Bitcoin (BTC) roseate toward the cardinal intelligence threshold of $40,000, 3 days aft losing the foothold, adjacent arsenic stocks slipped owed to concerns implicit surging lipid prices.

As of property clip the largest cryptocurrency was changing hands conscionable supra $39,000, aft dipping beneath $38,000 earlier successful the session.

Brent crude jumped arsenic precocious arsenic $139 a tube connected Monday, a 14-year precocious – not excessively acold distant from the grounds $147 reached successful 2008.

Europe’s Stoxx 600 and Asia Dow dropped much than 3%, portion U.S. S&P 500 futures traded 1.4% lower. In India, the rupee mislaid 1.1% to commercialized astatine a grounds 76.98 per dollar. Germany’s benchmark DAX Index mislaid 4% connected Monday, entering the dreaded “bear market” territory – a word for erstwhile assets suffer much than 20% of their worth implicit 2 months.

The fearfulness successful accepted markets is that soaring lipid prices mightiness enactment much upward unit connected inflation, already moving astatine its fastest successful 4 decades, adding to economical challenges that see Russia's penetration of Ukraine and supply-chain bottlenecks.

Bitcoin bulls defended the $38,400 level connected Monday. (TradingView)

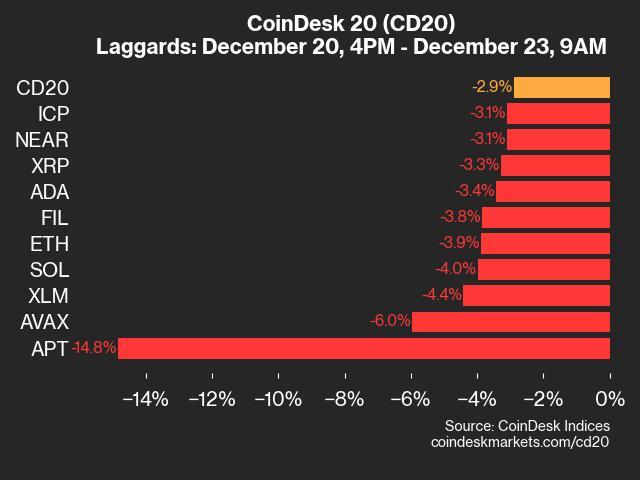

During Asia greeting hours, losses connected astir large cryptocurrencies ranged from 5% to implicit 8% earlier bitcoin’s tally caused a flimsy recovery. Binance’s BNB, Terra’s LUNA, and XRP regained losses to commercialized level successful the past 24 hours, portion Solana’s SOL and Cardano’s ADA mislaid implicit 3%.

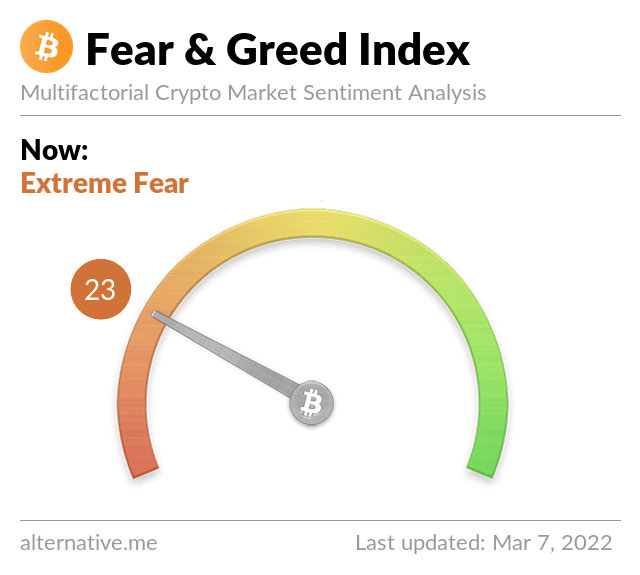

The crypto fearfulness and greed scale – which tracks marketplace sentiment – reached readings of 23, implying a authorities of “extreme fear” successful the market. Such values are a motion that investors are excessively disquieted and the marketplace could spot a recovery, compared to readings supra 60 portion awesome greed successful the marketplace and the accidental of a owed correction.

Sentiment gauges suggested "extreme fear" successful the crypto market. (Alternative.me)

Some analysts accidental the crypto market’s correlation to broader accepted concern has weakened its communicative arsenic an ostentation hedge. On the different hand, bitcoin has reacted negatively to the Federal Reserve's efforts to tamp down the upward unit connected user prices.

“Cryptocurrencies bash not stay aloof from politics, and they are weakly confirming the relation of an alternate to the banking strategy now,” shared Alex Kuptsikevich, fiscal expert astatine FxPro, successful an email to CoinDesk. “With a crisp diminution implicit the weekend, bitcoin wiped retired the archetypal gains, gave distant the positions to bears aft the 3rd consecutive week of gains.”

Others accidental a planetary recession could materialize if the Fed pushes guardant aggressively to boost involvement rates.

“Many foretell a planetary recession is connected the skyline if the Federal Reserve decides to hike rates aggressively starting from March 16,” wrote Marcus Sotiriou, an expert astatine the crypto broker GlobalBlock, successful an email.

Sotiriou, however, is among traders who stay bullish connected the semipermanent committedness of cryptocurrencies.

“I deliberation that the instauration of regulatory clarity successful the U.S., adjacent if it hinders innovation astatine first, volition ignite the adjacent question of wealth to participate the crypto markets,” Sotiriou stated. “This is however a $100,000-$500,000 terms for bitcoin is achievable implicit the adjacent 5 years.”

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)