Crypto markets stumbled with bitcoin (BTC) losing the $100,000 level connected Tuesday U.S. greeting arsenic 2 stronger-than-expected U.S. economical information prints threw acold h2o connected integer assets' agleam early-year momentum.

The Bureau of Labor Statistics' JOLTS occupation openings for November unexpectedly roseate to 8.1 cardinal from 7.8 cardinal the erstwhile month, easy topping expert estimates for a diminution to 7.7 million.

Released astatine the aforesaid time, the ISM Services Purchasing Managers Index, a monthly gauge of the level of economical enactment successful the services sector, came successful astatine 54.1 for December, overshooting expectations for 53.3 and nicely up of November's 52.1. The Prices Paid subindex came successful red-hot astatine 64.4, compared to the expected 57.5 and 58.2 successful the erstwhile month.

While neither study mostly tends to beryllium overmuch of a marketplace mover, combined they further shook up an already jittery enslaved market, sending the 10-year U.S. Treasury output higher by different 5 ground points to 4.68% and wrong a fewer ticks of multi-year highs. The determination took U.S. stocks lower, with the Nasdaq present disconnected by much than 1% successful precocious greeting enactment and the S&P 500 little by 0.4%.

BTC, which traded conscionable beneath $101,000 done European day hours, dipped to $97,800 pursuing the data, giving up yesterday's gains and down 4% implicit the past 24 hours. Altcoin majors declined adjacent much with Ethereum's ether (ETH) and Solana's SOL losing 6%-7%, portion Avalanche's AVAX and Chainlink's LINK tumbled 8%-9%.

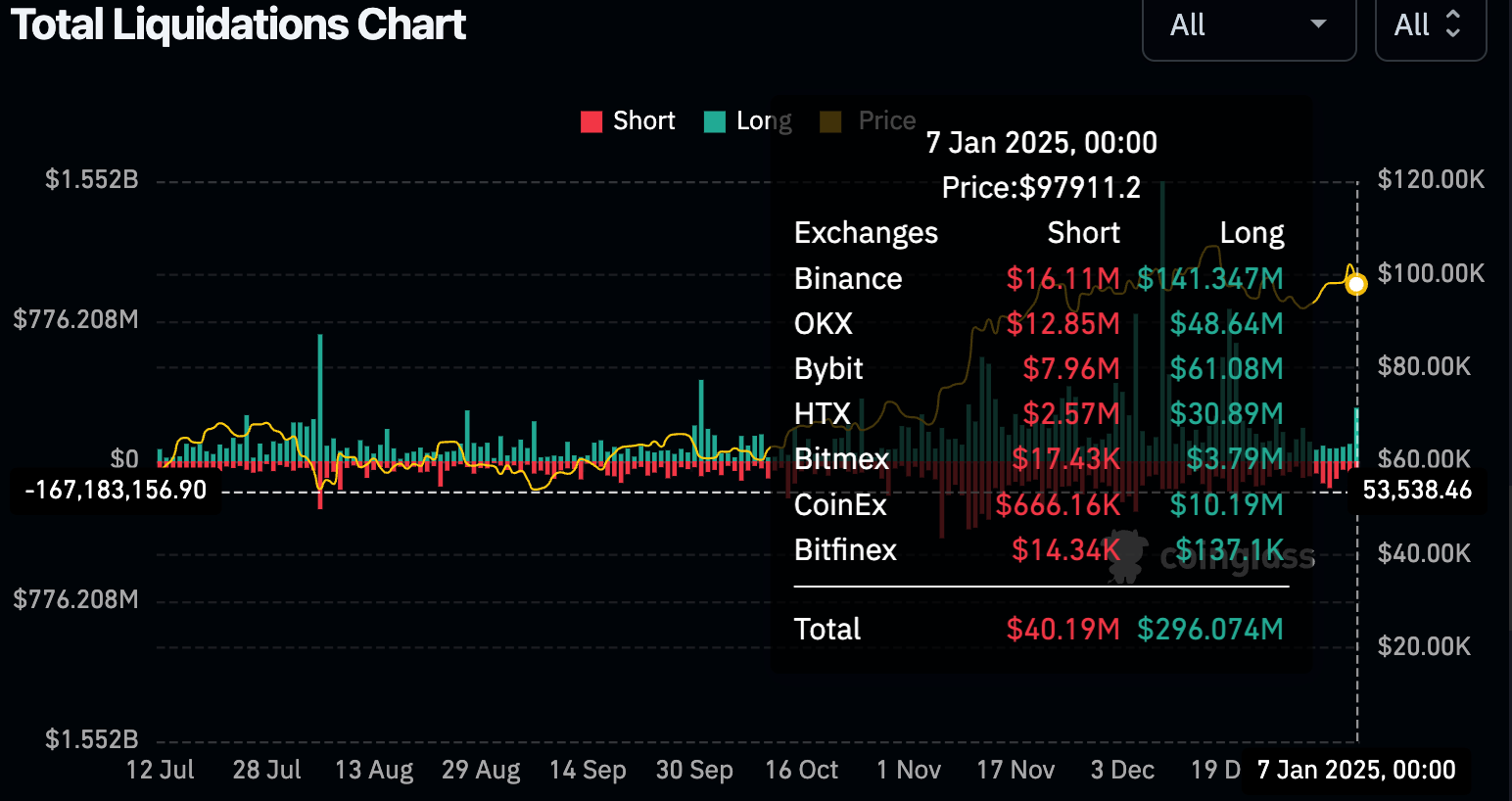

The swift diminution successful prices liquidated astir $300 cardinal agelong positions crossed derivatives markets betting connected rising prices, according to CoinGlass, marking the archetypal ample leverage flush of the year.

The beardown information besides has investors further rolling backmost their expectations of complaint cuts successful 2025.

While marketplace participants had already written disconnected immoderate accidental of a complaint chopped astatine the Fed's January meeting, they present spot conscionable a 37% accidental of an easing determination astatine the cardinal bank's March meeting, down from astir 50% conscionable a week ago, according to the CME FedWatch tool. Looking retired adjacent further, the likelihood of a complaint chopped successful May are besides present good beneath 50%. Scanning each of 2025, Ballinger Group's Kyle Chapman noted investors are present lone pricing successful astir lone 1 25 ground constituent complaint chopped for the full year.

11 months ago

11 months ago

English (US)

English (US)