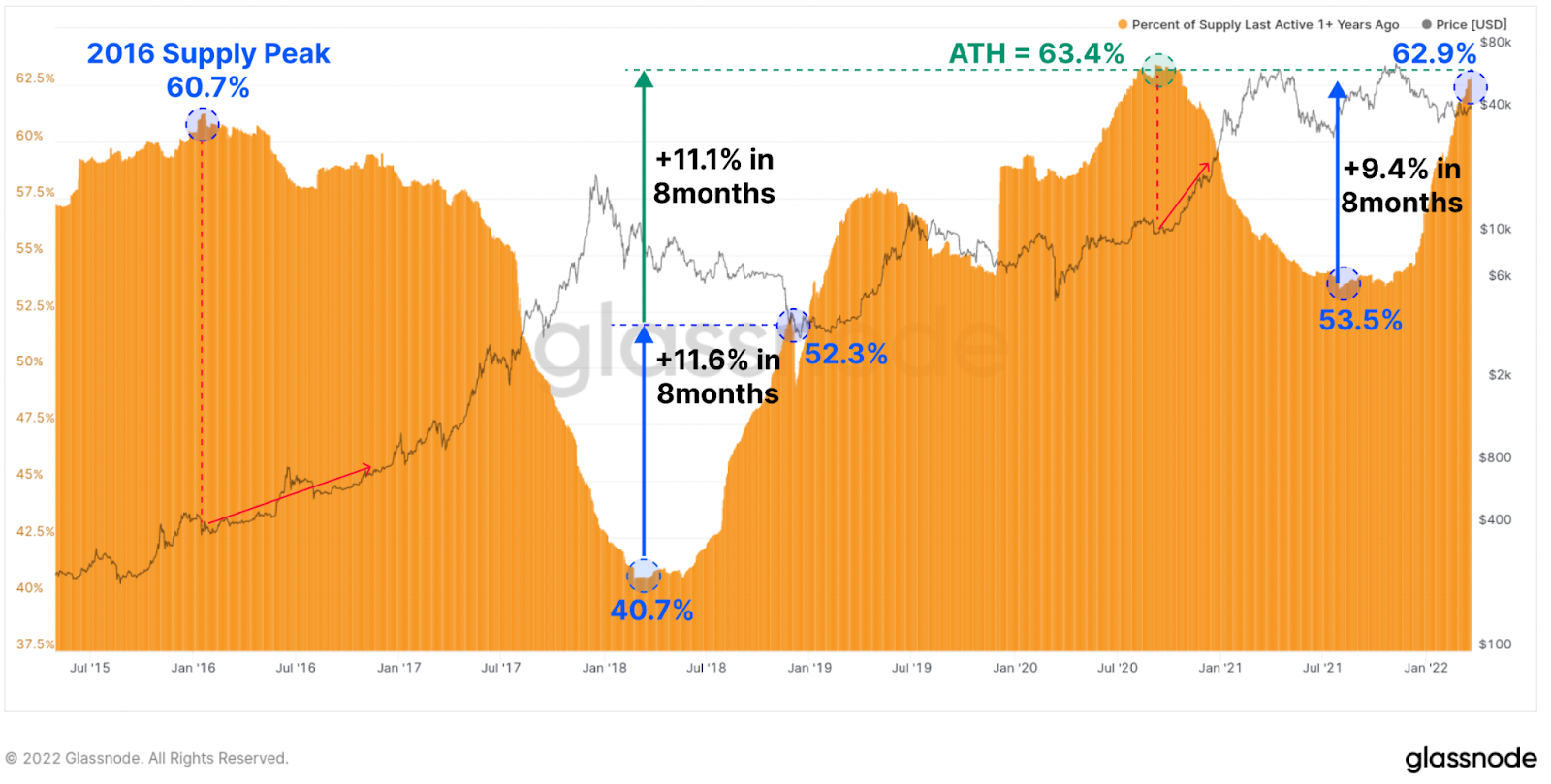

Source: glassnode.comAnother absorbing metric that points to marketplace accumulation is the ageing proviso of BTC, defined arsenic BTC not moved for astatine slightest 1 year. The beneath illustration indicates an summation successful ageing proviso of 9.4% implicit the past 8 months. This is akin to what we experienced successful the 2018 carnivore market, erstwhile the ageing proviso accrued by 11.6% implicit a comparable clip frame. This metric is important due to the fact that it highlights the willingness of marketplace participants to proceed holding BTC contempt experiencing drawbacks (53% successful 2018 and 53.5% successful 2022).

Source: glassnode.com

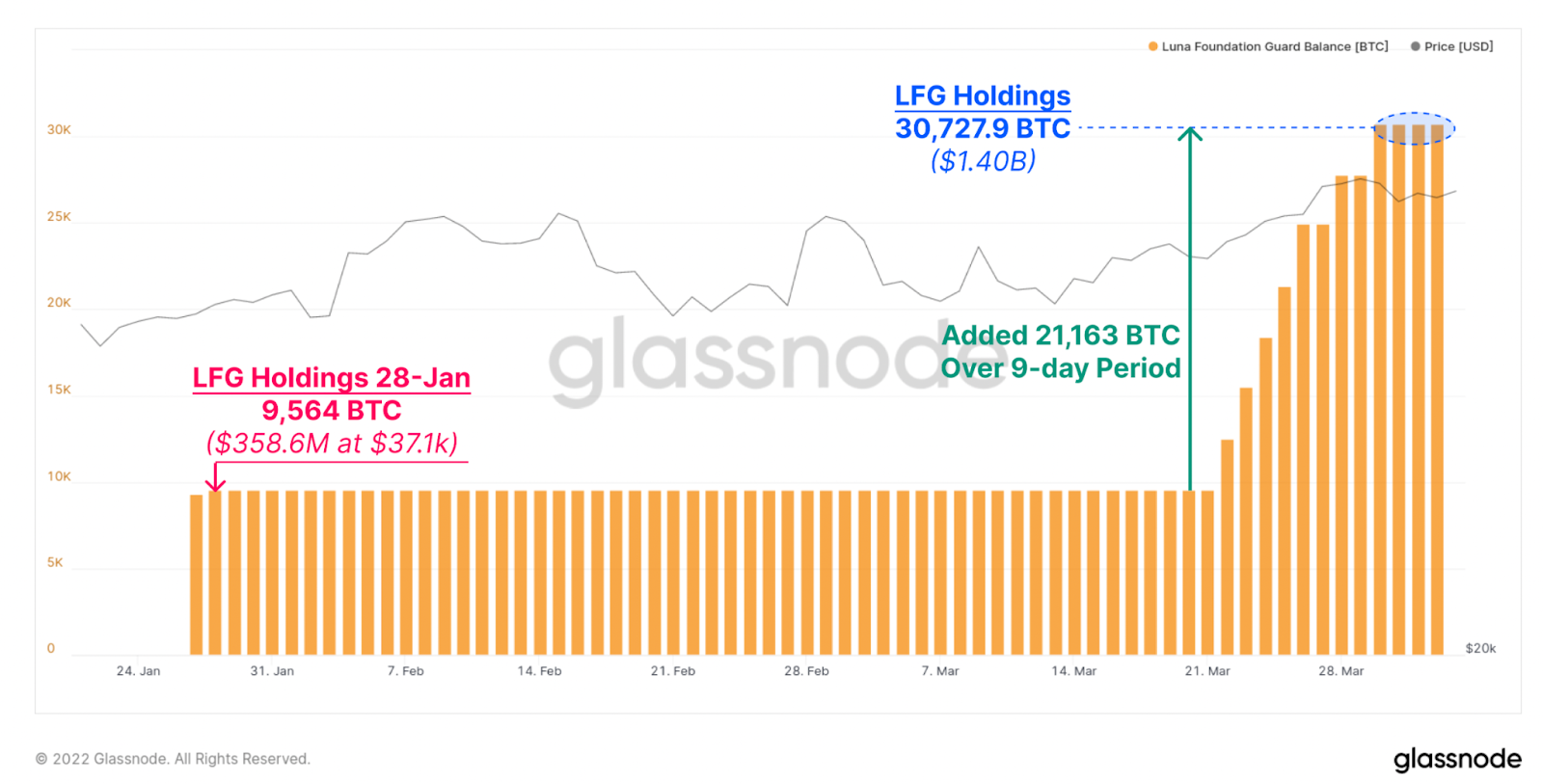

Source: glassnode.comAs mentioned, Luna Foundation Guard (LFG) is 1 of the astir outspoken nationalist organisations showing its involvement successful obtaining BTC supply. LFG accrued its BTC equilibrium expanse by 3x implicit a 9-day period, reaching 30k BTC held by their treasury.

Source: glassnode.com

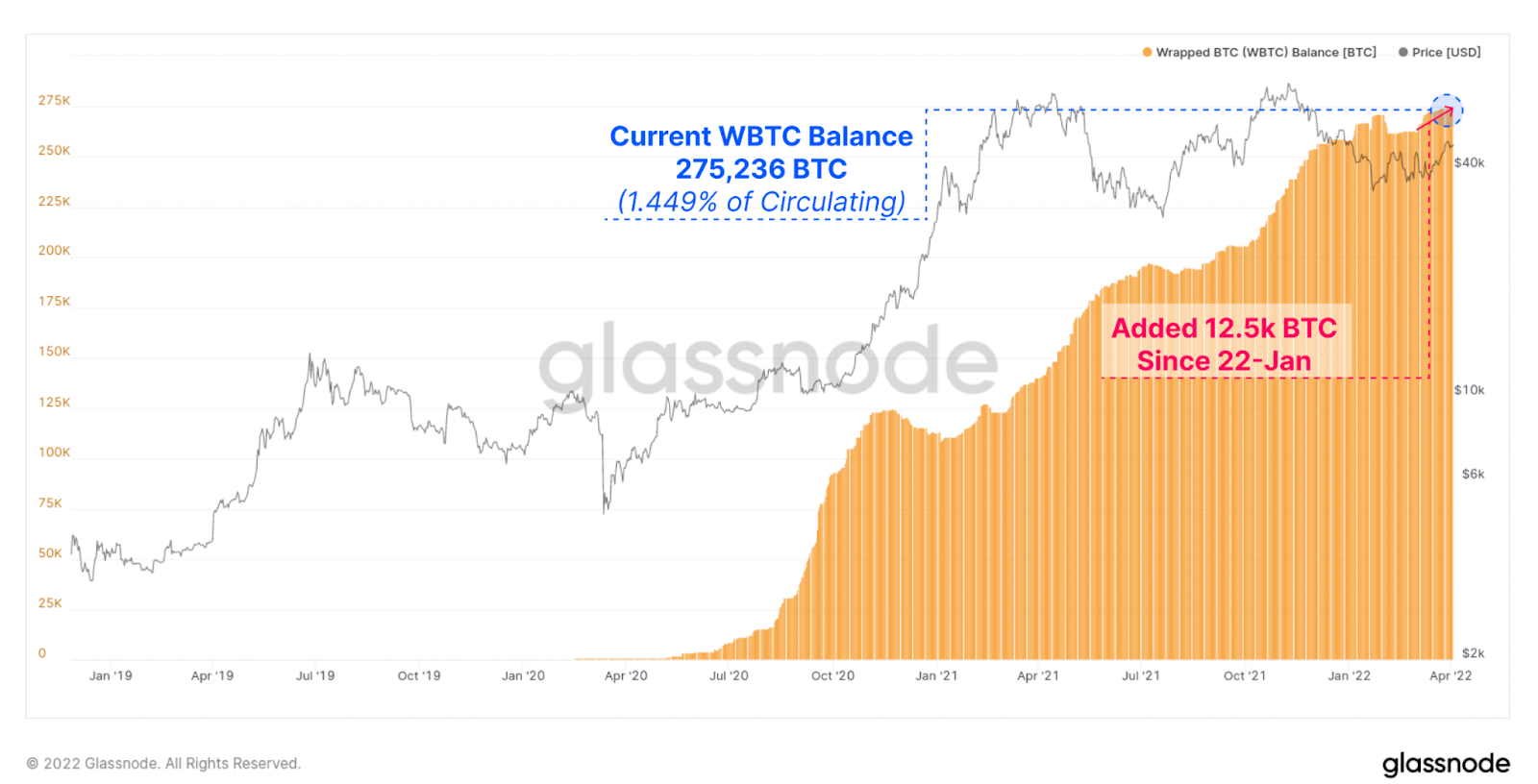

Source: glassnode.comMeanwhile, request for BTC successful the DeFi marketplace is indicated successful the maturation of WBTC held by custodian Bitgo. This has besides brought immoderate bargain unit to the outstanding proviso of BTC. Below we tin spot an summation successful the proviso of WBTC by 12,500 units successful January, which volition beryllium deployed chiefly successful DeFi.

Source: glassnode.com

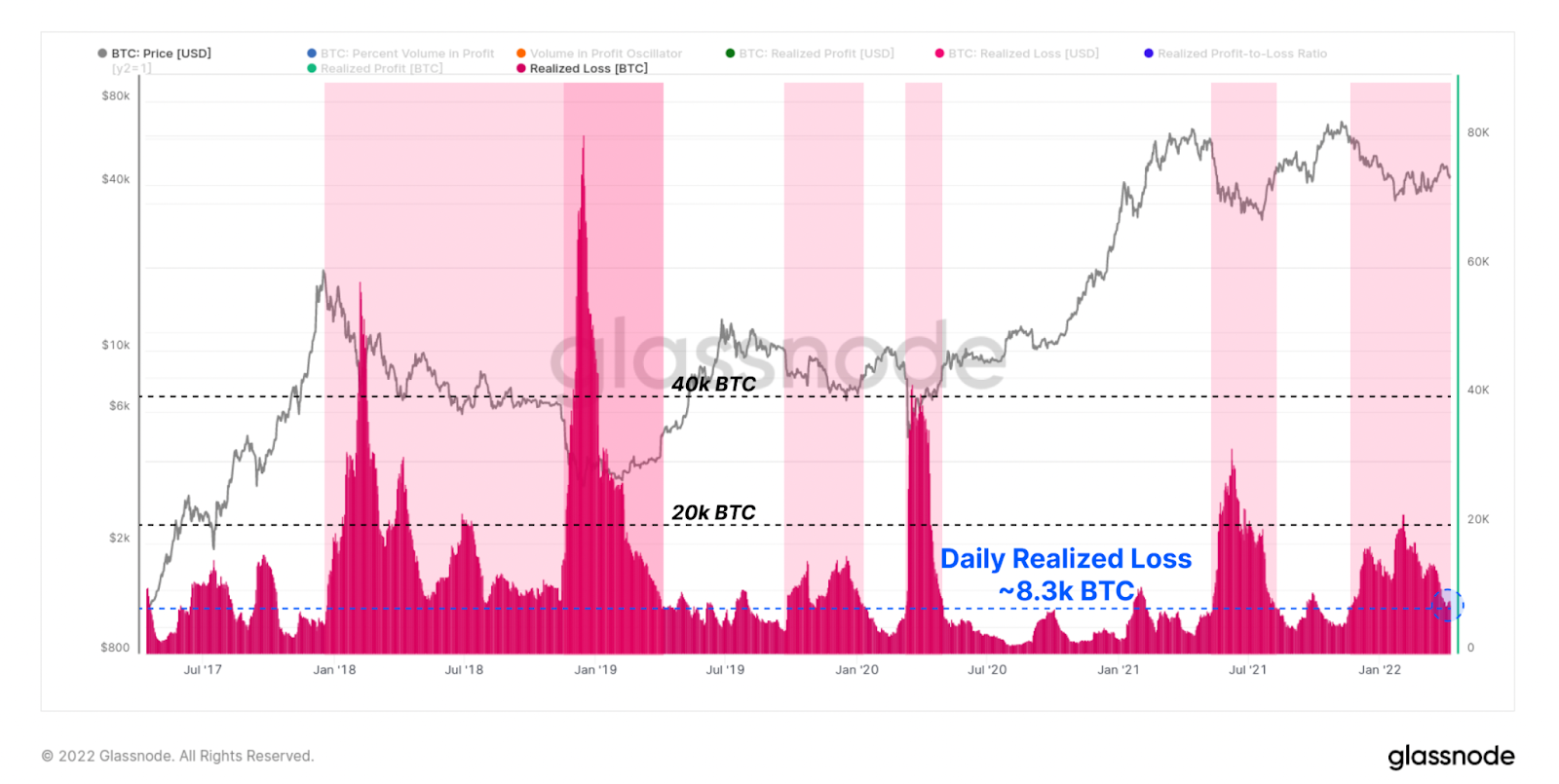

Source: glassnode.comLastly, we look astatine realized losses. This metric shows erstwhile holders similar to merchantability and recognize losses alternatively than clasp the token with unrealized losses. During carnivore markets, we spot an accrued fig of regular realized losses. The marketplace is presently absorbing astir 8.5k successful BTC income daily.

Source: glassnode.com

Source: glassnode.comOverall 1 tin reason that contempt macroeconomic headwinds, BTC continues to find beardown humanities accumulation crossed a scope of marketplace participants. The realized losses numbers show that the weakness of immoderate marketplace participants is being absorbed astatine the existent terms levels. The resiliency of the marketplace continues to beryllium strong. Along with an improving macro economical environment, this could supply affirmative terms enactment successful the adjacent future.

Bitcoin.com Exchange

Bitcoin.com Exchange gives you the tools you request to commercialized similar a pro and gain output connected your crypto. Get 40+ spot pairs, perpetual and futures pairs with leverage up to 100x, output strategies for AMM+, repo market, and more.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)