This is the May 2022 monthly marketplace insights study by Bitcoin.com Exchange. In this and consequent reports, expect to find a summary of crypto marketplace performance, a macro recap, marketplace operation analysis, and more.

Crypto Market Performance

May got disconnected to a unsmooth commencement arsenic the Federal Reserve confirmed a hawkish bias connected the backmost of lingering inflation. Markets reacted by going risk-off.

The collapse of LUNA and UST added substance to the fire, with the effect that crypto markets saw historically ample drawdowns.

BTC reached a debased of $25.4k USD, which is 60% disconnected its all-time precocious of $65k. ETH saw a comparable drawdown.

Other large-cap coins fared adjacent worse, with AVAX and SOL being down implicit 75% and 80% respectively from their all-time highs.

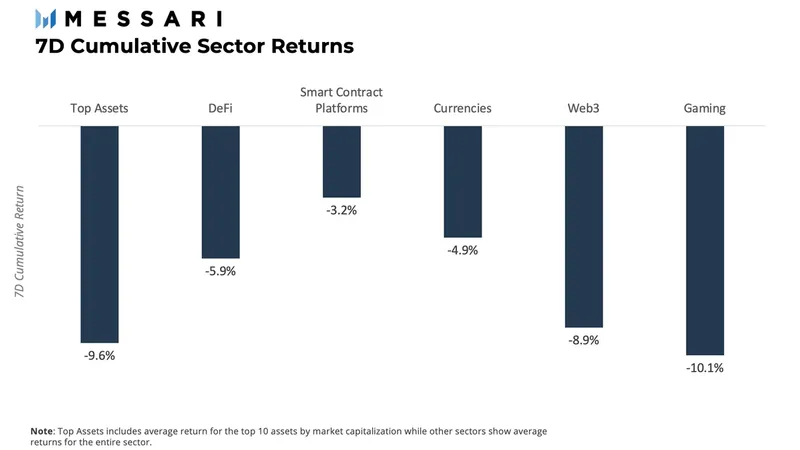

During the archetypal week of the month, gaming (play-to-earn) saw the worst show crossed crypto sectors, followed by apical assets (large caps) with losses of 9.6%, and Web3, which was down 8.9%.

Source: messario.io

Source: messario.ioMacro Recap: Quantitative Tightening (QT) Is Here to Stay

As expected by the market, connected May 3rd the Federal Reserve announced that it had voted for a complaint hike of 50 ground points to the funds rate. This announcement was connected the backmost of “robust” occupation gains and a alteration successful unemployment, which has led to increases successful inflation. There was besides the simplification of the equilibrium sheet, starting from $47B per period to up to $95B per period aft the archetypal 3 months. According to the Federal Reserve’s aboriginal statements, System Open Market Account (SOMA) volition trim its holdings of U.S. bureau indebtedness and U.S. bureau mortgage-backed securities (MBS).

The communicative was focused connected uncertainties regarding the macro environment, arsenic Russia’s penetration of Ukraine intensifies and supply-chain issues successful China lend to lackluster maturation globally.

CPI information provided nary relief, arsenic it marked 8.3% for the period of April, beating expectations by 20 ground points. April’s numbers were down lone somewhat from the 40-year precocious of 8.5% reached successful March.

Market Structure: Decrease successful Flows and Long-Term Holders Continuing Capitulation

As macro conditions look to worsen, we instrumentality a look astatine on-chain metrics to amended recognize terms enactment with the purpose of providing a wide presumption connected what could travel next. There are 2 areas we volition absorption on. These are 1) alteration of profitability by semipermanent holders (and capitulation) and, 2) stablecoin supply/demand.

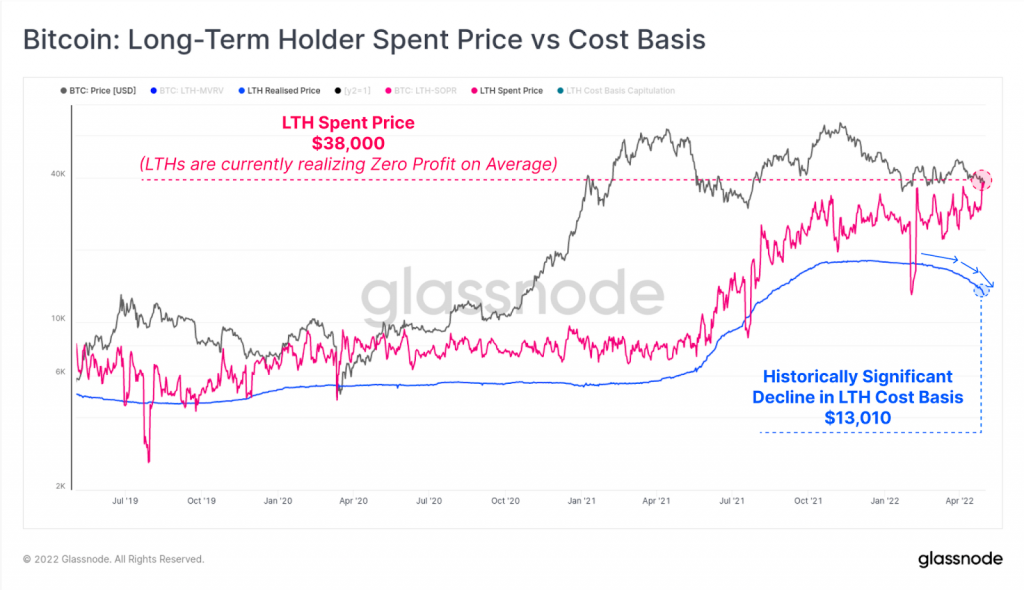

The graph beneath is the Long-Term Holder Spent Price vs Cost Basis, which depicts capitulation successful the marketplace by Long Term Holders (LTHs). The bluish enactment represents the Long-Term Realized Price, which is the mean buying terms of each coins that LTHs hold. This is declining, arsenic you tin spot from the graph, meaning LTHs are selling disconnected their coins. The pinkish enactment represents the mean acquisition terms of the coins being spent by LTHs connected that day. As you tin see, it’s trending higher, meaning that LTHs are selling astatine break-even connected average.

Source: glassnode.io

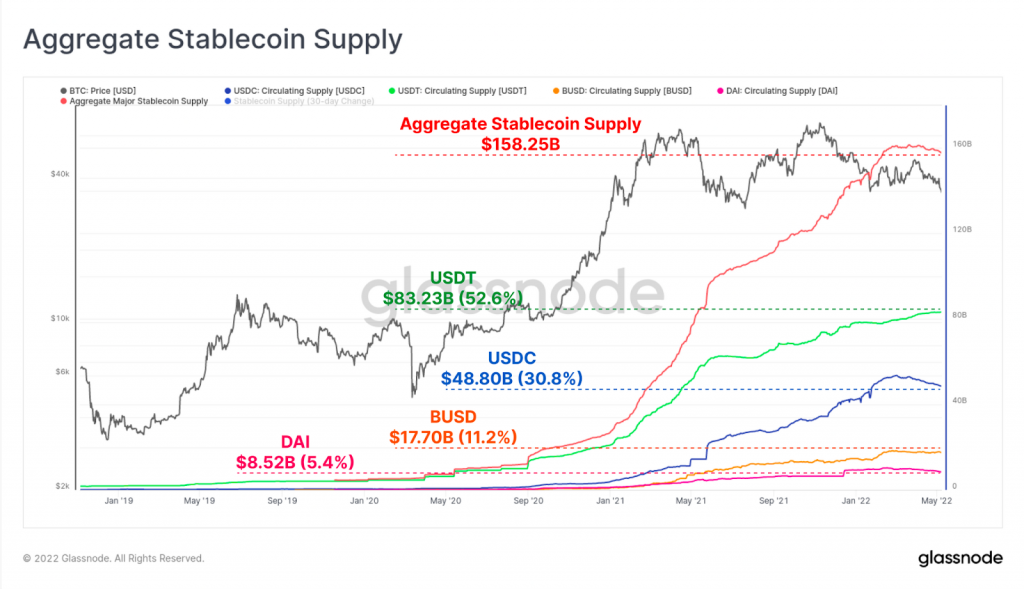

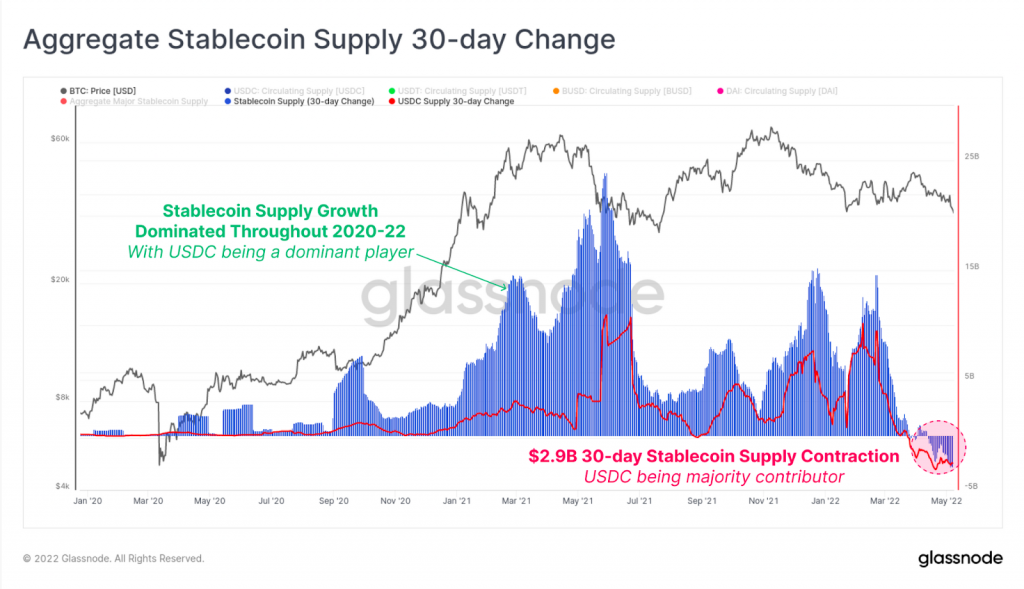

Source: glassnode.ioStablecoins are a cardinal constituent of the market, arsenic they facilitate entries of caller players arsenic good arsenic standardizing a portion of speech for crypto. By looking astatine the proviso of stablecoins we tin cognize whether oregon not much participants are entering the market. As seen connected the graph below, stablecoin proviso grew tremendously during the past bull marketplace owed to the summation successful request for crypto and acknowledgment to caller players entering the market. The proviso of large stablecoins went from $5.33 cardinal to $158.2 cardinal successful little than 3 years. Note, however, that aggregate stablecoin proviso has been level truthful acold successful 2022.

Source: glassnode.io

Source: glassnode.ioThis was driven mostly by an summation successful redemptions of USDC (into fiat), totalling $4.77B since the commencement of March contempt an summation of $2.5B successful USDT implicit the aforesaid period. In the beneath chart, we tin spot the 30-day alteration successful aggregate Stablecoin Supply vs the Contribution by USDC. USDC has seen a proviso contraction by a complaint of -$2.9bn per month, which tin beryllium identified successful the bottommost close country of the graph by the dashed reddish circle.

Source: glassnode.io

Source: glassnode.ioBeing 1 of the astir wide utilized stablecoins, USDC proviso contractions bespeak a determination of wealth from stablecoins arsenic a full backmost to fiat. More significantly, this indicates a risk-off sentiment arsenic good arsenic weakness successful the crypto marketplace overall.

LUNA and Do Kwon, The Man Who Flew Too Close to the Sun

In this conception we would similar to spell implicit the emergence and autumn of UST and the Terra ecosystem, and the resulting domino effect that impacted the markets. UST, 1 of the largest stablecoins ever created, was an undercollateralized algo-stablecoin successful the Terra ecosystem. It was created and sponsored by the Luna Foundation Guard (LFG), led by outspoken laminitis Do Kwon.

As an algorithmic stablecoin, UST implemented a two-token strategy wherever the UST and LUNA proviso should stay akin and wherever some tokens were redeemable betwixt themselves. If the terms of UST exceeded $1, traders were incentivized to pain LUNA successful speech for 1 dollar worthy of UST, which accrued its proviso and theoretically drove the terms backmost to $1.

Meanwhile, Anchor, a DeFi staking protocol wrong the Terra ecosystem, was offering “saving account” deals for users to involvement their UST. This was paying a whopping 20% APY. Anchor generated this output by borrowing and lending UST to different users for collateral. A ample sum of this collateral was LUNA.

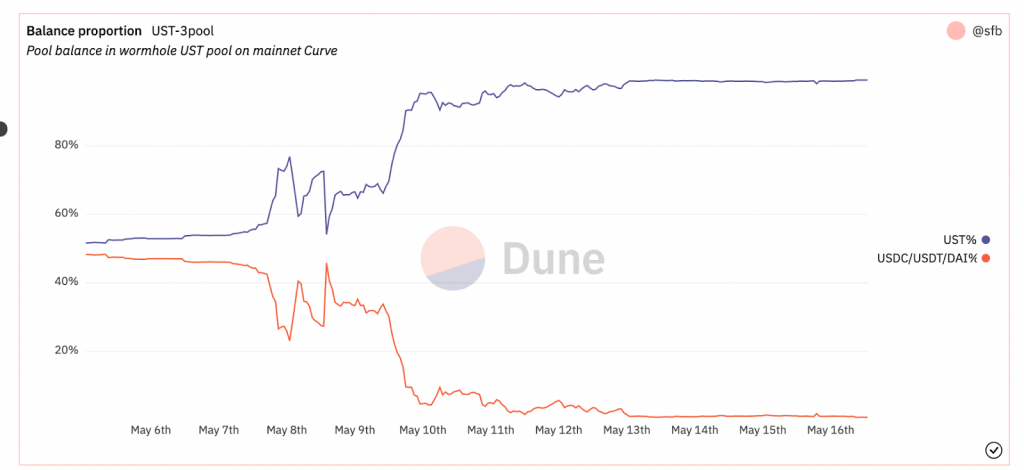

So what went wrong? Due to its aboriginal success, the Terra ecosystem grew enormously to go 1 of the largest projects by marketplace capitalization, astatine $40B. LFG, led by Do Kwon, began to deliberation of ways to amended the backing of UST. Thus, they decided to backmost portion of their reserves with ample headdress cryptocurrencies specified arsenic BTC and AVAX among others, making UST a multi-collateralized algo-stablecoin. Having done that, the stableness of UST peg became inherently correlated with the worth of the collateral successful its reserves. On May 8th, 2022, 4pool Curve, 1 of the largest stablecoin pools, saw an summation successful UST proviso of 60%, arsenic shown successful the illustration below.

Source: dune.com

Source: dune.comShortly thereafter, an $85 cardinal UST-to-USDC swap brought the excavation backmost to being lone somewhat imbalanced. Big players subsequently came successful and, by selling ETH successful the market, bought the worth of UST backmost astir to its $1 peg, arsenic shown successful the illustration below.

Source: Bitcoin.com Markets

Source: Bitcoin.com MarketsYou tin spot that the equilibrium of the Curve excavation was temporarily restored to erstwhile levels and the peg was temporarily saved. However, connected May 9th, we spot that a akin concern occurred erstwhile different monolithic merchantability of UST was executed connected the Curve pool, pushing the imbalance to supra 80% of UST successful the pool. The terms of UST dropped to astir $0.60 astir the aforesaid time. The crypto marketplace entered into a panic and the collateral held by LFG became little invaluable successful a downward spiral. This impacted the worth of LUNA, arsenic it’s expected to beryllium continuously sold to support the peg – and this was the opening of the end. The peg ne'er went supra $0.8 from that constituent on, and the worth of LUNA chemoreceptor dived by implicit 99%, presently sitting astatine $0.00026 USD.

A batch of questions are inactive unanswered from the Terra/Luna episode. Specifically, who was liable for the monolithic selling of UST connected Curve? Was this an orchestrated “attack” to depeg UST? Why didn’t LFG travel up with a contingency program to halt the devaluation of LUNA and UST? Why was the process of restabilization of the token done manually by the instauration and Do Kwon? Are BTC collateralized tokens harmless successful highly correlated scenarios?

We are yet to spot the aftermath of this achromatic section successful crypto history, arsenic the Terra ecosystem and UST are mostly marketed towards retail money. You whitethorn good spot increased scrutiny from regulators towards stablecoins and crypto overall. One happening you indispensable retrieve from this is that crypto is inactive an immature marketplace and being the decentralized, crowdsourced situation that it is, comes with precocious risk. Thus, you should ever support successful caput that each concern has its risks and doing your ain research continues to beryllium paramount.

Bitcoin.com Exchange

Bitcoin.com Exchange gives you the tools you request to commercialized similar a pro and gain output connected your crypto. Get 40+ spot pairs, perpetual and futures pairs with leverage up to 100x, output strategies for AMM+, repo market, and more.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

![Best Bitcoin & Crypto Exchanges [September 2025] – Updated Rankings](https://static.news.bitcoin.com/wp-content/uploads/2025/09/best-crypto-exchanges-sept-2025-768x432.png)

English (US)

English (US)