Bitcoin’s four-day driblet to $104,000 triggered what analysts telephone a “defensive rotation” among crypto investors, but onchain information suggests the correction was a steadfast reset alternatively than the commencement of a broader marketplace crash.

Bitcoin (BTC) experienced a four-day clang past week, falling from $115,000 connected Oct. 14 to a four-month debased of $104,000 by Friday, a level past seen successful June, TradingView data shows.

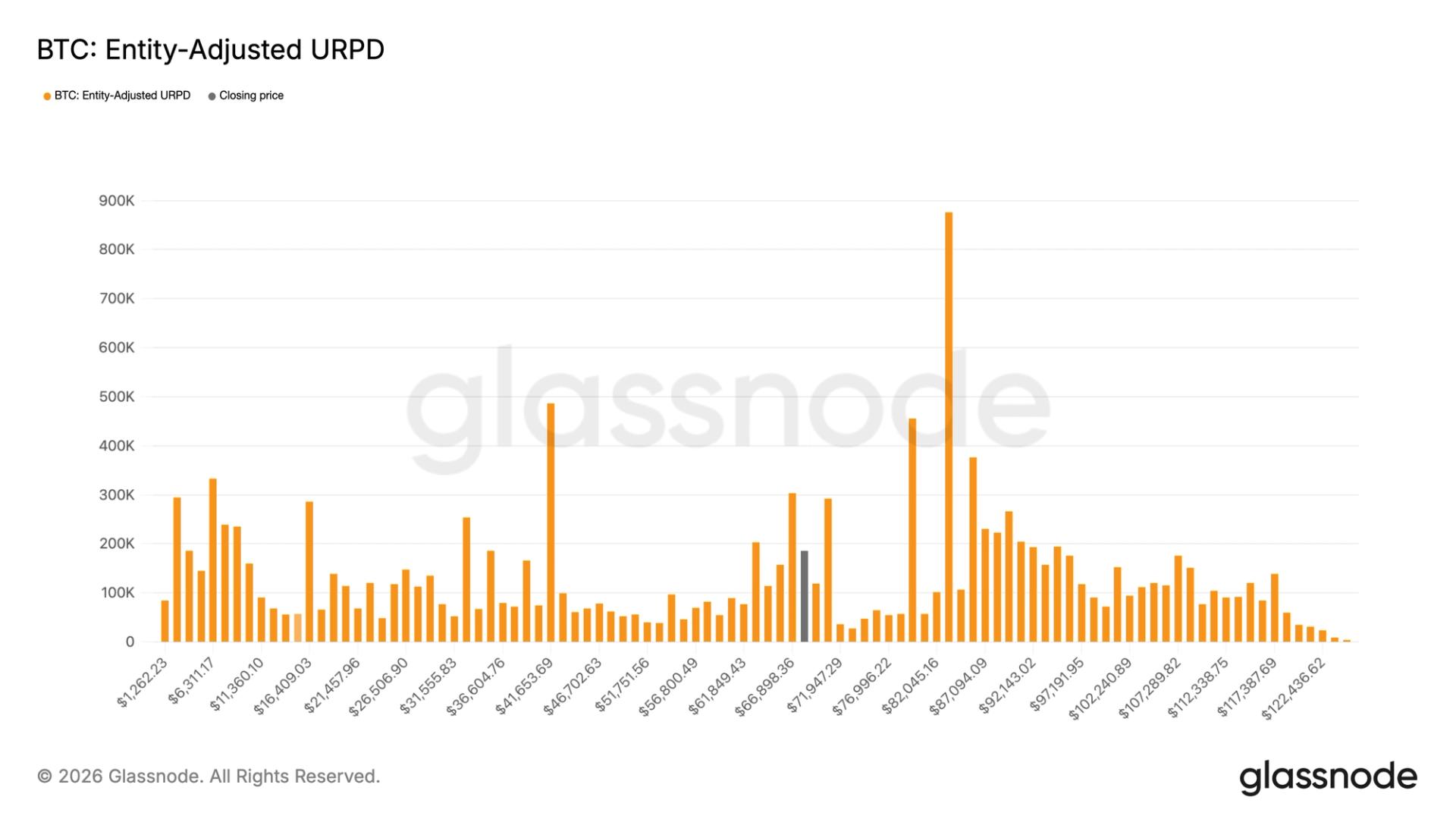

Despite the decline, analysts said the correction flushed retired excess leverage, prompting investors to displacement from chasing gains to protecting capital. In a report Tuesday, blockchain analytics steadfast Glassnode said short-term Bitcoin holder proviso has risen, signaling that “speculative capital” is taking a larger stock of the market.

“Onchain, the short-term holder proviso stock continues to rise, suggesting that speculative superior is becoming much dominant,” Glassnode said, adding:

“This operation of signals points to a marketplace shifting into extortion mode, with traders prioritizing superior preservation implicit directional bets.”Meanwhile, Bitcoin’s unfastened involvement fell by astir 30%, signaling that the crypto marketplace is “far little susceptible to different liquidation cascade,” said Glassnode successful a Tuesday X post.

Related: Elon Musk touts Bitcoin arsenic energy-based and inflation-proof, dissimilar ‘fake fiat’

Bitcoin’s emergence to $0.2 cardinal spells “hard time” for “paper hand” investors: Samson Mow

Glassnode’s study comes amid a play of increasing uncertainty related to the continuation of the cryptocurrency marketplace cycle.

“This $0.1M to $0.2M scope is simply a hard clip for those with anemic condemnation to HODL Bitcoin,” the Jan3 CEO, Samson Mow, wrote successful a Monday X post, adding:

“They’re uncertain due to the fact that the “cycle” didn’t hap similar before, and besides due to the fact that different assets similar golden are rallying.”Mow predicted that Bitcoin “will adhd a zero soon enough,” but warned that “paper hands” investors with anemic condemnation should not get shaken retired by the impermanent correction.

Related: DeFi booming arsenic $11B Bitcoin whale stirs ‘Uptober’ hopes: Finance Redefined

Meanwhile, semipermanent Bitcoin holders proceed selling to organization investors, according to Glassnode expert Chris Beamish.

Digital plus treasuries (DATs) and exchange-traded funds (ETFs) person absorbed an “incredible amount” of the semipermanent holder supply, but Bitcoin’s upside volition stay constricted until this cohort stops selling, the expert wrote successful a Monday X post.

Bitcoin ETFs person besides been deed by the governmental turmoil surrounding President Donald Trump’s renewed tariff threats against China.

On Monday, the Bitcoin ETFs recorded $40 cardinal worthy of nett outflows, marking their 4th consecutive time of selling, Cointelegraph reported.

Magazine: Bitcoin is ‘funny net money’ during a crisis: Tezos co-founder

4 months ago

4 months ago

English (US)

English (US)