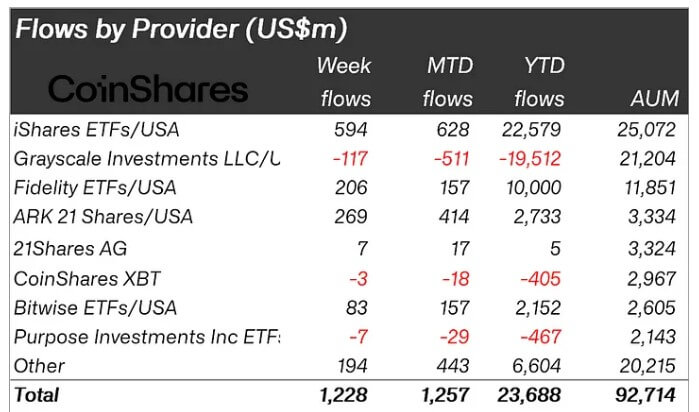

Inflows into crypto-related concern products continued for the 3rd consecutive week, with $1.2 cardinal flowing into the sector, according to CoinShares’ latest weekly report.

James Butterfill, CoinShares’ caput of research, attributed the beardown inflows to expectations of a dovish US monetary argumentation and affirmative marketplace momentum. These factors pushed full assets nether absorption up 6.2% to $92.7 billion.

The US Securities and Exchange Commission approved options trading for BlackRock’s spot Bitcoin ETF, which besides lifted marketplace sentiment. Despite these inflows, play trading measurement successful the assemblage dipped by 3.1%.

Bitcoin’s dominance continues

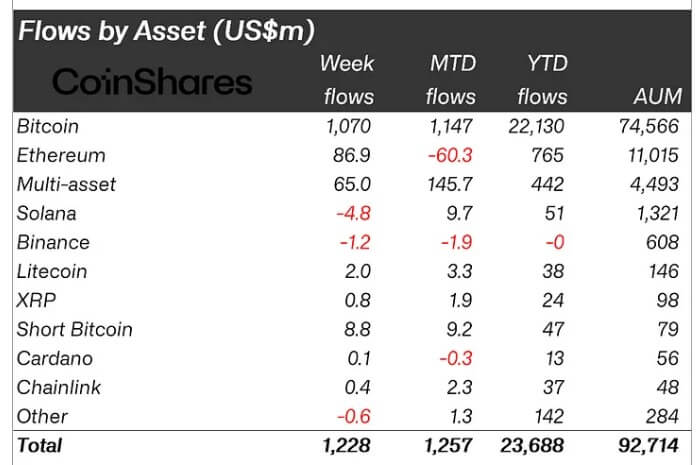

The CoinShares study showed that Bitcoin continued to predominate the flows, with investors pouring successful $1 cardinal to BTC-related concern products.

This tin beryllium linked to its beardown terms show and besides the improved inflows to spot Bitcoin ETF products past week. Notably, the funds tally by Bitwise, BlackRock, Fidelity, and Ark 21 Shares each saw affirmative show during the reporting period.

However, Grayscale’s crypto funds continued their nett outflow trend, dropping its full assets to $21.2 billion.

Crypto Assets Fund Flows (Source: CoinShares)

Crypto Assets Fund Flows (Source: CoinShares)Meanwhile, BTC’s caller uptrend to astir $65,000 fueled an $8.8 cardinal inflow into short-Bitcoin products, arsenic immoderate investors expect the existent rally to fade.

Regionally, sentiment was divided. The US led with $1.2 cardinal successful inflows, portion Switzerland trailed with $84 million. In contrast, Germany and Brazil experienced outflows of $21 cardinal and $3 million, respectively.

Ethereum breaks a antagonistic streak.

Ethereum-related products ended a five-week outflow streak, bringing successful $87 million—the archetypal important inflow since aboriginal August.

Data from SosoValue showed that spot Ethereum ETFs saw the second-highest play flows since their motorboat successful July.

Crypto Assets Weekly Flow (Source: CoinShares)

Crypto Assets Weekly Flow (Source: CoinShares)On the different hand, large-cap alternate integer assets had mixed results. Litecoin and XRP recorded inflows of $2 cardinal and $0.8 million, respectively. Meanwhile, Solana and Binance faced outflows of $4.8 cardinal and $1.2 million.

The station Bitcoin dominance drives $1.2B inflows successful crypto concern products appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)