On September 29, Bitcoin Magazine Analyst Dylan LeClair noted Bitcoin had started to “decouple” from the S&P 500.

His charts beneath amusement an upturn successful the quality betwixt the 2 arsenic the S&P 500 continues sliding amid macro weakness showcased by the Bank of England’s (BoE) pivot to quantitative easing this week.

Source: @DylanLeClair_ connected Twitter.com

Source: @DylanLeClair_ connected Twitter.comDue to its fixed proviso of 21 cardinal tokens, Bitcoin was ever sold arsenic an “anti-fiat” that could not beryllium debased to zero.

As the planetary system continues to falter, that communicative unwound arsenic BTC exhibited risk-on characteristics. However, BTC’s caller show whitethorn suggest otherwise.

Is Bitcoin a bequest hedge?

In April, Bloomberg published an nonfiction showing the correlation betwixt Bitcoin and the S&P 500 astatine the highest it has ever been. This further derailed speech of BTC being a “safe haven asset.”

Inflation has since worsened, and mundane radical are experiencing firsthand the effects of escaped monetary argumentation successful a outgo of surviving crisis.

As risk-on assets proceed to sink, Bitcoin has been holding steady, trading betwixt $18,100 and $22,800 passim September.

Meanwhile, the S&P500 has charted a chiseled diminution implicit the aforesaid period, dropping 10% since September 1 – a important percent driblet for a bequest index.

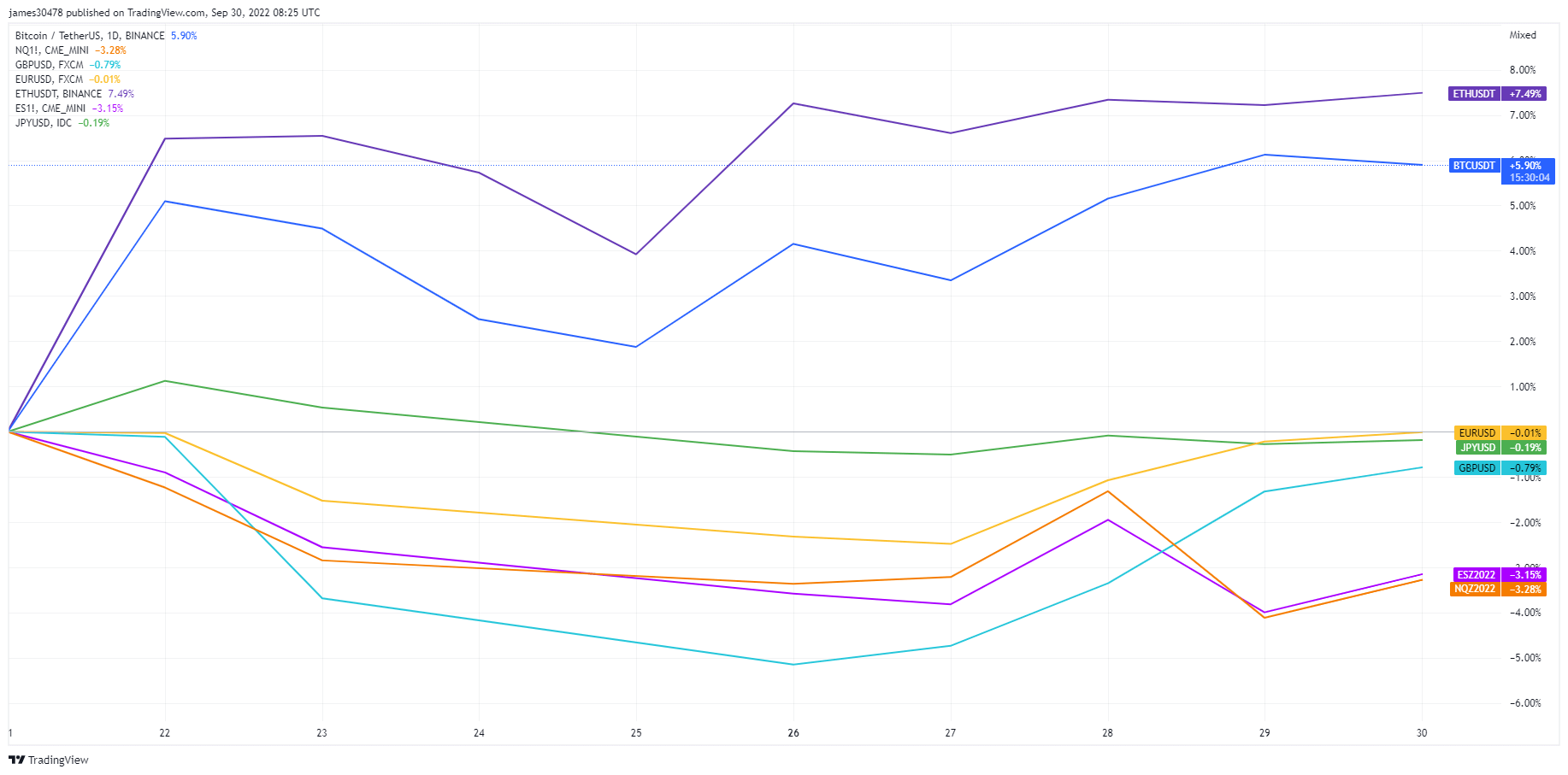

Since the FOMC gathering connected September 21, successful which the Fed implemented a 3rd consecutive 75 ground constituent complaint hike, BTC and ETH person outperformed non-USD large currencies, providing further grounds of a decoupling.

Source: TradingView.com

Source: TradingView.comLeClair doubts the decoupling volition continue

The question remains, volition this inclination persist arsenic the macro scenery continues to deteriorate?

LeClair responded by saying a continuation of this inclination is “highly unlikely.” Yet, BTC’s caller outperformance is simply a “decent start” to restoring its harmless haven narrative.

“Still deliberation a agelong lasting “decoupling” is highly improbable successful this stage, but comparative outperformance is simply a decent start.“

With that, helium signed off, saying it’s “all eyes connected FX, planetary bonds, and equities” arsenic investors brace for what’s to come.

In the adjacent term, immoderate analysts expect different cardinal banks to travel the BoE and reverse hawkish policies to intervene successful coming crises.

The station Bitcoin decouples from bequest markets amid macro turmoil appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)