By Omkar Godbole (All times ET unless indicated otherwise)

Over the past 24 hours, the crypto marketplace has experienced notable weakness, accordant with the bearish post-Fed pricing successful options and resilience successful the dollar index.

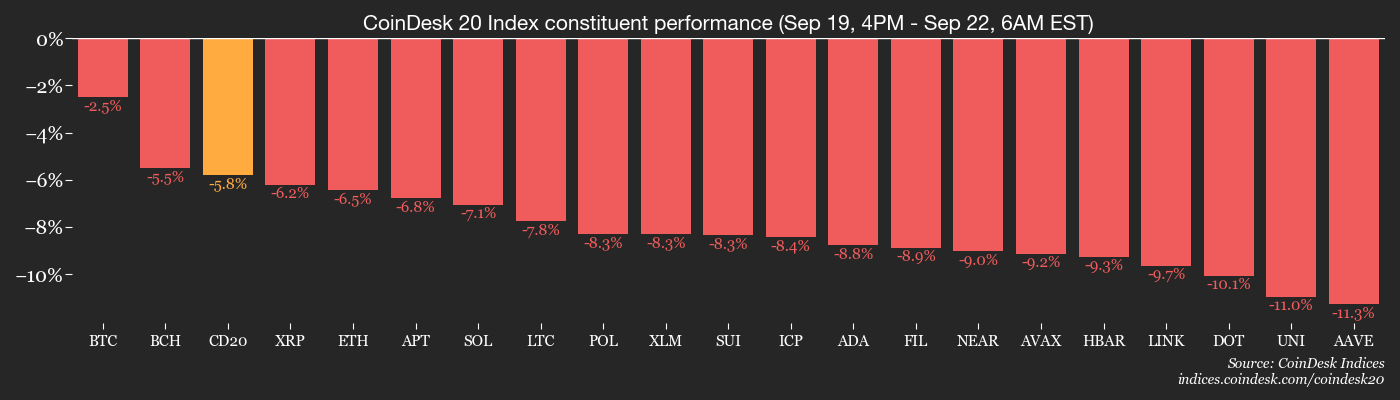

Bitcoin (BTC) fell 2.6% to $112,700, portion ether (ETH) slid much than 6%, CoinDesk information show. Broad marketplace sentiment, seen successful the CoinDesk 20 Index, dropped astir 8% and the CoinDesk 80 Index mislaid 7.5%, underscoring wide weakness.

U.S. crypto equities besides showed unit successful pre-market trading. Bitcoin capitalist Strategy (MSTR) and integer plus speech Coinbase Global (COIN) some mislaid 2.8% portion futures tracking the benchmark S&P 500 dipped conscionable 0.2%.

Some analysts framed the pullback as a steadfast correction that helps wide excessive leverage from the marketplace and sets the signifier for a much sustained advance. The descent has triggered the liquidation of roughly $1.5 cardinal worthy of leveraged crypto positions.

Others stay much cautious.

"Total inflows are not beardown capable to propulsion bitcoin materially higher," Markus Thielen, the laminitis of 10x Research, noted successful a lawsuit note.

Year-to-date, crypto markets person attracted astir $140.5 cardinal successful inflows: $63.1 cardinal from stablecoins, $52.4 cardinal into bitcoin via ETFs, futures, and MicroStrategy (MSTR), and $24.9 cardinal done ether, Thielen said.

The caller ETF flows bespeak a renewed penchant for bitcoin implicit ether. This period alone, U.S.-listed bitcoin ETFs person raised implicit $3.48 billion, portion ether ETFs person garnered conscionable $406.87 million, according to SoSoValue data.

Matrixport besides observed that request from integer plus treasuries — led precocious by Ethereum-focused companies — whitethorn beryllium waning.

"In caller months, the superior buyers person been Ethereum treasury companies, but with nett plus values shrinking, their capableness to deploy further superior whitethorn beryllium limited. From a method standpoint, tighter hazard absorption looks prudent," the steadfast said.

Meanwhile, Arthur Hayes' household bureau fund, Maelstrom, pointed to an upcoming proviso test for the decentralized speech Hyperliquid's HYPE token. Some 237.8 cardinal HYPE tokens are scheduled to beryllium unlocked implicit astir 24 months, representing an mean monthly proviso summation of astir $500 million.

Hayes reportedly sold 96,600 HYPE, worthy $5.1 million, aboriginal Monday. The token's terms fell to astir $46, extending a three-day losing streak.

In accepted markets, golden extended its rally, driven by fiscal concerns that boosted request for haven assets. The yen traded small changed against the dollar pursuing comments from Yoshimasa Hayashi — 1 of 5 candidates to regenerate Japanese Prime Minister Shigeru Ishiba — who attributed the weak yen to inflationary pressures. Stay alert!

What to Watch

- Crypto

- Sept. 22: Coinbase introduces Mag7 + Crypto Equity Index Futures, a merchandise combining large U.S. tech stocks with cryptocurrency ETFs successful a azygous futures contract.

- Macro

- Sept. 22, 8:30 a.m.: Canada August PPI YoY Est. N/A (Prev. 2.6%), MoM Est. 0.9%.

- Sept. 22, 12 p.m.: Fed Governor Stephen Miran code connected "Non-Monetary Forces and Appropriate Monetary Policy."

- Earnings (Estimates based connected FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Delysium (AGI) to unveil its assemblage governance plan.

- Gnosis DAO is voting connected a $40,000 aviator maturation money using condemnation voting connected Gardens to empower GNO holders and enactment small, community-led ecosystem initiatives. Voting ends Sept. 23.

- Balancer DAO is voting connected an ecosystem roadmap and backing plan done Q2 2026. It sets growth, revenue, innovation and governance targets and requests $2.87 cardinal successful USDC and 166,250 BAL to money initiatives. Voting ends Sept. 23.

- Unlocks

- None.

- Token Launches

- Sept. 22: 0G (0G) to database connected Kraken, LBank, Bitget and Bitrue.

Conferences

- Day 1 of 2: Canada Fintech Forum 2025 (Montréal)

- Day 1 of 2: Digital Assets Conference Brazil 2025 (São Paulo)

Token Talk

By Oliver Knight

- A fig of altcoins were dealt double-digit moves to the downside connected Monday, with the likes of PUMP, RAY, CRV and TIA each sliding to their lowest successful implicit a month.

- The sell-off was made worse by a $1.6 cardinal liquidation cascade, with $500 cardinal occurring connected ether (ETH) trading pairs, according to CoinGlass.

- Funding rates for ether flipped negative, which means abbreviated traders are paying to clasp their position, demonstrating a displacement successful sentiment pursuing ETH's rally from $2,400 astatine the commencement of July to $4,831 successful precocious August.

- It's worthy noting that crypto majors similar BTC, ETH and SOL are present astatine respective levels of enactment and arsenic sentiment has flipped bearish, a betterment could beryllium staged to people traders being overly assertive successful abbreviated positions.

- The mean crypto token comparative spot scale (RSI) is also astatine 28.4 retired of 100, indicating heavy oversold conditions that volition apt pb to a alleviation rally, unless ETH and BTC interruption their levels of support.

Derivatives Positioning

- The apical 20 tokens, but for BTC and HYPE, person seen double-digit declines successful futures unfastened involvement arsenic the terms drops shingle retired overleveraged bets.

- Shorts look to beryllium stepping successful via Binance-listed USDT futures, arsenic OI has accrued to 276K BTC from 270K alongside near-zero backing rates successful the past mates of hours.

- Funding rates successful TRX, ADA, LINK, TON, UNI and Binance-listed 1000SHIB futures are notably negative, indicating a bias for bearish, abbreviated positions. Funding rates for different majors, including BTC, are level to somewhat positive.

- BTC front-month futures connected the CME inactive commercialized astatine a astir $100 premium to the spot price. Traders request to ticker retired for a imaginable displacement into discount for signs of strengthening of selling pressure.

- On Deribit, enactment premiums comparative to calls person spiked, arsenic the terms drops bolster request for downside protection.

- Sentiment successful the XRP and SOL options has flipped bearish too, aligning with BTC and ETH markets.

Market Movements

- BTC is down 2.6% from 4 p.m. ET Friday astatine $112,403.60 (24hrs: -2.61%)

- ETH is down 6.7% astatine $4,162.70 (24hrs: -6.7%)

- CoinDesk 20 is down 5.93% astatine 4,015.36 (24hrs: -5.93%)

- Ether CESR Composite Staking Rate is down 5 bps astatine 2.8%

- BTC backing complaint is astatine 0.0002% (0.2606% annualized) connected Binance

- DXY is down 0.12% astatine 97.53

- Gold futures are up 1.4% astatine $3,757.50

- Silver futures are up 2.32% astatine $43.95

- Nikkei 225 closed up 0.99% astatine 45,493.66

- Hang Seng closed down 0.76% astatine 26,344.14

- FTSE is unchanged astatine 9,208.44

- Euro Stoxx 50 is down 0.47% astatine 5,432.61

- DJIA closed connected Friday up 0.37% astatine 46,315.27

- S&P 500 closed up 0.49% astatine 6,664.36

- Nasdaq Composite closed up 0.72% astatine 22,631.48

- S&P/TSX Composite closed up 1.07% astatine 29,768.36

- S&P 40 Latin America closed up 0.18% astatine 2,911.26

- U.S. 10-Year Treasury complaint is down 1.2 bps astatine 4.127%

- E-mini S&P 500 futures are down 0.3% astatine 6,702.00

- E-mini Nasdaq-100 futures are down 0.36% astatine 24,776.25

- E-mini Dow Jones Industrial Average Index are down 0.33% astatine 46,496.00

Bitcoin Stats

- BTC Dominance: 58.61% (+1.11%)

- Ether-bitcoin ratio: 0.03699 (-4.1%)

- Hashrate (seven-day moving average): 1,079 EH/s

- Hashprice (spot): $50.10

- Total fees: 3 BTC / $347,276

- CME Futures Open Interest: 145,845 BTC

- BTC priced successful gold: 30.1 oz.

- BTC vs golden marketplace cap: 8.59%

Technical Analysis

- The ratio betwixt the dollar prices of bitcoin and and golden has dropped to 30.25 connected TradingView, the lowest since June 23.

- The diminution pierced enactment astatine 30.57, the Sept. 9 low, and present looks acceptable to trial the June 24 debased of 29.44.

- In different words, gold's outperformance looks acceptable to continue.

Crypto Equities

- Coinbase Global (COIN): closed connected Friday astatine $342.46 (-0.2%), -3.59% astatine $330.18

- Circle (CRCL): closed astatine $144.14 (+2.65%), -4.18% astatine $138.11

- Galaxy Digital (GLXY): closed astatine $32.87 (-0.63%), -5.45% astatine $31.08

- Bullish (BLSH): closed astatine $69.18 (+5.44%), -4.76% astatine $65.89

- MARA Holdings (MARA): closed astatine $18.29 (-1.14%), -4.21% astatine $17.52

- Riot Platforms (RIOT): closed astatine $17.46 (-0.29%), -3.21% astatine $16.90

- Core Scientific (CORZ): closed astatine $16.62 (-0.78%), -2.71% astatine $16.17

- CleanSpark (CLSK): closed astatine $13.62 (+1.19%), -4.99% astatine $12.94

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $41.56 (+1.12%)

- Exodus Movement (EXOD): closed astatine $29.18 (-0.27%)

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $344.75 (-1.25%), -3.3% astatine $333.39

- Semler Scientific (SMLR): closed astatine $29.18 (-1.05%), -2.5% astatine $28.45

- SharpLink Gaming (SBET): closed astatine $17.33 (+0.64%), -6.58% astatine $16.19

- Upexi (UPXI): closed astatine $6.58 (-3.52%), -7.29% astatine $6.10

- Lite Strategy (LITS): closed astatine $2.80 (+3.32%), -3.57% astatine $2.70

ETF Flows

Spot BTC ETFs

- Daily nett flows: $222.6 million

- Cumulative nett flows: $57.68 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily nett flows: $47.8 million

- Cumulative nett flows: $13.94 billion

- Total ETH holdings ~6.67 million

Source: Farside Investors

While You Were Sleeping

- Ether, Dogecoin Lead $1.5B Liquidation Wipeout arsenic Bitcoin Slips Below $112K (CoinDesk): More than 407,000 traders were liquidated implicit a 24-hour period, Coinglass information amusement — the astir successful caller months — against a highly uncertain macro drop.

- Bitcoin Longs connected Bitfinex Jump 20%, Prices Drop Below 100-Day Average (CoinDesk): Bitfinex longs climbed 20% to much than 52,000 positions, adjacent arsenic bitcoin slipped beneath its 100-day mean of $113,283, a signifier that has often foreshadowed declines.

- UK Watchdog Speeds Up Crypto Approvals successful Response to Critics (Financial Times): The FCA has shortened crypto support times to conscionable implicit 5 months and raised its acceptance complaint to 45% arsenic it prepares to motorboat a afloat regulatory model successful 2026.

- Gold Hits Fresh Record arsenic Traders Wait for U.S. Rate-Path Clues (Bloomberg): Gold’s grounds tally is being fueled by expectations of deeper Fed complaint cuts, geopolitical tensions, tariff-driven ostentation worries and continued central-bank buying.

- Metaplanet Becomes Fifth Largest Listed Bitcoin Holder With $632M BTC Buy (CoinDesk): The Japanese firm's latest purchase, astatine a outgo of $116,724 per bitcoin, takes its full holdings to 25,555 BTC valued astatine astir $2.70 billion.

3 months ago

3 months ago

English (US)

English (US)