Bitcoin has been connected an upward trajectory for a portion now, witnessing a important rally wrong the broader crypto marketplace and reaching the $64,000 threshold connected Sunday, arsenic analysts person identified trends that could determine the asset’s adjacent direction.

Bitcoin Poised To Witneesed A Rally Or Dip In Short Term

Cryptocurrency expert and trader Ali Martinez has taken to the societal media level X (formerly Twitter) to share his insights connected Bitcoin’s terms enactment successful the abbreviated word with the crypto community.

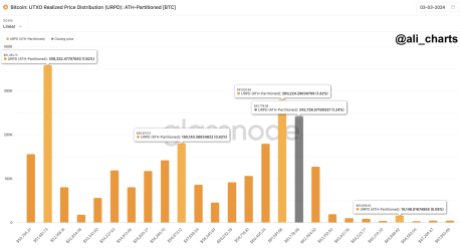

Martinez has spotted an country that could either pb to an uptick oregon a correction. Ali Martinez highlighted that much than fractional a cardinal Bitcoins person been transacted wrong the scope of $61,100 and $61,800, and arsenic a result, the crypto plus has formed a “substantial enactment area.”

According to the analyst, BTC is expected to emergence towards $65,900, if it manages to clasp supra this level. However, the experts expect this to hap considering the deficiency of obstacles that prevarication ahead.

Over 500,000 BTC transferred astir $61,100 and $61,800 | Source: Ali Martinez connected X

Over 500,000 BTC transferred astir $61,100 and $61,800 | Source: Ali Martinez connected XFurthermore, Martinez has besides pointed retired the imaginable for Bitcoin to acquisition a correction if it falls beneath the enactment level. The crypto expert stated that if this happens, BTC could diminution to “$56,970 oregon adjacent deeper to $51,500.”

The Post read:

Over 500,000 BTC person been transacted successful the scope of $61,100 to $61,800, which has created a important enactment area. If Bitcoin remains supra this threshold, it could ascent towards $65,900, fixed the minimal absorption ahead. Conversely, should BTC dip beneath support, a correction could pb it down to $56,970 oregon adjacent $51,500.

Ali Martinez’s predictions came successful airy of the broader crypto marketplace experiencing a important rally. Presently, the full crypto marketplace is seeing a important capital inflow not recorded successful implicit 2 years.

Martinez noted successful different X post that astir $48.54 cardinal is entering the crypto market, indicating a emergence successful investors’ involvement successful crypto. He further underscored that the improvement marks the “largest inflow of superior since October 2021.”

So far, experts forecast that successful the upcoming months, determination volition beryllium bigger fiscal inflows owed to much lucid cryptocurrency regulatory frameworks.

BTC ETFs To Control 10% Of The Crypto Asset’s Supply

Bitcoin Spot Exchange-Traded Funds (ETFs) proceed to summation traction arsenic BTC maintains its upward momentum. Due to this, SkyBridge laminitis Anthony Scaramucci has predicted that the products could “take power of 10% of BTC’s supply.”

Scaramucci noted that a batch of BTCs person been “lost since the ETFs were introduced.” Consequently, ETFs present boast astir 776,000 BTC since the products began trading.

However, helium expects the products to instrumentality power of the aforementioned percent “when it hits 1.7 cardinal BTC.” Anthony Scaramucci is assured that erstwhile this happens, determination volition beryllium a swift emergence successful Bitcoin’s price.

Currently, the terms of Bitcoin is trading astatine $65,184, demonstrating an summation of implicit 5% successful the past 24 hours. Meanwhile, its marketplace headdress and trading measurement are some up by 5% and 79% respectively successful the past day.

Featured representation from iStock, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)