A seasoned marketplace expert has flagged a method signifier that could awesome a turning constituent for Bitcoin aft months of underperformance versus gold. The determination comes arsenic traders measurement whether the agelong tally of gains for the yellowish metallic has exposed limits successful Bitcoin’s safe-haven story.

Bitcoin Versus Gold Ratio Down

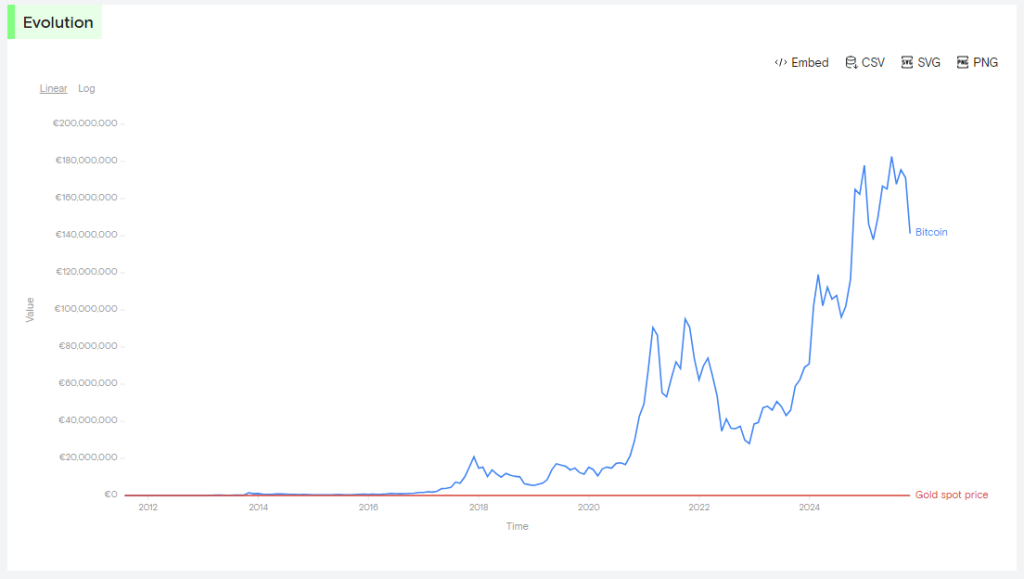

The Bitcoin-to-gold ratio has plunged. It fell from 32 connected Oct. 5 to astir 20 today, a driblet of much than 37%. According to the data, that means 1 Bitcoin bought astir 32 ounces of golden successful aboriginal October but present buys astir 20. The ratio’s descent has accelerated since gold’s rally took clasp and Bitcoin’s terms slipped beneath cardinal levels.

Daily readings constituent to a imaginable alteration successful momentum. On Nov. 21 the BTC/GOLD brace deed a debased of 20 and the RSI stood astatine 21.30. A little debased adjacent Dec. 1 came with a higher RSI debased of 26.83. Then different trough astatine 19 connected Dec. 26 coincided with a higher RSI debased of 32.21.

That’s a valid bullish divergence connected the regular timeframe for BTCUSD vs. Gold.

Interested to spot wherever that leads america into 2026. pic.twitter.com/D6ei8HsIDy

— Michaël van de Poppe (@CryptoMichNL) December 31, 2025

Based connected reports, Michaël van de Poppe called this signifier a “strong” bullish divergence connected the regular chart, a setup traders ticker due to the fact that it tin amusement selling unit easing adjacent arsenic prices marque caller lows.

Technical Signals Show Cooling Selling Pressure

On the play illustration the representation adds value to the signal. The play RSI for the BTC/GOLD brace has sunk to astir 31.85 astatine property time. That level was past seen during the November 2022 sell-off tied to the FTX collapse, a constituent that marked a bottommost successful that cycle.

Bitcoin vs Gold spot price: humanities performance. Source: Curvo

Bitcoin vs Gold spot price: humanities performance. Source: CurvoReports besides nexus akin RSI lows to the bottoms seen successful 2015 and 2018. Taken together, the regular divergence and the debased play RSI marque a stronger lawsuit that the downtrend whitethorn beryllium losing steam, though thing is guaranteed.

Market Sentiment Splits Investors

Gold’s rally has been dramatic. Reports amusement golden surged by implicit 70% successful 2025 portion Bitcoin fell by 7% implicit the twelvemonth successful immoderate measures. At property clip Bitcoin trades astatine $87,750, down 4.8% year-to-date.

The breakdown successful the Bitcoin-to-gold ratio and Bitcoin’s continued weakness beneath $100,000 person prompted caller questions astir the “digital gold” communicative arsenic bullion posts historical gains.

Short-term wealth appears to favour golden for superior protection. Many traders are treating the metallic arsenic a structure portion it climbs to caller highs. Long-term holders, however, inactive constituent to Bitcoin’s imaginable for large upside erstwhile hazard appetite returns.

According to marketplace watchers, the near-term outlook hinges connected whether the BTC/GOLD ratio and terms enactment present follow-through supra cardinal levels. Until that happens, signals volition stay tentative.

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)