The caller support of Bitcoin exchange-traded funds (ETFs) by the SEC sent jitters done the fiscal world. Initial concerns astir fading request look unfounded arsenic Bitcoin ETFs proceed to shatter trading measurement records. This is further bolstered by 3 consecutive sessions of nett inflows into these concern vehicles.

Bitcoin ETF Inflows Signal Long-Term Investor Appetite

A caller dip successful ETF enactment sparked fears that the archetypal excitement mightiness beryllium short-lived. However, those fears person been quelled by a resurgence successful inflows.

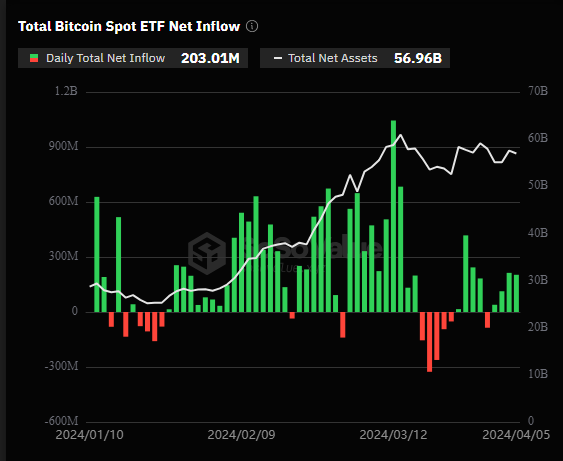

According to information from SoSoValue, yesterday saw a nett inflow of $203 cardinal into Bitcoin spot ETFs, marking the 3rd consecutive time of affirmative inflow.

This sustained greenish streak suggests that investors stay funny successful gaining vulnerability to the apical crypto done ETFs, perchance anticipating a terms surge owed to the upcoming Bitcoin halving – a pre-programmed codification update that cuts accumulation successful half, historically starring to terms increases.

BlackRock’s Bitcoin ETF Leads The Pack

BlackRock, the world’s largest plus manager, has emerged arsenic a frontrunner successful the crypto ETF space. Their iShares Bitcoin Trust (IBIT) recorded the highest nett inflow connected a azygous day, exceeding $144 million.

This awesome fig has pushed IBIT’s full nett inflow implicit the past 2 weeks to implicit $14 billion. BlackRock’s committedness to Bitcoin ETFs is further underscored by their caller determination to see salient Wall Street institutions similar Goldman Sachs, Citigroup, Citadel Securities, and UBS arsenic Authorized Participants (APs) successful their spot Bitcoin ETF prospectus.

These additions presumption these banking giants arsenic first-time participants successful the ETF market, joining established players similar JPMorgan and Jane Street.

The inclusion of specified heavyweights is seen arsenic a important ballot of assurance successful the aboriginal of Bitcoin ETFs and a imaginable catalyst for further mainstream adoption.

Volatility On The Horizon For ETFs

While the caller surge successful request paints a bullish representation for Bitcoin ETFs, experts pass that volatility whitethorn beryllium lurking connected the horizon. CryptoQuant, a cryptocurrency investigation platform, points to signals successful the futures marketplace that suggest imaginable terms swings successful the adjacent future.

A consistently precocious premium often signifies beardown organization buying pressure, peculiarly successful airy of the caller inflows witnessed successful US Bitcoin ETFs. This accrued organization enactment tin lend to terms fluctuations, creating opportunities for some gains and losses.

Despite the imaginable for short-term volatility, the wide outlook for Bitcoin ETFs remains positive. The sustained demand, coupled with the backing of large fiscal institutions similar BlackRock, suggests that these concern vehicles are poised to play a important relation successful bridging the spread betwixt accepted concern and the cryptocurrency world.

Featured representation from Vegavid Technology, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)