After its third-largest play autumn successful implicit a year, the Bitcoin (BTC) terms has yet began to rise. BTC’s terms has efficaciously rebounded from the important enactment level of $37,500, contempt an impending Federal Reserve complaint hike.

Bitcoin Poised For 10% Jump

Various analysts, similar The Wolf of All Streets, Michael van de Poppe, and PlanB, are bullish connected the bullish trend, with the Bitcoin terms presently holding supra $39,000.

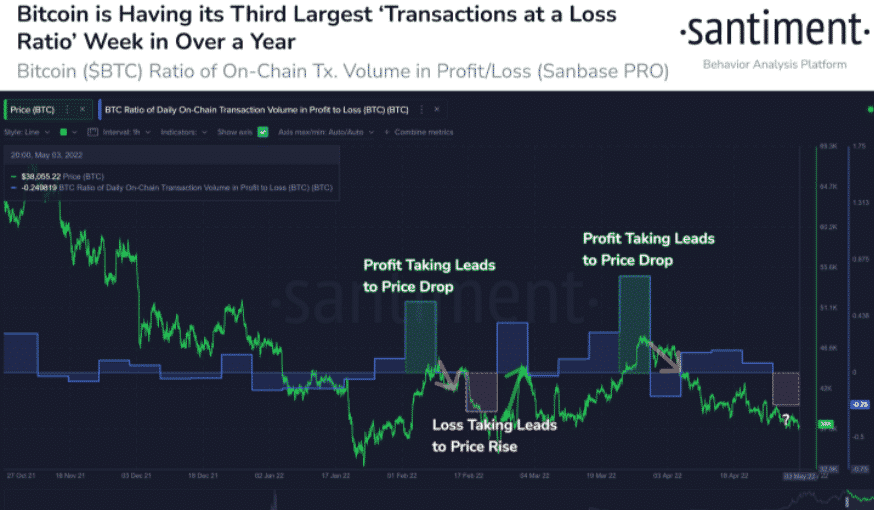

In a tweet connected May 4, on-chain information supplier Santiment published humanities information showing a 20% rally arsenic a effect of BTC transactions is antagonistic astatine the aforesaid levels betwixt February 16 and 22. The week’s Bitcoin Ratio of On-Chain Transactions Volume successful Profit/Loss statistic is the 3rd largest capitulation successful a year.

As technicals improve, respective analysts and traders forecast a terms summation successful the pursuing days.

Michaal van de Poppe predicts that the terms of Bitcoin (BTC) volition emergence from existent levels. He stated,

“Bitcoin starts to look mode amended astatine this stage. Odds that the lawsuit contiguous is simply a ‘Sell the rumour, Buy the News’ lawsuit are increasing.”

A salient crypto trader, The Wolf Of All Streets, predicted a rebound successful Bitcoin terms arsenic it breaks supra the inclination line. A large emergence could beryllium anticipated if the BTC terms stabilizes implicit $39,000.

According to PlanB, the archetypal $55K S2F model, which was released successful March 2019, appears to beryllium tracking the Bitcoin terms trend. He besides expects Bitcoin to emergence successful value.

The terms of Bitcoin (BTC) has regained implicit 5% successful the erstwhile 24 hours, stabilising adjacent $39,000. Whales proceed to accumulate astatine dips, resulting successful a immense summation successful trading volume. Furthermore, the BTC has avoided a driblet beneath the captious enactment level. It suggests that a rally could hap successful the adjacent respective days.

Suggested Reading | Bitcoin Briefly Tops $40,000 As More Countries Adopt Crypto

BTC Trades Sideways

BTC has been trading sideways implicit the past fewer days, with the terms dropping beneath $40,000 connected April 26. Although, aft reaching the plaything highs adjacent $48,000, the terms has already begun to drop. BTC retreated and mislaid 45 percent of its value. BTC sellers, connected the different hand, are weary arsenic the terms trades sideways successful a constrictive scope since April 25.

B

A regular adjacent beneath the session’s low, connected the different hand, would disprove the bullish terms assumption. In that situation, $36,000 would beryllium the lowest constituent connected the downside.

BTC/USD is presently trading astatine $39,874, up 5.63 percent for the time arsenic of publishing time. According to CoinMarketCap, the archetypal cryptocurrency by marketplace capitalization has a 24-hour trading measurement of $35,528,442,016.

Suggested Reading | Will Bitcoin Shoot Over $40,000 — Or Drop To $35,000?

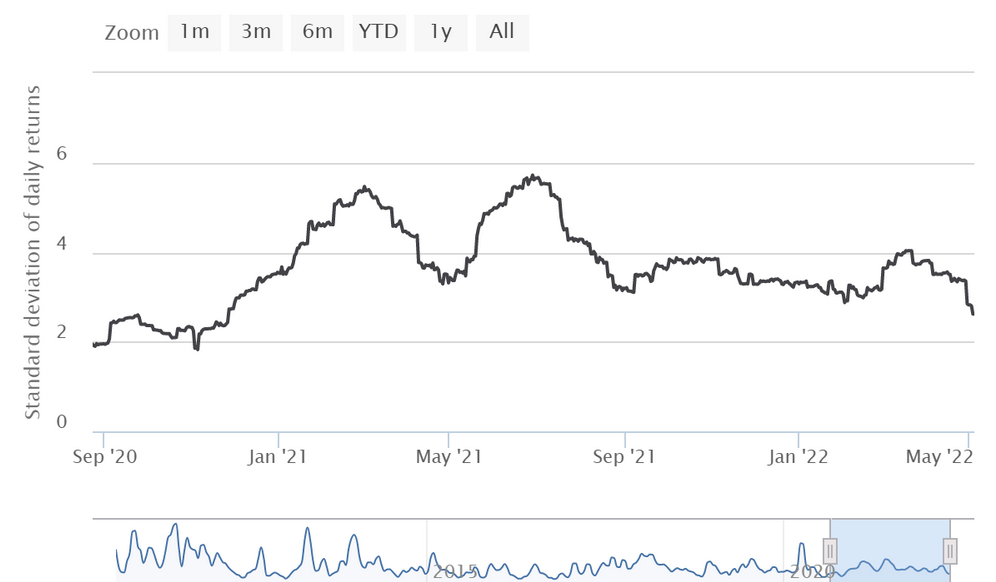

Volatility Drops

Bitcoin’s humanities volatility is astatine 18-month lows, according to statistic released by the Buy Bitcoin Worldwide webpage. Its anticipated 60-day mean worth fell to 2.62%.

Bitcoin (BTC) volatility was past this debased successful November 2020, erstwhile the orangish coin broke done $10,000 for the archetypal clip successful this bullish cycle.

On April 27, 2022, thirty-day volatility reached a section low, but it is already showing signs of recovery.

The Bitcoin Volatility Index (BVOL), akin to the banal market’s VIX, shows however overmuch Bitcoin’s terms changes connected a fixed time successful narration to its erstwhile price.

The astir caller summation successful Bitcoin (BTC) volatility occurred successful July 2021, erstwhile the flagship cryptocurrency was doubly arsenic volatile implicit a 30-day play arsenic it is now.

Featured representation from Pixabay, illustration from TradingView.com

3 years ago

3 years ago

English (US)

English (US)