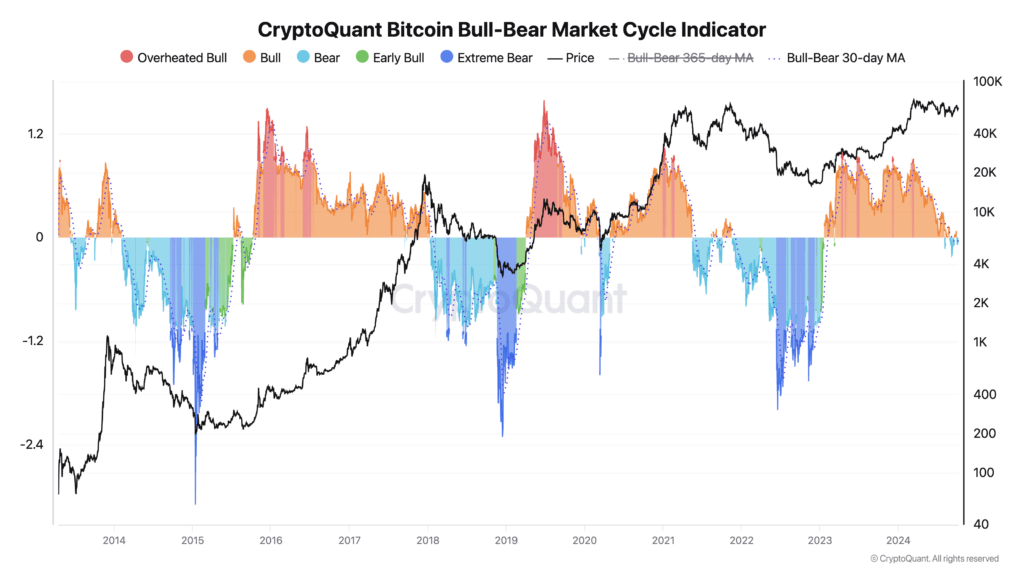

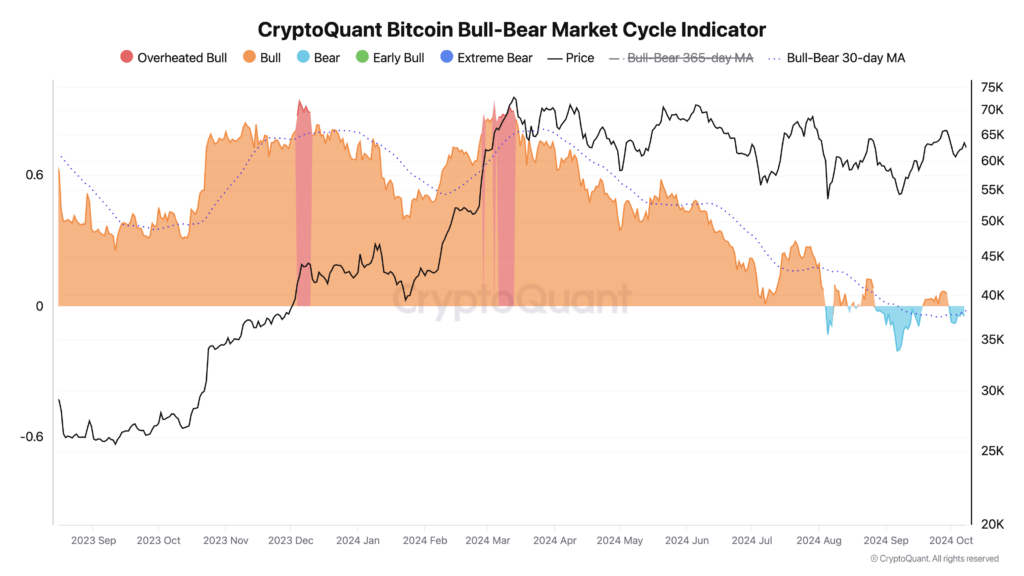

Bitcoin’s caller marketplace trends punctual questions astir whether the aboriginal 2024 bull tally has ended oregon if determination is inactive imaginable for further maturation into 2025, aligning with humanities post-halving peaks. According to CryptoQuant’s Bitcoin Bull-Bear Market Cycle Indicator, Bitcoin has transitioned into a carnivore signifier aft an overheated bull play earlier this year.

In March 2024, Bitcoin surged to an all-time precocious of $73,750.07, reflecting a important highest successful marketplace optimism. This surge corresponded with an overheated bull phase, wherever prices importantly exceeded humanities averages. Historically, Bitcoin’s bull markets scope their peaks astir 500 days aft a halving event, suggesting that the existent rhythm whitethorn not person afloat matured.

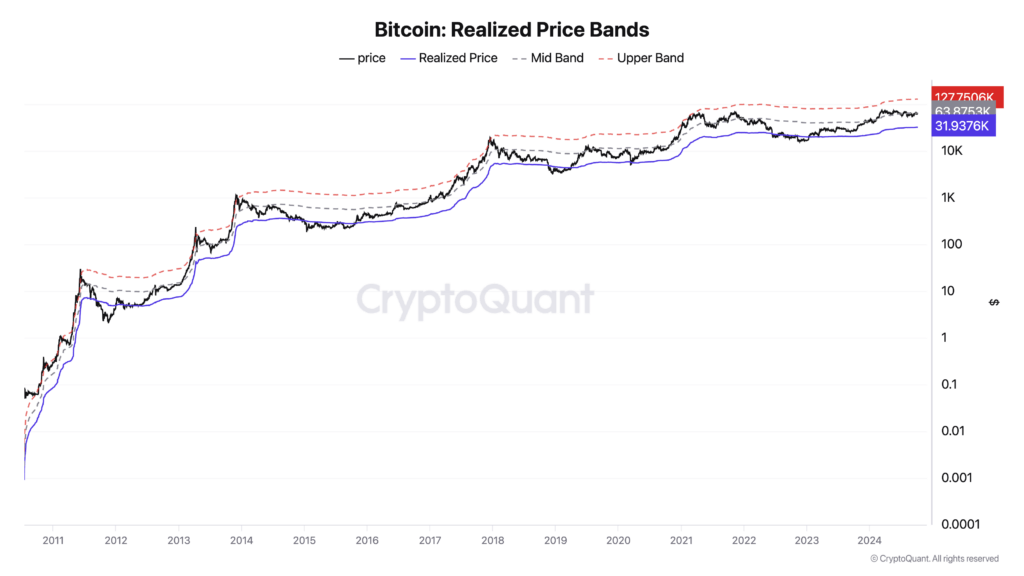

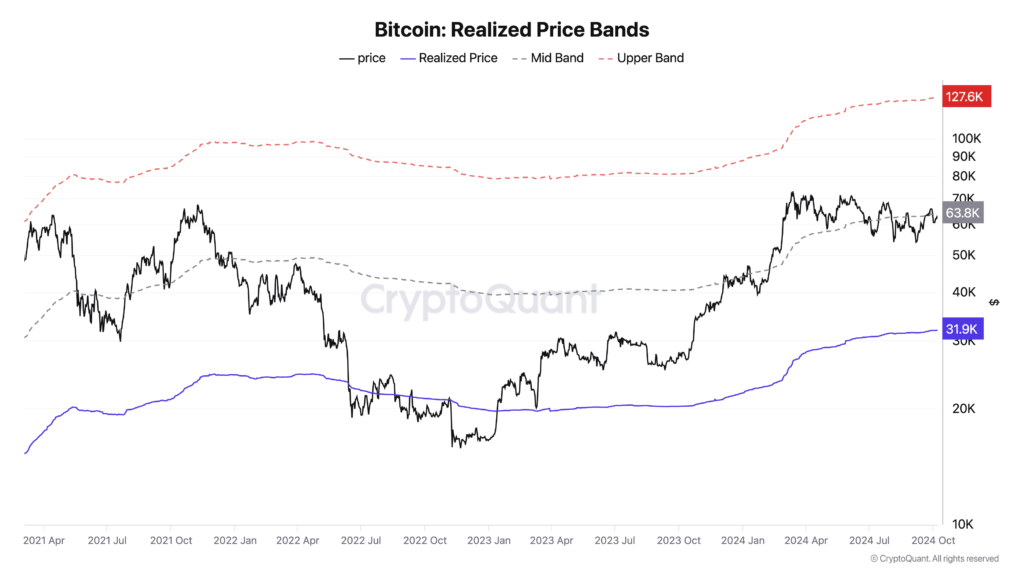

However, the realized terms chart, which calculates the mean terms of each Bitcoins based connected their past movement, indicates that Bitcoin is inactive astir the midpoint of its cycle. In erstwhile cycles, the realized terms has risen to caller highs earlier the marketplace transitions into a prolonged carnivore phase. The existent information implies that Bitcoin has yet to deed the highest typically observed successful past bull markets.

Despite entering a carnivore phase, Bitcoin’s terms remains beardown compared to the opening of the year. On Oct. 9, Bitcoin was trading astatine $62,151, astir doubling its worth since January, erstwhile it was astir $42,000. This sustained show suggests robust marketplace support, adjacent amid fluctuations and cooling marketplace sentiment.

Bitcoin marketplace cycles are characterized by periods of accelerated maturation followed by corrections. The caller displacement into a carnivore signifier could awesome a impermanent consolidation alternatively than the extremity of the bull market. Previous cycles person exhibited akin patterns, with interim carnivore phases occurring earlier the marketplace resumes its upward trajectory toward caller peaks.

Analysts are debating whether the aboriginal 2024 highest represents the cycle’s climax oregon if Bitcoin volition proceed to emergence into 2025, fitting the humanities signifier of bull marketplace tops appearing over a year aft the past halving. The realized terms illustration supports the anticipation of further growth, arsenic the highest typically occurs aft surpassing the midpoint, with the precocious set presently astatine $127,000.

Factors specified arsenic regulatory developments, the 2024 US Election, organization adoption, and different macroeconomic conditions could power Bitcoin’s trajectory successful the coming months. The interplay betwixt the bear/bull marketplace indicator and the realized terms suggests that portion marketplace sentiment has cooled, underlying fundamentals whitethorn inactive enactment continued growth. Further, with Bitcoin holding beardown supra $60,000, it is hard to beryllium bearish connected the asset.

The cardinal question remains whether Bitcoin volition adhere to its humanities cycles, with a important highest yet to come, oregon if the aboriginal 2024 surge was the pinnacle for this period, bolstering fears of importantly diminishing returns.

The station Bitcoin dips into carnivore marketplace portion though realized terms shows country for maturation to $127,000 appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)