Ethena Labs has revealed its latest strategical move: the inclusion of Bitcoin (BTC) arsenic collateral for its synthetic dollar-pegged product, USDe. This decision, aimed astatine importantly scaling the product’s proviso from its existent $2 billion, capitalizes connected the burgeoning BTC derivative markets for enhanced scalability and liquidity successful delta hedging practices.

Ethena Labs’ ambitious extremity is to leverage the sizeable maturation of BTC unfastened interest, which has seen a important emergence from $10 cardinal to $25 cardinal successful conscionable 1 year, acold outpacing Ethereum’s (ETH) maturation rates. Ethena’s connection highlighted the strategical benefits of integrating BTC, emphasizing the superior liquidity and duration illustration of Bitcoin compared to liquid staking tokens and the imaginable for USDe to execute greater scalability arsenic a result

“With $25bn of BTC unfastened involvement readily disposable for Ethena to delta hedge, the capableness for USDe to standard has accrued >2.5x,” the announcement noted, illustrating the robust backing that BTC provides.

Excited to denote that Ethena has onboarded BTC arsenic a backing plus to USDe

This is simply a important unlock which volition alteration USDe to standard importantly from the existent $2bn proviso pic.twitter.com/FOZRWBrVZV

— Ethena Labs (@ethena_labs) April 4, 2024

CryptoQuant CEO Issues Bitcoin Crash Warning

This determination has not been met without skepticism. Ki Young Ju, CEO of the analytics steadfast CryptoQuant, took to X to dependable his concerns, drafting parallels to the infamous LUNA illness and questioning the hazard absorption strategies employed by Ethena Labs.

“This isn’t bully quality for Bitcoin holders—it sounds similar a imaginable contagion risk, similar LUNA. How bash they support a delta-neutral strategy for BTC successful bear markets?” Ju queried, implying that the occurrence of specified strategies is mostly contingent connected marketplace conditions that favour bull runs.

He further elaborated connected the complexities of shorting BTC successful carnivore markets, suggesting that the marketplace size for specified operations could beryllium smaller than the full worth locked (TVL), perchance starring to important marketplace disruptions. The CryptoQuant CEO stated:

How bash they support a delta-neutral strategy for BTC successful carnivore markets? In bull markets, they clasp spot BTC and abbreviated BTC. If there’s a method to abbreviated BTC by holding immoderate DeFi-wrapped BTC, the marketplace size would beryllium smaller than its TVL. This is simply a CeFi stablecoin tally by a hedge fund, effectual lone successful bull markets. Correct maine if I’m wrong.

Ju added that he’S acrophobic astir a repetition of a LUNA-like doom scenario: “selling BTC to stabilize USDe’s peg if their algorithm fails during carnivore markets.”

Adding to the discourse, OMAKASE, a erstwhile advisor for Sushiswap, referenced humanities challenges faced by delta-neutral strategies, highlighting their propensity to crook illiquid and the trouble successful unwinding specified positions without causing marketplace slippage.

“Delta neutral strategies are usually ne'er delta neutral. Post dot-com roar successful Singapore, it took years for banks to unwind delta neutral books that had abruptly turned illiquid. Size begets slippage,” OMAKASE remarked, underscoring the inherent risks of specified fiscal maneuvers.

The industry’s absorption to Ethena Labs’ announcement has been mixed, with immoderate lauding the imaginable for accrued scalability and others cautioning against the risks of replicating past fiscal crises. A fewer days ago, Fantom laminitis Andre Cronje besides questioned the stableness of USDe.

Amidst these concerns, Ethena Labs stands by its decision, pointing to the advantageous marketplace conditions and the increasing BTC derivative markets arsenic cardinal factors supporting their strategy. “While BTC does not person a autochthonal staking output similar staked ETH, staking yields of 3-4% are little important successful a bull marketplace erstwhile backing rates are >30%,” the institution stated, indicating a strategical optimization for the existent marketplace environment. This move, according to Ethena, is not conscionable astir scaling but besides astir offering a safer and much robust merchandise to its users.

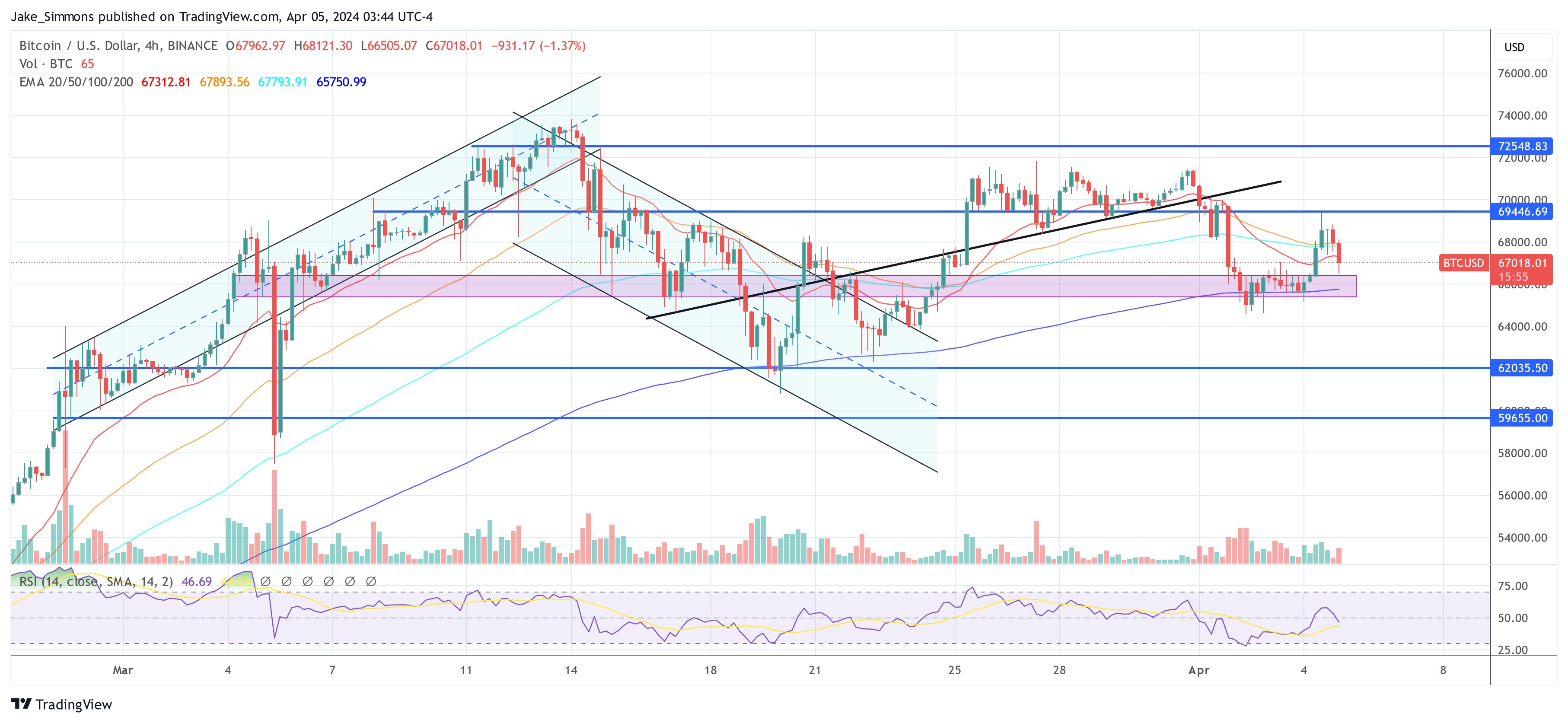

At property time, BTC traded astatine $67,018.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)