- Glassnode released a study detailing Bitcoin’s show during the carnivore marketplace and the imaginable for a interruption retired from existent levels.

- The study highlights that Bitcoin is performing likewise to however it did successful different carnivore markets and whitethorn request much clip to respond and move.

- The profitability of semipermanent holders is besides astatine 60%, but a subset of semipermanent holders are seeing capitulations.

The crypto marketplace is looking overmuch much affirmative arsenic it heads into the caller year, with Bitcoin holding dependable supra the $20,000 level. Other crypto assets person besides been doing well, astir notably Dogecoin (DOGE), but the market’s biggest plus is wherever each eyes are on. The crypto marketplace had been successful a rut for galore months, with volatility besides hitting lows.

#Bitcoin has rallied backmost supra the cardinal $20k intelligence level aft galore months of debased volatility.

In this edition, we analyse however Bitcoin whitethorn beryllium hammering retired a near-textbook carnivore marketplace level and what risks whitethorn laic connected the roadworthy ahead.

Read it present 👇https://t.co/WrsifLhxHC

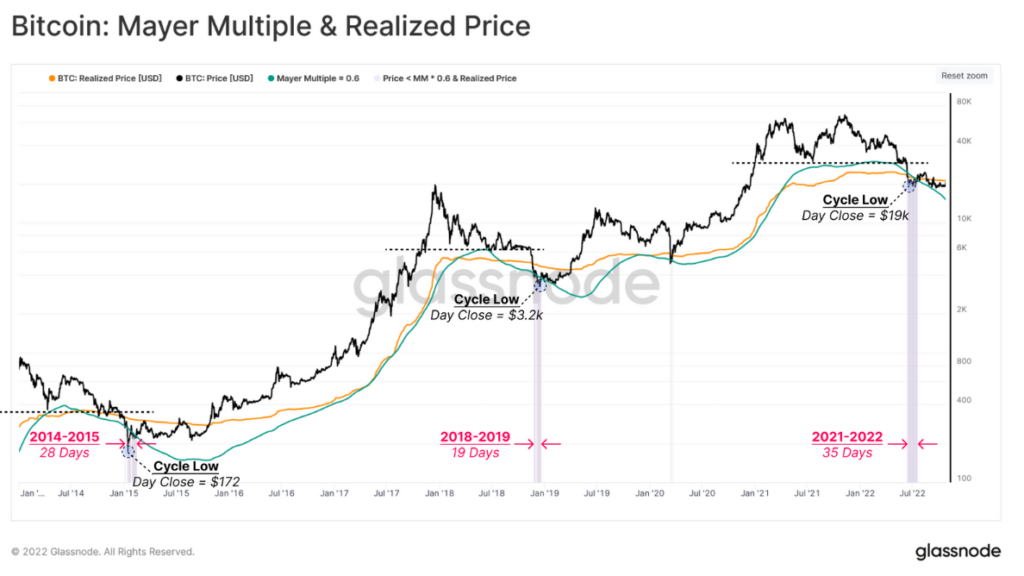

However, caller movements bespeak that the marketplace whitethorn beryllium heading retired of its stagnant authorities and into a imaginable bullish period. Glassnode reported that Bitcoin’s caller terms past is 1 that should make immoderate tentative optimism. The institution uses Bitcoin’s realized terms and the Mayer Multiple to gauge the presumption of the cryptocurrency.

Source: Glassnode

Source: GlassnodeGlassnode antecedently described the bottommost find signifier of the market, saying that this begins erstwhile the terms falls done the superior carnivore marketplace floor. It notes that the terms has historically recovered itself betwixt the realized terms and the Mayer Multiple little band. The second is the ratio betwixt the terms and the 200-day elemental moving average, which is utilized successful analyses successful accepted finance.

The study states that erstwhile the bottommost enactment has been identified, the adjacent measurement is uncovering the imaginable terms fluctuation range. As per Glassnode’s data, the perfect terms ranges for the bottommost enactment are the realized terms of $21,000 and the balanced terms of $16,500. However, it is speedy to enactment immoderate caveats,

“Compared to humanities precedence, the terms has traded wrong this scope for ~3 months, successful examination to anterior cycles which lasted betwixt 5.5 and 10 months. This suggests duration whitethorn stay a missing constituent from our existent cycle.”

Long-Term BTC Holders Profitability astatine 60%

The Glassnode study besides discusses the proviso profitability of semipermanent holders. This fig is astatine 60%, portion the full percent proviso successful nett is astatine 57%. At this point, for this to bespeak that a betterment is connected the horizon, Bitcoin spot prices would person to scope $21,700.

However, Glassnode does constituent retired that a subset of semipermanent holders spot capitulations. It says that the mean semipermanent holder who has endured afloat cycles of volatility has underperformed compared to the wider market.

In conclusion, Glassnode reports that the 2022 level lacks a grade of duration, which means that it whitethorn necessitate an further signifier of redistribution to trial investors. Glassnode fundamentally highlights that Bitcoin is acting arsenic it did successful different carnivore markets, but that clip and possibly a caller influx of investors could propulsion the plus forward.

3 years ago

3 years ago

English (US)

English (US)