Bitcoin’s latest descent has pushed prices into territory not seen truthful acold this year, with the marketplace concisely trading adjacent the debased $75,000 area.

Losses person piled up implicit caller months, leaving the plus good beneath its grounds highest and stirring caller statement astir whether the broader uptrend has stalled.

The driblet did not hap successful isolation, though, and the timing points to wider unit crossed hazard assets alternatively than a crypto-only shock.

Bids Cluster Below $73k

Order books amusement thicker bargain involvement clustered successful a scope that stretches from astir $71,500 down toward $64,000. According to marketplace feeds, that request is disposable but tentative.

When galore bids beryllium connected speech books they tin dilatory a fall, but they tin besides vanish rapidly if sellers accelerate.

Liquidations person amplified the slide: forced closures of leveraged longs person been reported successful the millions and specified events tin make short, convulsive drops adjacent wherever cardinal request remains.

This exemplary shows existent bitcoin terms enactment is inactive sitting wrong humanities norms astatine $74,000.

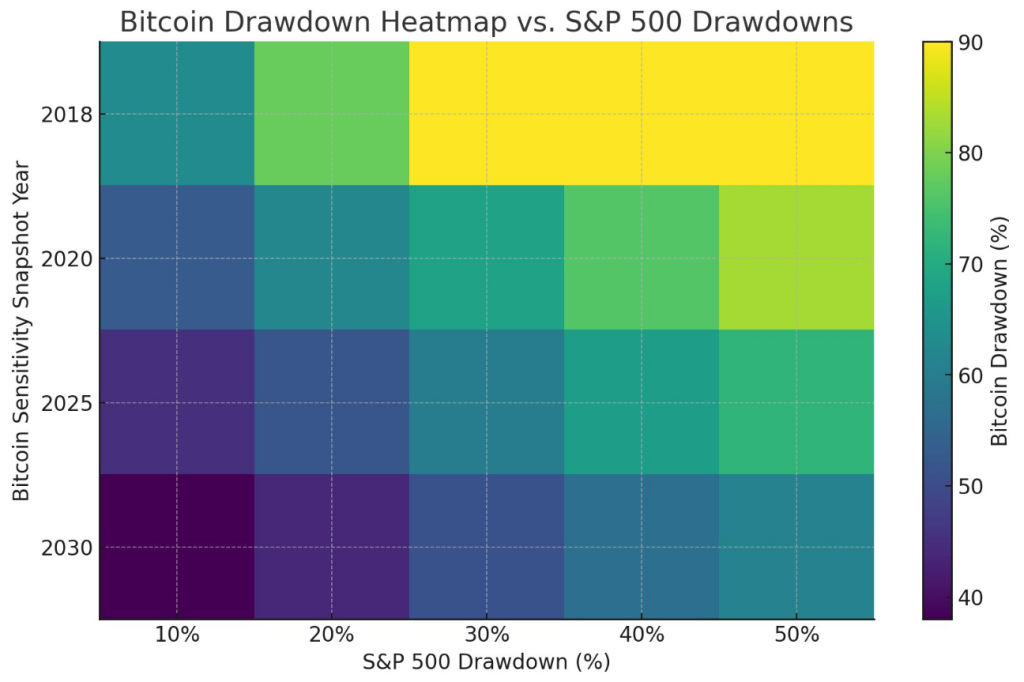

Bitcoin is down ~40% from its October precocious portion U.S. equities stay adjacent each clip highs, with the S&P 500 down little than 10%. Under those conditions, a imaginable ~45% bitcoin… https://t.co/E8oiOKD3VE

— Joe Burnett, MSBA (@IIICapital) February 3, 2026

Nothing Out Of The Ordinary

According to Joe Burnett, vice president of Bitcoin strategy astatine Strive, the caller downturn inactive fits wrong patterns seen successful anterior marketplace cycles.

Burnett said Bitcoin hovering astir the mid-$70,000 scope reflects a drawdown size that has appeared earlier during periods of accelerated adoption and terms discovery.

He added that swings of this standard thin to amusement up erstwhile an plus is inactive being priced by the market, alternatively than erstwhile it has settled into a unchangeable trading range.

Tech Stocks Drag On Risk Appetite

The pullback successful US tech names, peculiarly those tied to AI infrastructure, has been cited by respective marketplace watchers arsenic a linked cause.

NVIDIA and Microsoft were among the bigger drags connected large indices, and reports enactment that anemic sentiment astir net and high-cost AI build-outs has near investors much cautious.

When large maturation stocks wobble, investors often trim different risky positions too, and crypto has been swept up successful that flow.

Retail dip-buying was disposable connected immoderate exchanges, and organization spot purchases were reported arsenic well.

According to Burnett, a 45% drawdown is adjacent to historical swings, which suggests volatility similar this has precedents. That presumption does not region symptom for traders, but it does spot the driblet into a longer signifier alternatively than labeling it terminal.

Featured representation from Unsplash, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)