Bitcoin (BTC) prices showed a sideways question successful the past time producing nary important changes. Following the caller rejection astatine the $110,000 terms range, the maiden cryptocurrency failed to interruption retired of a descending consolidatory channel; therefore, fears connected the existent presumption of the bull marketplace stay intact.

Amidst the existent temper of uncertainty, salient marketplace expert Ali Martinez has identified 2 important enactment levels successful the advent of a terms downturn.

On-Chain Data Reveals Strong Bitcoin Support At $106,500 And $98,500

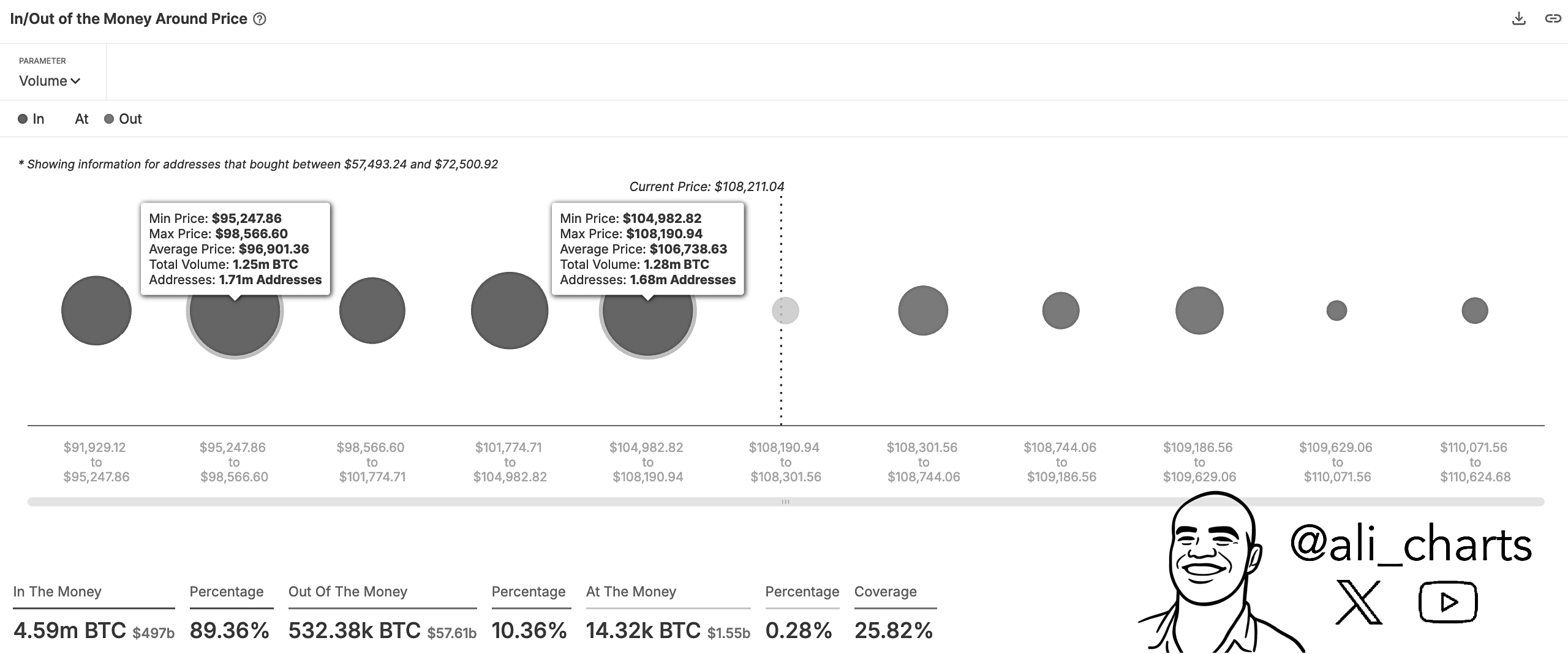

In an X post connected July 5, Ali Martinez shares a perchance impactful on-chain penetration connected the Bitcoin market. Using information from the In/Out Money Around Price (IOMAP) Chart from Sentora, the expert shares that large enactment zones person emerged that could play a important relation successful shaping the BTC’s short-term terms direction.

The IOMAP illustration analyzes Bitcoin wallet addresses and the mean prices astatine which they acquired BTC, giving insights into imaginable zones of buying oregon selling pressure. Essentially, it shows wherever holders are presently successful nett i.e. successful the money” oregon astatine a nonaccomplishment i.e. retired of the money.

Source: @ali_charts connected X

Source: @ali_charts connected XFrom the chart, it is observed that 1.68 cardinal addresses bought 1.28 cardinal BTC betwixt $104,982 and $108,190, with an mean acquisition terms of $106,738. Historically, specified ample concentrations of buying enactment thin to signifier beardown support zones, arsenic holders whitethorn support their positions from slipping into loss. Therefore, this improvement makes the $106,700 scope a formidable near-term enactment level.

A 2nd important enactment level is identified successful the $95,247 to $98,566 range, wherever 1.7 cardinal addresses acquired 1.25 cardinal BTC astatine an mean terms of $96,901. Should Bitcoin suffer its footing supra $106,000, this little scope would enactment arsenic the adjacent large cushion, perchance absorbing downward momentum. However, a decisive terms adjacent beneath $96,901 would corroborate important bearish intent by the Bitcoin market.

Bitcoin Market Overview

According to information from the IOMAP chart, astir 89.36% of each BTC addresses are “in the money,” meaning their holdings were purchased astatine a little terms than the existent marketplace value. This is mostly considered a bullish signal, suggesting the bulk of marketplace participants are successful nett and frankincense little pressured to sell.

Meanwhile, lone 10.36% of addresses are “out of the money,” highlighting the comparatively debased hazard of wide panic selling, unless Bitcoin were to interruption beneath these captious levels highlighted above. At property time, the premier cryptocurrency continues to commercialized astatine $108,154 reflecting a 0.24% summation successful the past day. Meanwhile, it’s regular trading measurement is down by 27.09% and valued astatine $31.04 billion.

Featured representation from Pexels, illustration from Tradingview

4 months ago

4 months ago

English (US)

English (US)