Bitcoin (BTC) hovered astir $111,500 connected Monday, keeping a choky scope arsenic traders measurement macro catalysts for cues connected positioning.

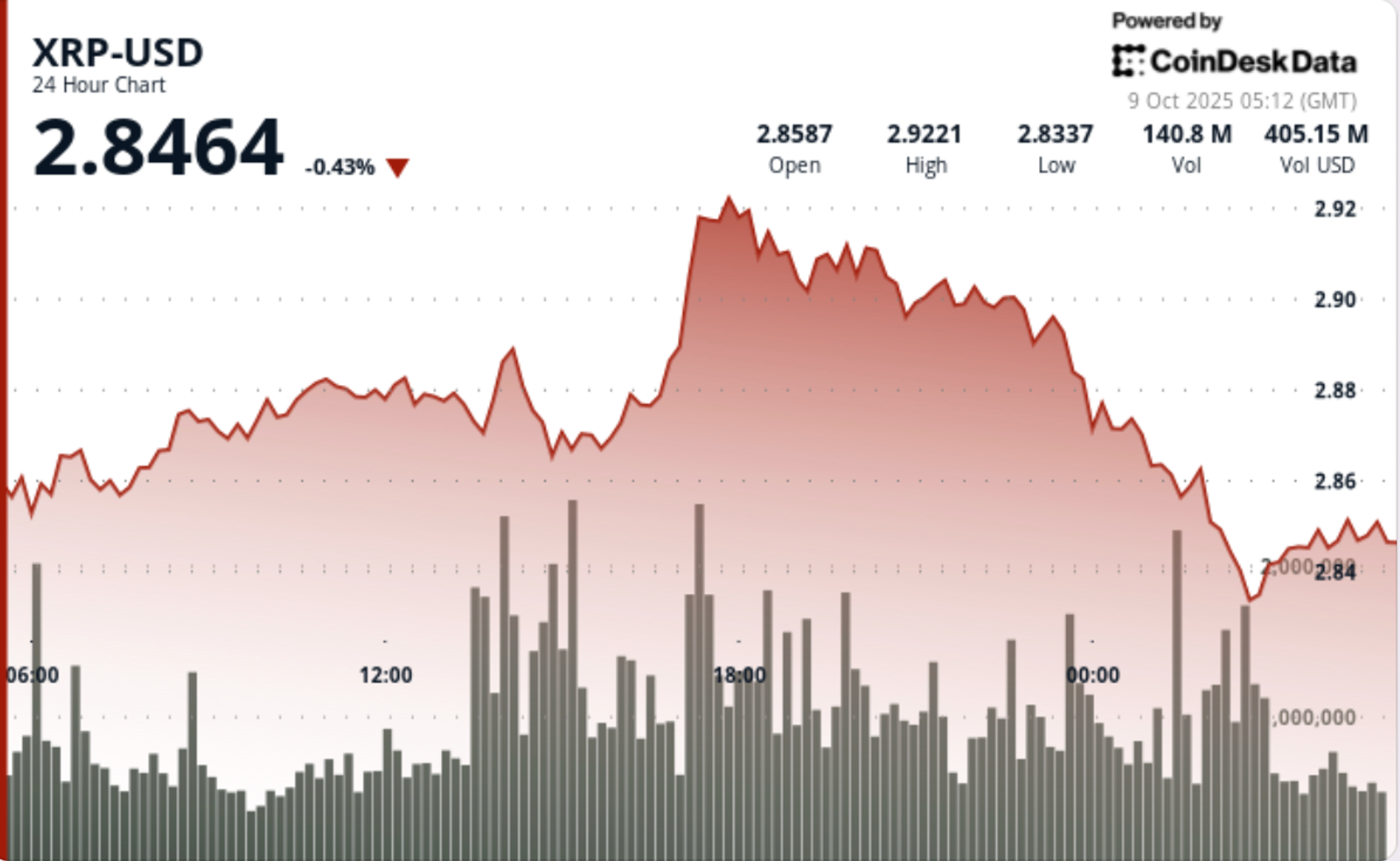

Ether (ETH) traded adjacent $4,312, XRP (XRP) held $2.96, BNB (BNB) astatine $880, and Solana's SOL (SOL) climbed to $218. Dogecoin (DOGE) extended its 11.6% play summation to 24 cents, outpacing astir large cryptocurrencies arsenic the first-ever memecoin ETF looks acceptable to spell unrecorded for trading successful the U.S. connected Thursday.

The marketplace code stayed tentative. “Crypto prices treaded h2o overmuch of the past week, but with BTC lagging noticeably some vs its adjacent radical arsenic good arsenic vs equities and spot gold,” said Augustine Fan, caput of insights astatine SignalPlus, successful a enactment to CoinDesk, pointing to softer buying successful integer plus trusts and a pullback successful on-ramp enactment astatine centralized exchanges.

“The short-term representation looks a spot much challenging and we would similar a much antiaircraft stance accordant with the pugnacious seasonal story. Keep an oculus connected DAT premia compressing and the hazard of antagonistic convexity connected the downside,” Fan said, referring to the galore integer plus treasuries held by U.S.-listed companies that person sprouted successful caller months.

Macro could interruption the stalemate. “Markets are entering a decisive week arsenic US information and cardinal slope decisions converge,” said Lukman Otunuga, elder marketplace expert astatine FXTM, successful an email.

He added a cooler CPI and immoderate downward revision to payrolls would fortify the lawsuit for Fed cuts, weaken the dollar and could assistance alternate assets, portion a sticky people would reason for patience and rise volatility crossed cryptoThat propulsion and propulsion is mirrored successful positioning.

“Investors are caught betwixt turning bearish and risking missed upside, oregon buying the dip excessively early,” said Justin d’Anethan, laminitis of Poly Max Investment. He noted chatter astir Strategy’s imaginable S&P 500 inclusion faded, denting the firm treasury meme, yet nationalist companies present clasp astir 1 cardinal BTC.

“In the bigger picture, BTC consolidating astir 111K is simply a good spot for semipermanent believers. Pullbacks of 10% to 15% wrong bull runs person not historically breached the trend,” d’Anethan said.

For traders, the checklist is straightforward. Watch CPI and PPI for the argumentation path, the dollar for cross-asset hazard appetite, and the DAT premium for immoderate renewed knee-jerk selling into redemptions.

4 weeks ago

4 weeks ago

English (US)

English (US)