Crypto prices are experiencing a rocky Monday owed to mediocre U.S. macroeconomic information and rampant profit-taking.

Bitcoin (BTC) has dropped 1.8% successful the past 24 hours to $91,800, a terms not seen since Dec. 5, the time it broke done $100,000 for the archetypal time. The largest cryptocurrency has fallen much than 14% from its Dec. 17 grounds of $108,278.

Ether (ETH) has mislaid less, falling 0.7% to $3,320, though it’s present 17% beneath its December highs, and inactive has not surpassed the grounds $4,820 it deed successful 2021. Solana (SOL) is besides proving a small stronger than bitcoin, with the SOL/BTC ratio up 0.35% today.

The CoinDesk 20 — an scale of the apical 20 cryptocurrencies by marketplace capitalization, excluding stablecoins, memecoins and speech coins — is besides successful the red, sliding 3.74%. Ripple (XRP) and Stellar (XRM) person taken the biggest hits, down 6% and 6.3% respectively, portion the astir resilient coin too ether has been litecoin (LTC), which is 1.9% lower.

Stocks of crypto-related companies besides took a hit. MicroStrategy (MSTR) and Coinbase (COIN) fell 7% and 5.3%, respectively and large bitcoin mining firms similar MARA Holdings (MARA) and Riot Platforms (RIOT) person dropped much than 7%.

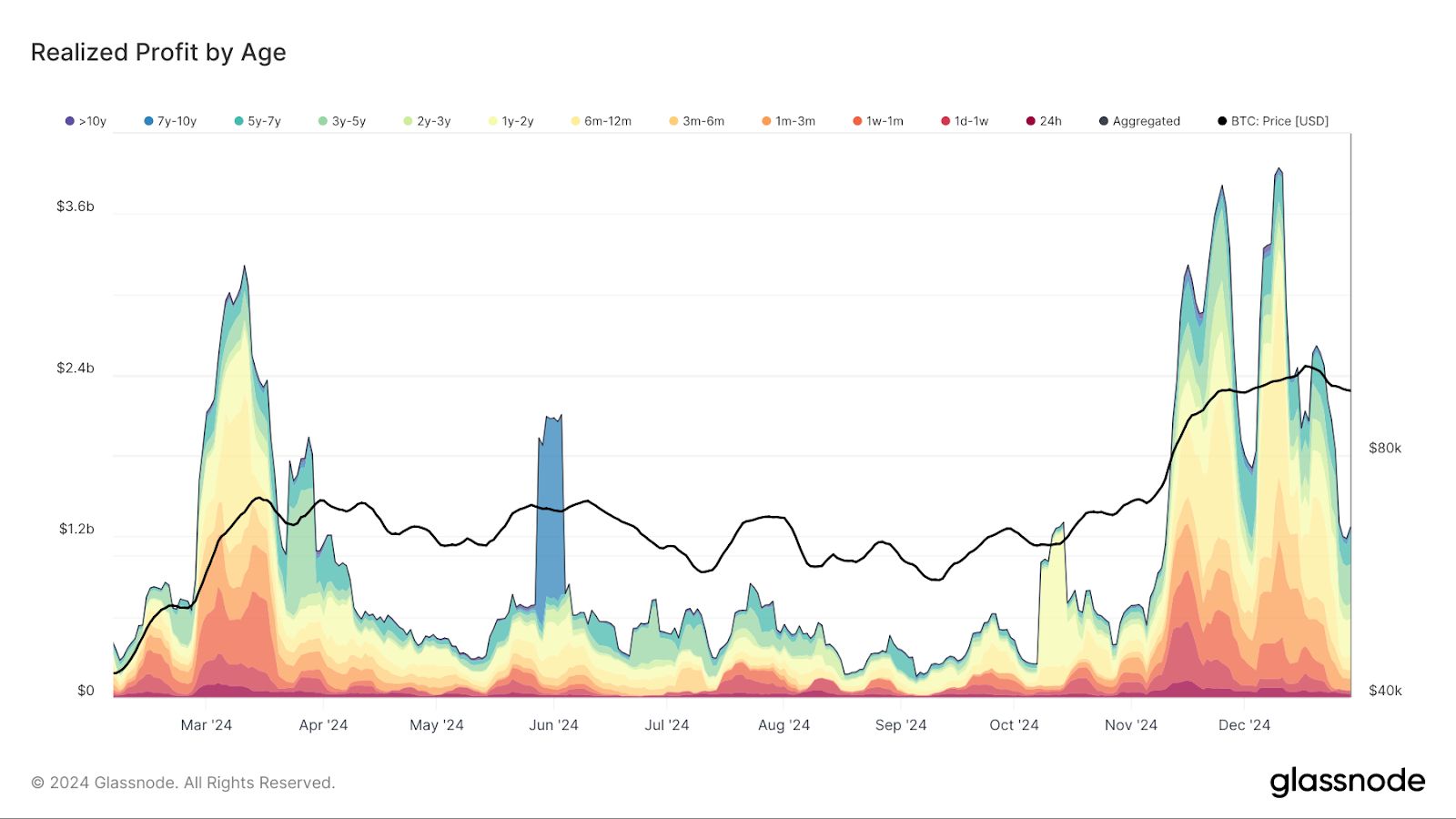

The selling unit is partially caused by investors cashing retired aft bitcoin changeable up much than 117% this year. Profit-taking presently exceeds $1.2 cardinal connected a seven-day moving average, and portion that is importantly little than the Dec. 11 highest of $4.0 billion, it’s inactive overmuch much than usual. Additionally, the lion's stock of profits is being taken by investors who person held bitcoin for galore years.

Macroeconomics are besides weighing connected the market, with the U.S. Chicago PMI — which measures the show of the manufacturing and non-manufacturing assemblage successful the Chicago country — flashing its lowest speechmaking since May, suggesting an economical slowdown is underway.

Uncertainty astir the Federal Reserve’s interest-rate argumentation going into 2025 isn’t helping, since the U.S. cardinal slope has signaled it volition intermission complaint cuts until astatine slightest March. The inauguration of President-elect Donald Trump, slated for Jan. 20, whitethorn besides beryllium playing a role. The S&P 500, Nasdaq, and Dow Jones are down much than 1%.

"The marketplace exceeded expectations successful 2024, but signs of exhaustion signaled the request for consolidation," Joe Carlasare, spouse astatine Amundsen Davis, told CoinDesk. "Looking up to 2025, I’m optimistic but expect the way to diverge from consensus, arsenic markets often do. Bitcoin’s adoption continues to grow, and I expect it volition mostly determination successful enactment with accepted markets. If the U.S. avoids a important maturation slowdown, bitcoin should execute well, though the thrust whitethorn beryllium bumpier than successful 2024."

11 months ago

11 months ago

English (US)

English (US)