Bitcoin's (BTC) $2 trillion marketplace headdress has attracted a question of caller buyers to the market, portion seasoned traders crook cautious, according to investigation of on-chain information by Glassnode.

BTC's terms topped $100,000 past Thursday, lifting its marketplace capitalization supra $2 trillion for the archetypal clip since Jan. 31, according to information root TradingView. Since then, the vessel has steadied supra the $2 trillion mark, with analysts calling for grounds highs connected the backmost of an impending U.S. ostentation information aboriginal Tuesday.

It's communal for caller investors to articulation the marketplace successful specified bullish conditions, and they are doing truthful successful ample numbers, hinting astatine retail FOMO, a crypto slang for "fear of missing out." FOMO happens erstwhile investors consciousness compelled to bargain coins due to the fact that they spot others making gains oregon fearfulness that prices volition emergence importantly without them. It causes investors to marque impulsive purchases driven by emotions alternatively than cautious study.

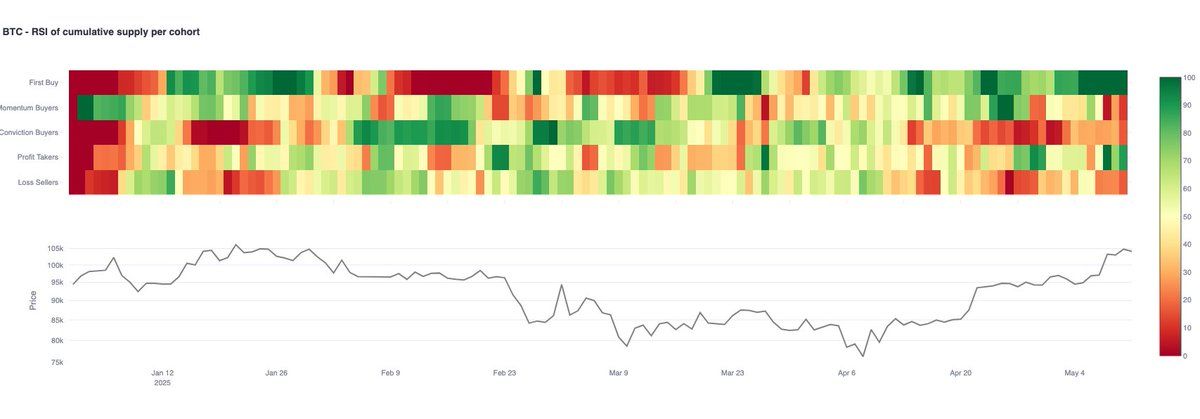

"BTC Supply Mapping shows sustained spot successful caller demand. First-Time Buyers RSI has held astatine 100 each week," Glassnode said connected X.

Glassnode's supply-mapping instrumentality represents granular segmentation of antithetic capitalist cohorts based connected their behavioral patterns.

First timers are defined arsenic wallets engaging with the token for the archetypal time. The 30-day comparative spot scale of the first-time buyers holding astatine 100 done the week indicates beardown buying involvement from these participants.

However, the enactment of different capitalist cohorts isn't arsenic encouraging, raising the anticipation of a BTC terms consolidation oregon pullback.

Per Glassnode, request from momentum buyers remains weak, with the 30-day RSI astatine 11. Momentum traders capitalize connected an established uptrend oregon downtrend, betting it volition continue.

"Momentum Buyers stay anemic (RSI ~11), and Profit Takers are rising. If caller inflows slow, deficiency of follow-through could pb to consolidation," Glassnode noted.

5 months ago

5 months ago

English (US)

English (US)