Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

According to CoinGecko’s 2025 Q1 Report, the cryptocurrency market, led by Bitcoin, mislaid astir one-fifth of its worth successful the archetypal 4th of 2025, afloat negating the gains made towards the extremity of 2024.

Total marketplace worth witnessed a driblet of $3.8 trillion to $2.8 trillion, an 18.6% diminution implicit the quarter. This crisp plunge marked the turnaround earlier the inauguration of Donald Trump arsenic US president, successful stark opposition to past year’s ramp up. Trading measurement besides suffered immoderate contractions, arsenic the regular volumes dropped to $146 billion, a alteration of 27%.

Bitcoin Rules Market While Others Decline

Bitcoin insulated itself reasonably from the turbulence successful different cryptocurrencies truthful that its marketplace stock reached astir 60%, the highest successful 4 years. Bitcoin achieved highest valuation astatine $106,182 successful January soon aft inauguration but plunged astir 12% to decorativeness the 4th astatine $82,514.

Compared with Bitcoin during this period, golden and US Treasury bonds were accepted safe-haven investments with little performance.

Compared to Ethereum, however, the concern was overmuch worse. Its terms fell by 45%, fundamentally wiping retired each gains successful 2024. Its marketplace stock dropped to astir 8%, the lowest it has been since the extremity of 2019.

As it has been observed by astir analysts, this downturn is not thing caller since much and much activities person shifted toward “Layer 2” networks built atop Ethereum and not utilizing the Ethereum main network.

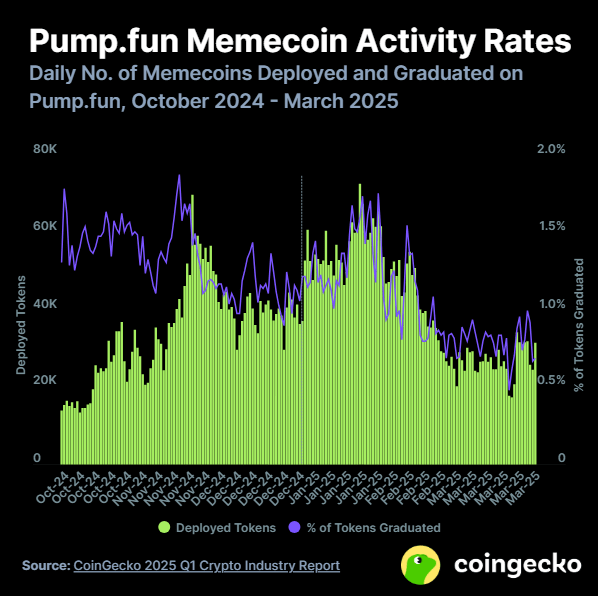

Meme Coins Crash After Major Scam

The antecedently red-hot meme coin abstraction received a rude wake-up telephone successful aboriginal 2025. Following a roar successful Trump-themed tokens, the manufacture was severely wounded erstwhile the Libra token – introduced by Argentina’s President Javier Milei – proved to beryllium a scam.

The task was abandoned by developers aft they had taken investors’ funds, shattering assurance successful specified tokens. By precocious March, caller token launches connected the level Pump.fun per time had dropped by implicit 50%.

DeFi Industry Loses More Than A Quarter Of Its Value

Not adjacent the decentralized concern (DeFi) manufacture was exempted. Overall wealth successful DeFi projects dropped 27% to $48 cardinal during the archetypal quarter. Ethereum’s dominance successful the DeFi abstraction declined to 56% by quarter-end.

Not everything was negative, though. Stablecoins specified arsenic Tether (USDT) and USD Coin (USDC) became much fashionable with investors seeking a safer stake arsenic the marketplace tanked.

Solana besides remained successful its enactment position, holding 39.6% of each decentralized speech (DEX) trading during Q1, courtesy mostly of meme coin mania. Even Solana’s leadership, however, started to wane astatine the extremity of the play arsenic the meme coin mania declined.

The melodramatic displacement successful marketplace sentiment shows however rapidly cryptocurrency fortunes tin change. After a promising extremity to 2024, the caller twelvemonth brought a harsh world cheque for crypto investors, with astir $1 trillion successful marketplace worth disappearing successful conscionable 3 months.

Featured representation from Pexels, illustration from TradingView

7 months ago

7 months ago

English (US)

English (US)