If there’s 1 crypto plus that is expected to marque it large this 2025, it has got to beryllium Bitcoin. The premiere crypto has demonstrated singular occurrence arsenic it ushers successful 2025.

Registering coagulated numbers successful the past fewer weeks, analysts person precocious hopes that it tin marque further breakthroughs. In fact, based connected latest research, Bitcoin has surpassed accepted plus classes specified arsenic gold, cementing the optimism down the coin.

The integer coin’s occurrence this twelvemonth is unsurprising, attributable to respective advantageous marketplace conditions, including Donald Trump’s triumph successful the caller US elections.

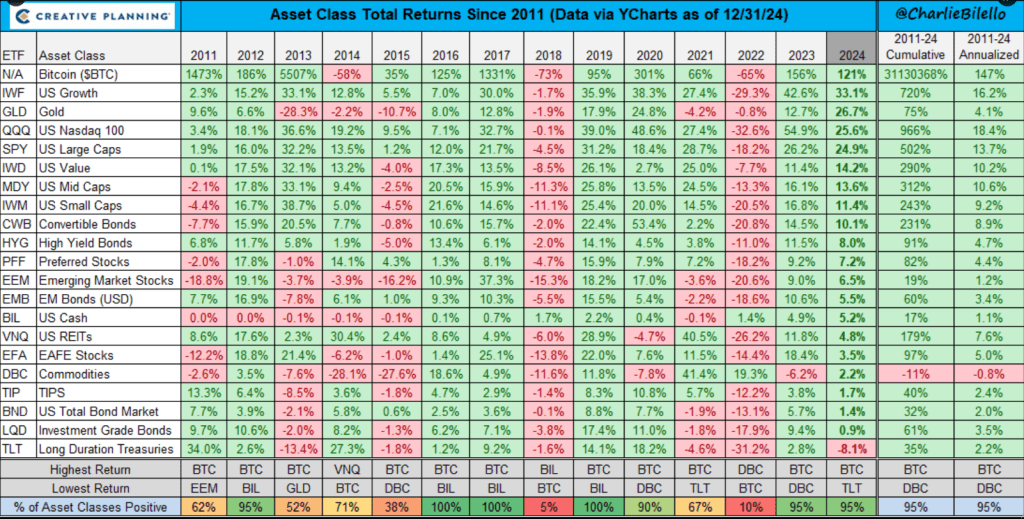

According to a study from Creative Planning, and from a station connected Twitter/X by Charlie Bilello, Bitcoin’s show dwarfed the results of different plus classes, with golden offering returns of conscionable 26%.

The aforesaid information shows the Nasdaq 100 gained 25%, US ample caps 24%, mid-caps 13%, and convertible bonds 10%. Although proving showing decent numbers, Bitcoin is inactive a volatile plus with melodramatic terms swings.

With the objection of Long Duration Treasuries, each large plus finished higher successful 2024 with Bitcoin starring the mode for the 2nd consecutive year.https://t.co/l5IYmkf6Ih pic.twitter.com/TyStoT73rp

— Charlie Bilello (@charliebilello) January 1, 2025

Bitcoin Edges Gold And Other US Indexes

Although Bitcoin has received a fewer criticisms and was the taxable of regulatory actions, it remains a top-performing plus class. Since 2011, BTC has led each different plus classes, but for astatine slightest 3 years wherever it yielded antagonistic returns to holders. For example, successful 2018, Bitcoin’s output was astatine -73%.

But astir of the time, Bitcoin was a accordant performer, and determination were adjacent immoderate instances erstwhile yields topped 1,000%. According to the aforesaid chart, Bitcoin adjacent offered yields of 1,437% successful 2011, adjacent beating semipermanent treasuries with a “modest” 34%.

There were instances erstwhile Bitcoin’s output disappointed its holders and investors. If we cheque the asset’s output this year, we’ll observe that it’s little than past year’s 156% return. Last year, Bitcoin was besides the apical performer among large plus classes, besides beating gold.

Bitcoin Shows Strength, But Volatility Remains

While astir of the past 14 years person seen large show of Bitcoin against different plus classes, its volatility inactive raises questions. Owning Bitcoin oregon different cryptocurrencies ever has hazards related to erratic terms swings and adjacent argumentation announcements.

Bitcoin’s terms has much than doubled since starting 2024 wrong the $40k range. As of property time, Bitcoin trades betwixt $95k and $97k.

Last December 5th, Bitcoin’s terms deed the $100k people earlier dipping beneath $100k again aft 1 day. Ether besides joined the surge and volatility, with its astir 50% summation for the year, and it’s presently trading successful the $3,400 range.

Featured representation from Newsbit, illustration from TradingView

11 months ago

11 months ago

English (US)

English (US)