Crypto plus prices slid connected Thursday, gathering connected Wednesday's market-wide selloff spurred by Federal Reserve Chair Jerome Powell disappointing investors with his comments connected U.S. involvement complaint chopped expectations for adjacent year.

Bitcoin's (BTC) effort to bounce backmost supra $100,000 rapidly faded earlier during the time and slid to the low-$97,000s during the U.S. day. Recently, it modestly recovered to astir $98,000, but was inactive down 4.8% implicit the past 24 hours.

Altcoins fared overmuch worse, with the broad-market CoinDesk 20 Index diving much than 10% during the aforesaid period. Ethereum's ether (ETH) dipped 10.8% to beneath $3,500, portion Cardano's ADA, Chainlink's LINK, Aptos' APT, Avalanche's AVAX and Dogecoin's DOGE each suffered 15%-20% losses. Notably, SOL sank to its weakest terms since Nov. 7 — astir erasing its post-election rally pursuing a 26% plunge from its record high deed little than a period ago.

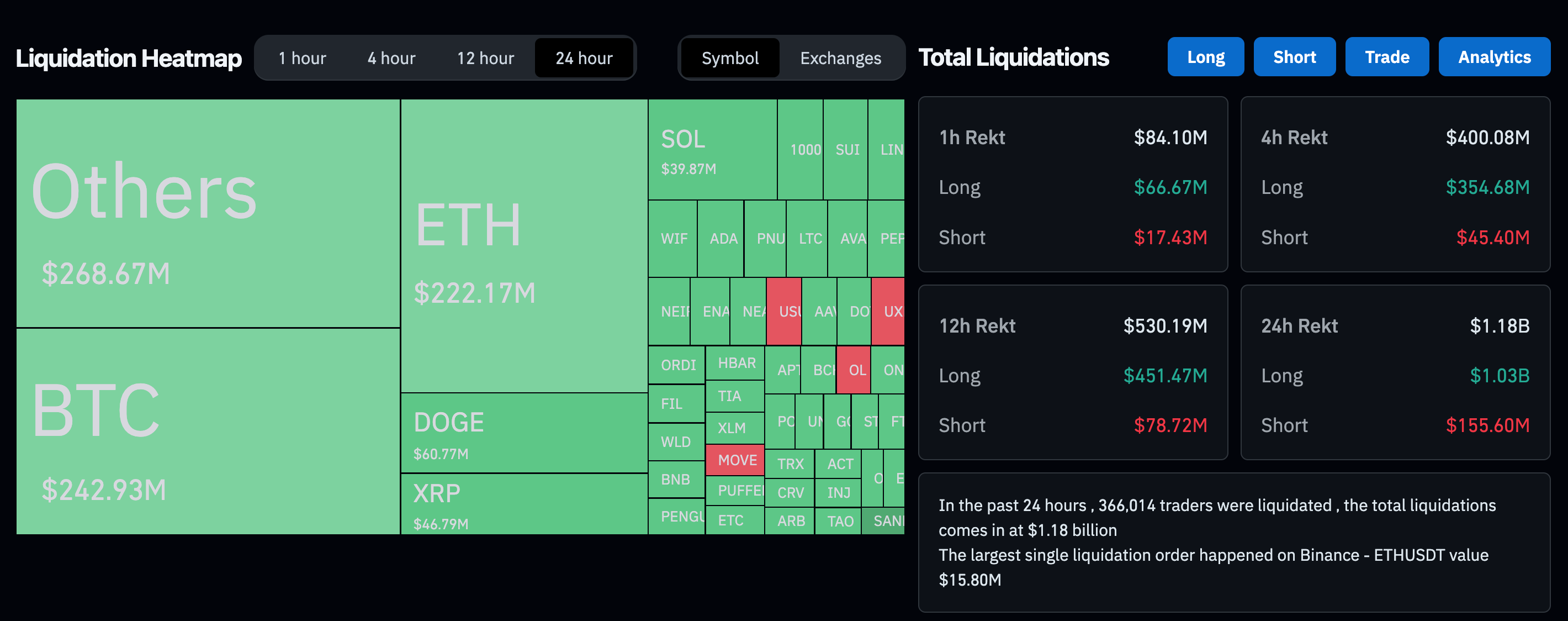

Over the past 24 hours — astir since yesterday's complaint determination by Fed argumentation makers — astir $1.2 cardinal worthy of leveraged crypto derivatives trading positions person been liquidated crossed each assets, CoinGlass data shows. Over $1 cardinal of those were agelong positions, oregon bets that prices would rise.

In accepted markets, U.S. banal indexes somewhat bounced from Wednesday's lows but gave backmost portion of the pre-market gains during the session. The S&P 500 and the tech-heavy Nasdaq were 0.5% up from the Wednesday close.

Crypto prices roseate astir vertically since Donald Trump's statesmanlike predetermination triumph successful aboriginal November, buoyed by hopes of pro-crypto policies from his incoming administration. Wednesday's Fed projection of a slower gait of complaint cuts for adjacent twelvemonth and Powell's hawkish code connected rising ostentation expectations caught galore investors offside, triggering a broad-market selloff crossed crypto, equities and adjacent gold.

The U.S. dollar scale (DXY), a cardinal spot gauge against a handbasket of overseas currencies, surged supra 108, its strongest level since November 2022, portion 10-year U.S. Treasury yields besides roseate sharply supra 4.6%, the highest since May.

"The crypto marketplace has already been connected pins and needles astir the anticipation for a correction pursuing the grounds tally successful the terms of bitcoin done $100,000," Joel Kruger, marketplace strategist astatine LMAX Group, said successful a Thursday note. "We got that catalyst from the satellite of accepted markets. … Fallout from Wednesday’s Fed determination was simply excessively overmuch to ignore."

"When you zoom retired and see the year-over-year growth, a pullback similar this feels healthy," Azeem Khan, co-founder and COO of layer-2 web Morph, said successful an email shared with CoinDesk.

"It’s besides worthy noting that, historically, year-end selloffs successful securities tin hap arsenic investors offset losses against gains to little their taxation liabilities," Khan added. "While it’s hard to accidental however overmuch of this is driving the existent trend, it could beryllium a contributing factor."

9 months ago

9 months ago

English (US)

English (US)