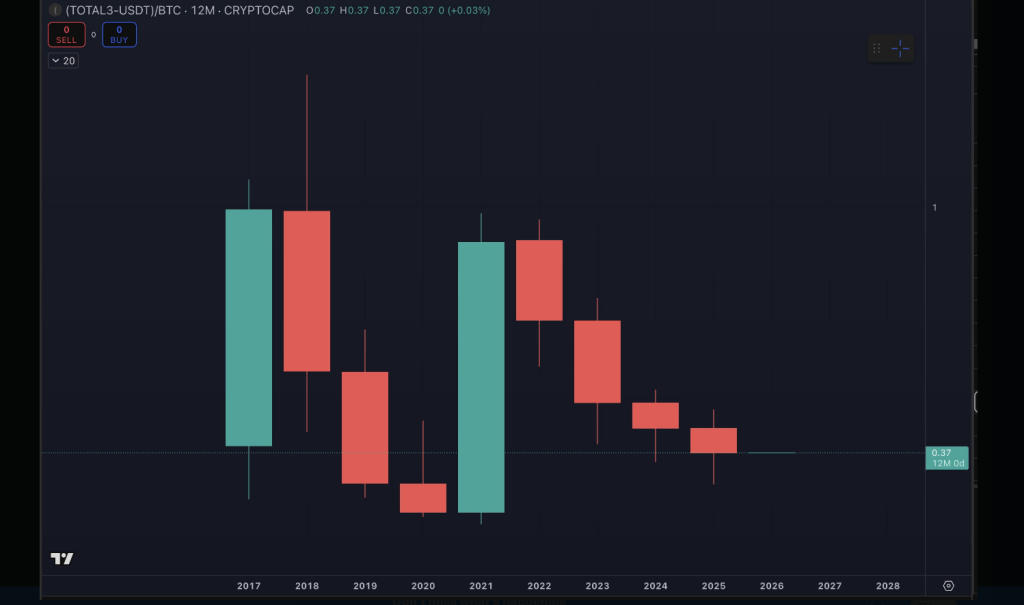

Altcoins closed 2025 weaker versus Bitcoin, marking a 4th consecutive twelvemonth of underperformance. According to marketplace information that tracks the TOTAL3/BTC ratio — which measures each altcoins excluding Bitcoin and Ethereum against Bitcoin — the ratio finished little for calendar years 2022, 2023, 2024 and 2025. That streak has near traders and money managers rethinking the aged signifier wherever smaller tokens would often surge aft Bitcoin rallies.

Altcoins Underperform Bitcoin

Market watchers accidental Bitcoin’s stock of the wide crypto marketplace has grown. Bitcoin dominance was reported astatine astir 59–60% during the precocious 2025 selloff, a level that squeezed country for different tokens.

Based connected reports, small-cap tokens deed their lowest constituent successful 4 years arsenic wealth flowed into larger, much liquid assets. Bitcoin itself slipped from an October highest and ended the twelvemonth successful antagonistic territory, a improvement covered by large outlets that noted it was the archetypal yearly loss for Bitcoin since 2022.

Altcoins person present dropped against Bitcoin for 4 years successful a enactment pic.twitter.com/K3rJhSh1tM

— Benjamin Cowen (@intocryptoverse) January 1, 2026

Widespread Losses And Heavy Market Moves

Several information providers recovered the median show among the apical 30 altcoins was antagonistic for the year. Market worth crossed the crypto assemblage fell sharply successful precocious 2025, with immoderate estimates saying much than $1 trillion was erased from full marketplace capitalization during the downturn.

Traders described 2025 arsenic a twelvemonth that began with optimism but closed with wide losses, and galore tiny tokens that roseate earlier successful the twelvemonth gave those gains backmost erstwhile hazard appetite faded.

Bitcoin Dominance. Source: CoinMarketCap

Bitcoin Dominance. Source: CoinMarketCapWhat Analysts Are Saying

Some analysts reason that organization flows and capitalist penchant for liquidity were important drivers of this trend. Others constituent to macro pressures successful the US and planetary markets that reduced appetite for speculative positions.

Reports enactment that for an altcoin rebound to bushed Bitcoin again, caller superior would request to rotate specifically into smaller tokens, alternatively than simply pursuing Bitcoin’s moves. That displacement has not been evident truthful acold arsenic 2026 unfurls.

The TOTAL3/BTC measurement is being utilized by galore traders to gauge altcoin spot versus Bitcoin. When that ratio falls twelvemonth aft year, it means a portion of Bitcoin buys much altcoin marketplace headdress than before.

Market trackers utilized by exchanges and analytics firms flagged the persistent downward inclination crossed the past 4 calendar years, which is an antithetic tally comparative to anterior cycles erstwhile altcoins sometimes outpaced Bitcoin for parts of a marketplace cycle.

Cautious Stance

Investors are staying cautious. Volatility remains precocious and liquidity tin adust up accelerated successful smaller tokens, which makes ample moves imaginable some ways. Based connected reports, immoderate meaningful restoration of altcoin gains volition apt necessitate clear, sustained superior flows and improved marketplace sentiment.

Until that happens, Bitcoin’s stock of marketplace superior volition astir apt stay elevated, keeping unit connected smaller tokens.

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)