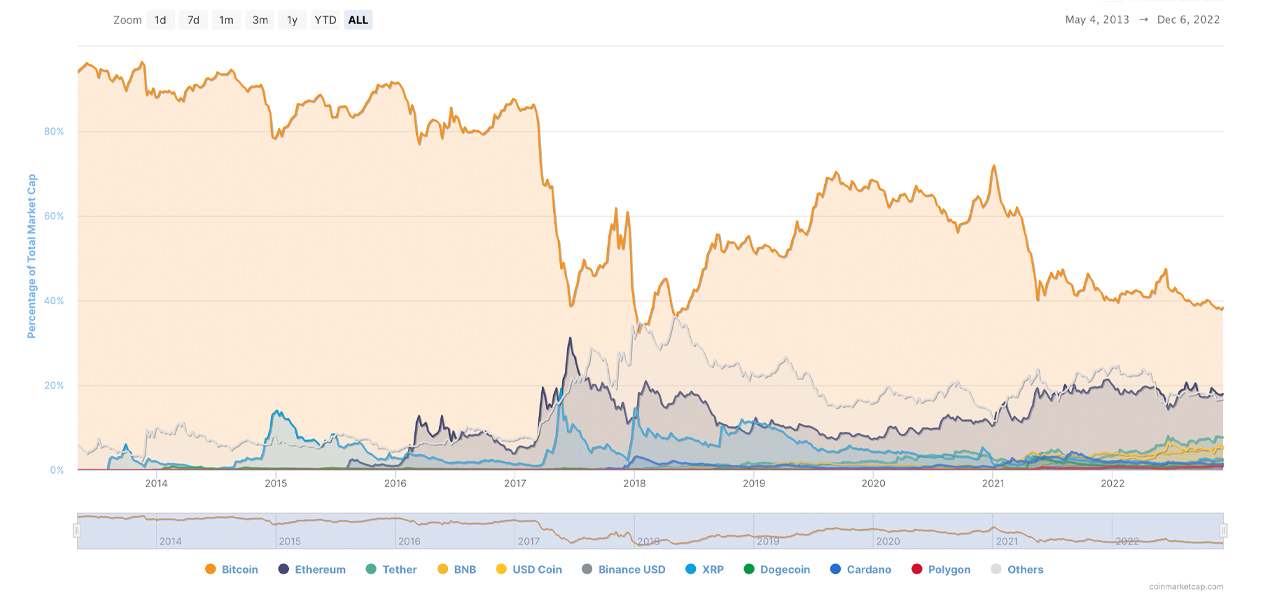

Over the past 100 days oregon astir 3 months, bitcoin’s marketplace dominance among 21,958 antithetic crypto assets worthy astir $850 cardinal has been nether 40%. Bitcoin dominance has been nether 40% since Aug. 27, 2022, with a little lawsuit of rising supra the 40% scope 52 days ago, connected Oct. 15.

Bitcoin’s Market Superiority Lost 41% successful 35 Months

Bitcoin’s marketplace capitalization has been supra the $325 cardinal portion since Nov. 29, 2022. At the clip of writing, bitcoin’s (BTC) wide marketplace valuation is astir $328 billion, which represents astir 38.3% of the crypto economy’s full $856,947,917,107 marketplace cap.

The 2nd starring crypto asset, ethereum (ETH), connected the different hand, has a marketplace headdress contiguous of astir $155.38 cardinal oregon 18.1% of the aggregate $856 billion. In the aboriginal days, BTC’s marketplace supremacy was supra the 90% portion from erstwhile it archetypal gained worth successful 2010, each the mode up until the 2nd week of Nov. 2014.

Crypto marketplace dominance, among the thousands of integer plus marketplace capitalizations, refers to the comparative size of the coin’s capitalization compared to the wide marketplace capitalization of the full crypto economy. After mid-Nov. 2014, BTC’s marketplace dominance slid beneath the 90% portion but remained supra the 80% scope each the mode until the archetypal week of March 2017.

Bitcoin dominance among the apical 10 crypto assets by marketplace valuation.

Bitcoin dominance among the apical 10 crypto assets by marketplace valuation.Essentially, during those aboriginal days, BTC’s marketplace superiority was 90% for 61 months and aft Nov. 2014, it was supra 80% for 33 months. However, determination were a little fewer instances successful Jan. 2015, March 2016, May 2016, and Sept. 2016, that saw BTC’s marketplace dominance driblet beneath the 80% region.

Bitcoin dominance has been little than 80% for 68 months to date, and it’s been struggling to clasp the 40% scope successful much caller times. On May 15, 2021, and up until Aug. 27, 2022, BTC’s marketplace supremacy successful presumption of capitalization had been supra the 40% scope which was astir 15 months.

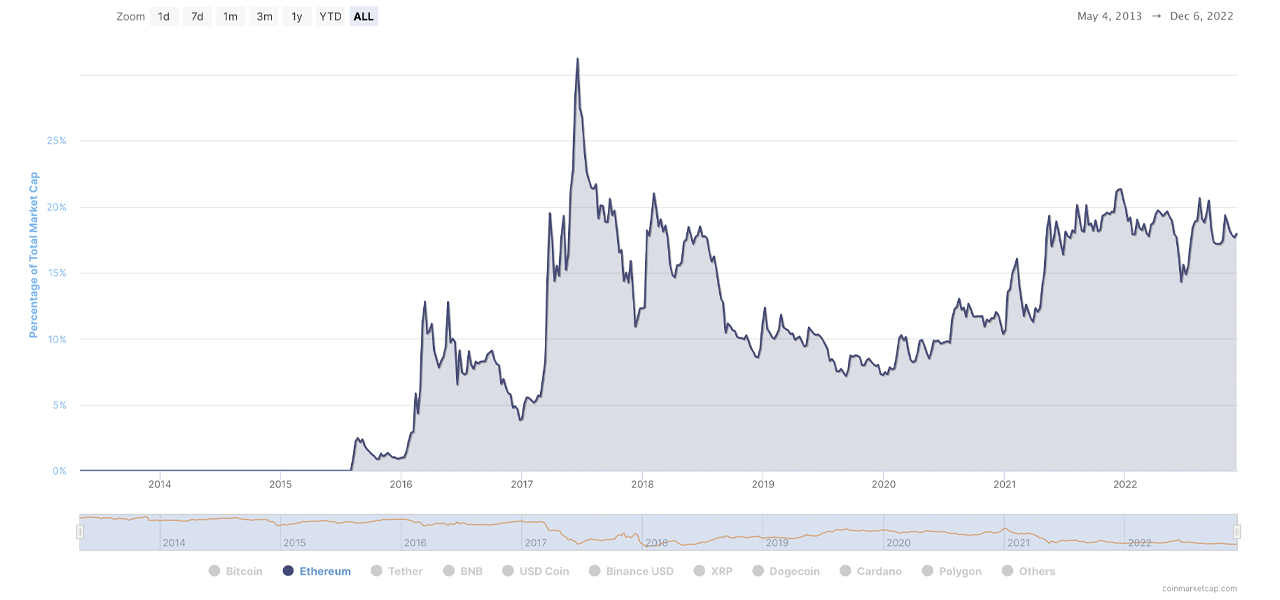

Ethereum (ETH) dominance.

Ethereum (ETH) dominance.Ethereum, Tether, and Dogecoin Market Dominance Levels Rise

Today, it’s been much than a coagulated 3 months of BTC dominance beneath the 40% scope and dominance has not been this debased since May 2018. From a logarithmic perspective, ethereum’s (ETH) marketplace dominance, among each the different integer assets, has shown a important emergence since Jan. 2020.

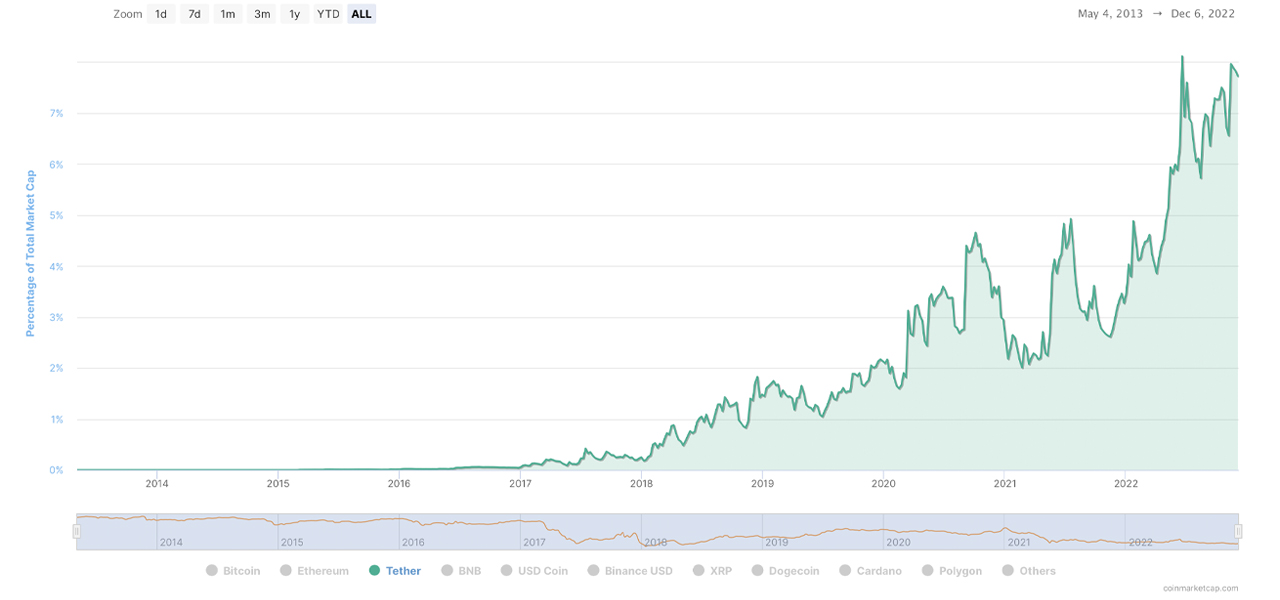

Tether (USDT) dominance.

Tether (USDT) dominance.ETH dominance accrued 130.86% since Jan. 2020, portion BTC dominance gradually slid 41.96% successful that clip frame. From January 2020 until contiguous oregon astir 35 months, tether’s (USDT) marketplace dominance jumped 285%, successful examination to the aggregate worth of much than 20,000 listed crypto assets.

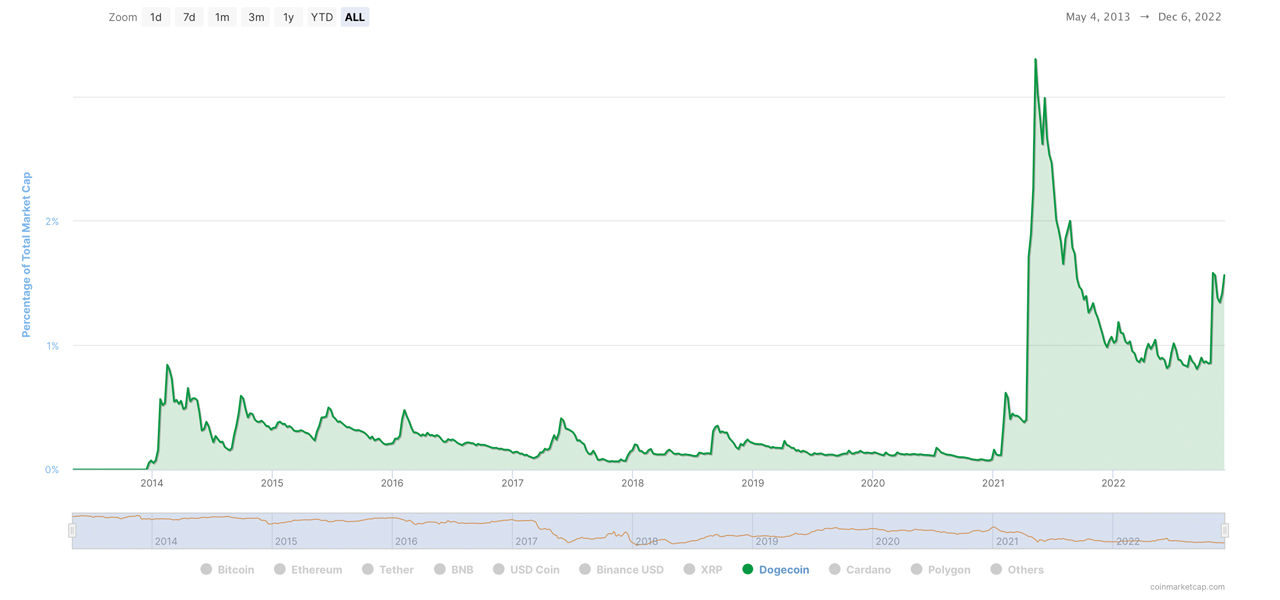

Dogecoin (DOGE) dominance.

Dogecoin (DOGE) dominance.BNB saw its marketplace dominance turn by 440% implicit the past 35 months and usd coin’s (USDC) dominance jumped by 2,500%. Like bitcoin (BTC), xrp’s (XRP) marketplace supremacy has dropped during the past 35 months, sliding 47% since January 2020.

Out of the apical 10 integer assets successful presumption of marketplace valuations, BTC’s and XRP’s dominance levels person seen the worst declines. The meme token dogecoin’s (DOGE) dominance level, connected the different hand, jumped 1,100% higher during the past 35 months.

There’s a large woody of radical who don’t enactment overmuch worth into marketplace capitalization and dominance information erstwhile it comes to integer currencies. For instance, a bitcoin maximalist would accidental that BTC’s marketplace headdress is each that matters, and others whitethorn accidental that a meme coin similar DOGE shouldn’t beryllium compared to blockchains that were not meant to beryllium a joke.

However, galore crypto supporters bash judge marketplace dominance levels connection meaningful data. Bitcoin and ethereum, for instance, tin beryllium viewed against their competitors arsenic having precocious marketplace superiority levels, which tin person a important power connected the market. More often than not, erstwhile BTC’s and ETH’s prices spell up oregon down, alternate crypto assets travel the ascendant crypto’s marketplace patterns.

Tags successful this story

30 time stats, Bitcoin, bitcoin dominance, BNB Dominance, BTC, BTC & XRP, BTC Dominance, BUSD, crypto marketplace update, Cryptocurrencies, DOGE dominance, Dogecoin Dominance, Dominance, ETH, ETH dominance, Ethereum, Global Trade Volume, Market Caps, Market Update, Markets, monthly stats, Stablecoins, Tether, usd coin, USDC, USDC Dominance, USDT, XRP Dominance

What bash you deliberation astir bitcoin’s dominance levels among the thousands of marketplace capitalizations? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)