This is the June 2022 monthly marketplace insights study by Bitcoin.com Exchange. In this and consequent reports, expect to find a summary of crypto marketplace performance, a macro recap, marketplace operation analysis, and more.

Crypto Market Performance

Crypto markets continued connected a downtrend arsenic BTC and ETH were down 30% and 44% respectively implicit the past 30 days.

The macroeconomic outlook continues to beryllium unfavorable for hazard assets arsenic precocious ostentation combines with elevated commodity prices and choky U.S. labour marketplace conditions. Adding to that, crypto has experienced a recognition situation arsenic large borrow/lend players specified arsenic Celsius, 3AC, and Babel Finance person gone insolvent.

Despite the large losses seen connected BTC and ETH, immoderate ample headdress assets person held strong. Out of the apical 50 assets by marketplace cap, Helium performed astir positively, gaining 33% implicit the past 30 days. LEO was up 11.20% and LINK remained practically unchanged. The largest underperformance was seen by AVAX which was down 44%, Bitcoin Cash (down 39%), and Cronos (down 40%).

Macro Recap: Commodities Pressure Despite Central Banks Actions

In the latest FOMC meeting, for the archetypal clip since 1994, the U.S. Federal Reserve accrued rates by 75 ground points. This was connected the backmost of continued precocious CPI data, which came successful astatine 8.1% for May 2022 (the highest since 1981). Labor conditions successful the U.S. stay choky arsenic April numbers (released connected June 1) showed occupation openings came down lone somewhat to 11.4M aft posting grounds highs of 11.8M for March. Chairman Powel hinted astatine different complaint hike of betwixt 50 to 75 bps, which would beryllium announced successful the FOMC’s July 2022 meeting.

As cardinal banks tighten, proviso concatenation issues combined with governmental instability proceed to propulsion commodities prices higher. Oil led the way, with airy lipid futures reaching $120 USD per tube earlier stabilizing supra $105 successful the latest trading sessions. Supply/demand continues to equilibrium towards higher demand. Despite immoderate request demolition from precocious lipid prices, the proviso concatenation constraints owed to sanctions against Russian exports person kept proviso tight.

Market Structure: Forced Capitulation A Sign Of Local Bottom?

BTC markets person seen 2 forced merchantability offs of important size successful a month’s clip span. First was the liquidation of assets by Luna Foundation, which sold up to 80,000 BTC, on with sizeable sums of ETH and different liquid assets. Second was the recognition situation and liquidation of Celsius, 3AC, and Babel Finance. Crypto marketplace capitalization dropped by $2.1T from the all-time-highs reached successful November 2021.

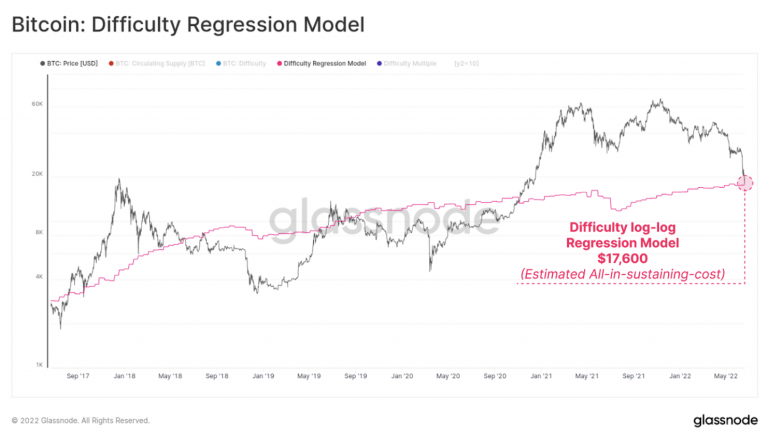

This has enactment unit connected miners, who are besides facing accrued energy costs. As prices proceed to declinem, we tin spot that the profitability for miners diminishes. According to Glassnode’s trouble regression model, the “all-in sustaining cost” of mining presently sits astatine $17,800, which is astir wherever BTC traded past weekend.

With Bitcoin’s hashrate already down 10% from its all-time-high, it seems unprofitable miners are already going offline.

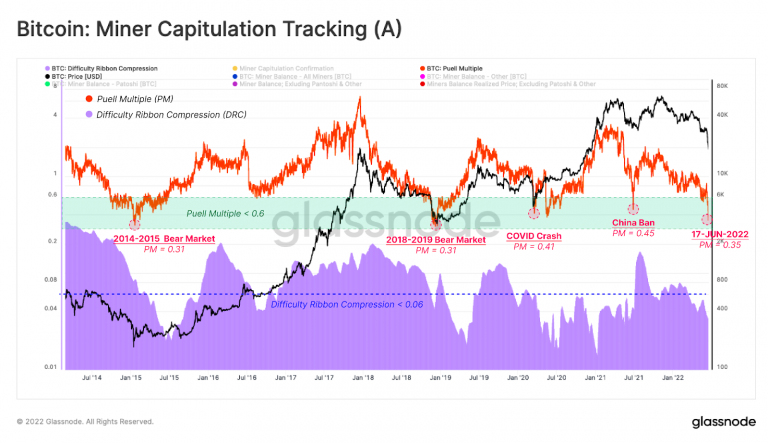

One tin reason that arsenic profitability decreases, miners volition go forced sellers. The Puell Multiple (PM), shown successful orangish successful the illustration below, is an oscillator which tracks the gross generated by miners. The PM is showing a worth of 0.35, which equates to revenues 61% beneath the yearly average. This is adjacent to the levels seen successful the 2014/2015 and 2018/2019 carnivore markets. At that time, miners saw a PM aggregate of 0.31, which equated to a 69% gross diminution vs the yearly average.

The Difficulty Ribbon Compression (DRC), shown successful purple successful the supra chart, is simply a miner’s accent model. It indicates mining rigs going offline. Mining rigs going offline happens for galore reasons. These see regulatory considerations, expanding trouble of the Bitcoin algorithm, expanding energy costs, and of people decreasing profitability owed to little marketplace prices. In the supra chart, we tin spot a alteration successful this metric, which indicates that little rigs are progressive owed to 1 oregon much of the reasons mentioned.

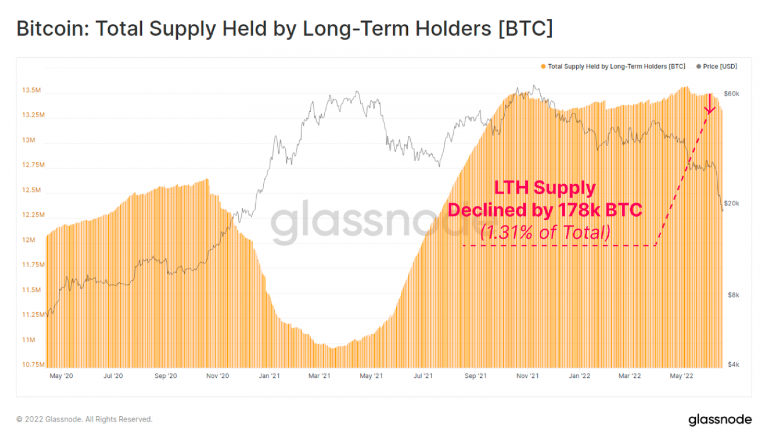

Next, we volition look astatine the Long Time Holders (LTH) cohort. As marketplace participants capitulate, LTHs travel nether stress. As shown below, the LTH cohort has seen a full proviso alteration of 178K BTC implicit the past month, which accounts for 1.31% of the full holdings of this group.

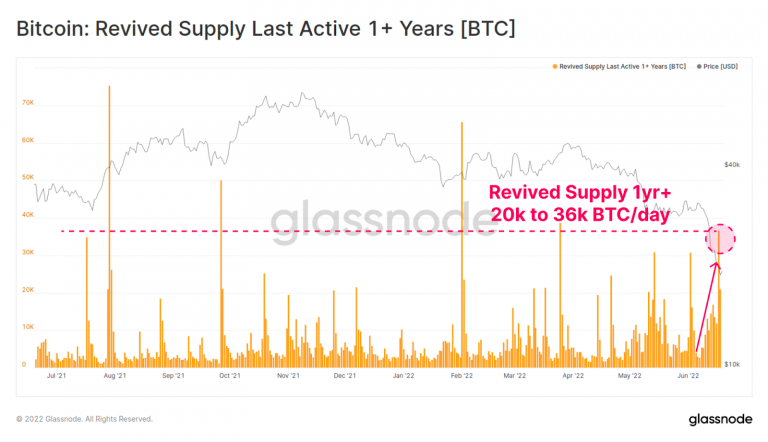

Another absorbing metric to recognize the presumption of the existent merchantability disconnected is the aged proviso being revived. As tin beryllium seen below, astir 20-36K BTC are presently being revived per day, which is akin to levels seen successful April 22. This indicator tin beryllium viewed arsenic a fearfulness index, arsenic it shows the request for semipermanent holders to merchantability their positions owed to the existent conditions.

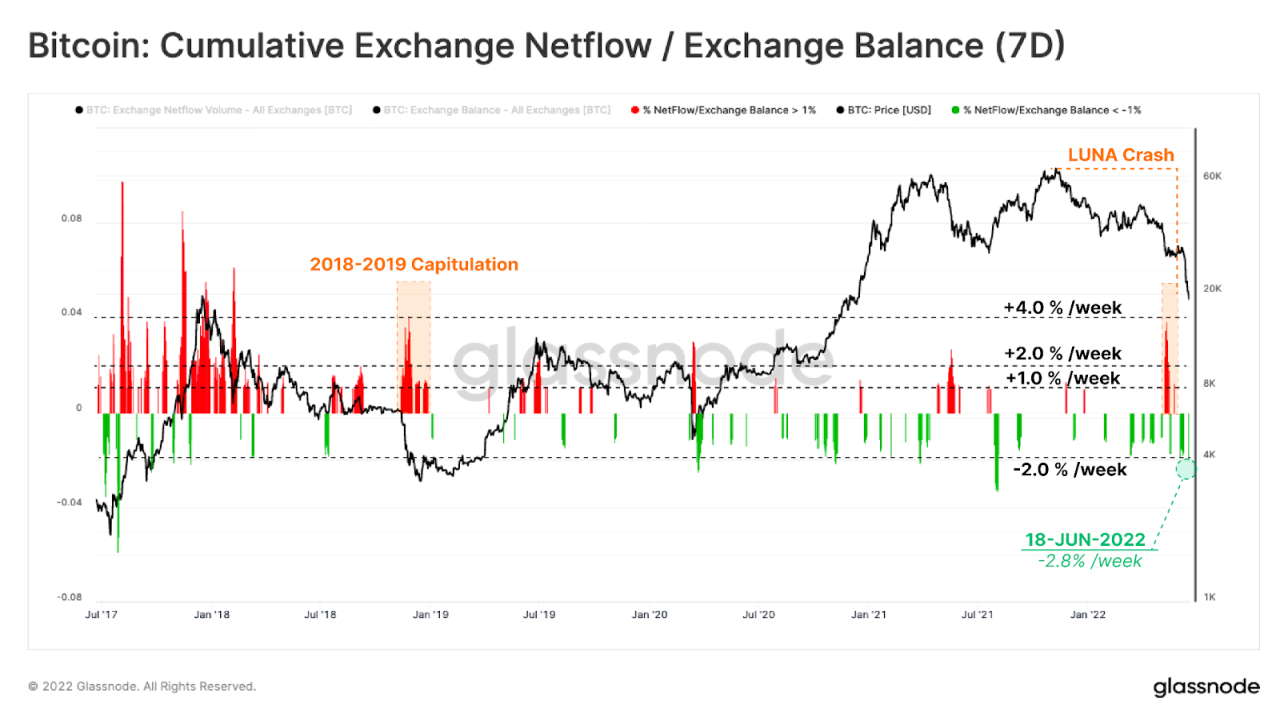

Lastly, we volition look astatine the inflows and outflows from centralized exchanges, besides known arsenic the netflow speech balance. When we spot marketplace inflow to exchanges, we tin presume marketplace participants are looking to merchantability their tokens. When we spot marketplace outflow from exchanges, we tin presume marketplace participants are looking to clasp their tokens.

Below we tin announcement a beardown marketplace inflow successful May 2022 connected the backmost of the LUNA crash, with inflows reaching +4% per week (exchange balance). This was akin to the 2018-2019 merchantability disconnected (>1% of speech equilibrium inflows).

In the latest merchantability disconnected (June), however, we announcement an outflow of 2.8% per week. This tin beryllium attributed to the uniqueness of the merchantability off. As the creditworthiness of immoderate of the largest crypto players came into question, participants whitethorn person been driven to determination their tokens to self-custody, wherever determination is little perceived risk.

In summary, the marketplace experienced back-to-back merchantability offs successful May and June 2022. Although these were precipitated by beardown macroeconomic headwinds, 2 black-swan events (namely the LUNA clang and the insolvency of 3AC and different large players) whitethorn person caused overselling. This whitethorn bespeak that we person already seen a section bottom. In the long-term, however, it’s apt that the macro representation volition proceed to person a beardown power connected the markets.

3 years ago

3 years ago

English (US)

English (US)