Environmentalists accidental Bitcoin uses excessively overmuch energy. The satellite can’t spend it. It’s not worthy it. That’s what they say. So, it indispensable beryllium true. Or indispensable it? If you’re speechmaking this, you’re astir apt alert of the fashionable anti-Bitcoin “energy per transaction” narrative. You’ve seen it successful galore large media publications. It goes thing like this:

“According to Digiconomist, a azygous bitcoin transaction uses the aforesaid magnitude of powerfulness that the mean American household consumes successful a period — which equals astir a cardinal times much successful c emissions than a azygous recognition paper transaction. And globally, the c footprint of bitcoin mining is greater than that of the United Arab Emirates and falls conscionable beneath the Netherlands.”

–”Environmentalists Sound Alarm At US Politicians’ Embrace Of Cryptocurrency,” The Guardian

The Bitcoin web does so usage a batch of powerfulness to supply permissionless security and, successful bid to preserve number idiosyncratic rights, that powerfulness is highly efficient. However Digiconomist’s “energy per transaction” metric, which compares Bitcoin to retail outgo providers and is often utilized successful the media, is an invalid comparison. Journalists and columnists are popularizing an intellectually dishonest metric that is misleading astatine champion and a state-sponsored onslaught astatine worst.

“Energy Per Transaction” Is Misleading

First, let’s analyse wherefore the “energy per transaction” metric is misleading. Cambridge University’s Centre for Alternative Finance explains:

“The fashionable ‘energy outgo per transaction’ metric is regularly featured successful the media and different world studies contempt having aggregate issues.

“First, transaction throughput (i.e. the fig of transactions that the strategy tin process) is autarkic of the network’s energy consumption. Adding much mining instrumentality and frankincense expanding energy depletion volition person nary interaction connected the fig of processed transactions.

“Second, a azygous Bitcoin transaction tin incorporate hidden semantics that whitethorn not beryllium instantly disposable nor intelligible to observers. For instance, 1 transaction tin see hundreds of payments to idiosyncratic addresses, settee second-layer web payments (e.g. opening and closing channels successful the Lightning network), oregon perchance correspond billions of timestamped information points utilizing unfastened protocols specified arsenic OpenTimestamps.”

–Cambridge Centre For Alternative Finance, Cambridge University

The disorder stems from the information that Bitcoin is simply a last “cash” colony furniture without the request for a trusted party. High-performance retail payments networks, similar PayPal oregon Visa, bash not connection last colony betwixt banks — they are credit-based systems that trust connected a monetary basal furniture of cardinal banks, which are backed by militaries, for last and irreversible settlement. In information each bequest retail payments systems, including accepted banking, are layered successful this manner.

Bitcoin wholly replaces the real-time gross colony (RTGS) basal furniture of cardinal banks with a planetary and neutral monetary colony network.

“One Bitcoin transaction… tin settee thousands of off-chain oregon near-chain transactions connected immoderate of these third-party networks. Exchanges and custodians could take to settee up with each different erstwhile a day, batching hundreds of thousands of transactions into a azygous settlement. Lightning channels could settee virtually millions of payments into a azygous bitcoin transaction with a transmission closure.

“This isn’t conscionable speculative. It’s happening today. As Fedwire’s 800,000 oregon truthful regular transactions uncover small astir the full payments measurement supported by the network, Bitcoin’s 300,000 regular transactions and 950,000 outputs bash not archer the full story.”

–“The Frustrating, Maddening, All-Consuming Bitcoin Energy Debate,” Nic Carter

If 1 wants to accurately comparison outgo systems, the media and academics should beryllium comparing Bitcoin to the transactions of cardinal slope RTGS systems — and see the interaction of the militaries and institutions that legitimize them. Bitcoin is astir accurately compared to Fedwire successful the United States and TARGET2 (the successor to TARGET) successful the Eurosystem. Retail outgo systems tin and volition plug into Bitcoin the aforesaid mode they bash with permissioned state-sponsored systems.

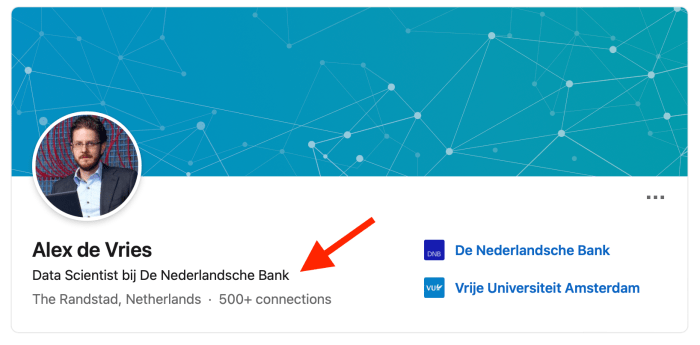

This brings america to wherever the “energy per transaction” metric originates and wherefore it has the quality of a state-sponsored onslaught connected Bitcoin, that the media seems each excessively anxious to propagate. The “energy per transaction” metric was devised by Alex de Vries, an employee of De Nederlandsche Bank (DNB) — different known arsenic the Dutch Central Bank. De Vries publishes the Digiconomist website. De Vries’s enactment for DNB focuses connected fiscal economical crime.

As such, de Vries is efficaciously a paid absorption researcher for a cardinal slope RTGS strategy that competes with Bitcoin. It’s nary wonderment that de Vries and his leader would beryllium antagonists of Bitcoin — his institution’s aboriginal depends connected Bitcoin not succeeding. Neither he, nor galore of the journalists that mention him, regularly disclose this struggle of interest.

Source: LinkedIn

De Vries archetypal formed a narration with the Dutch Central Bank in June of 2016, erstwhile helium spent a twelvemonth determination arsenic a information scientist. At the time, his Digiconomist website did not screen Bitcoin’s biology impact successful depth.

On November 26, 2016, halfway done his one-year employment with DNB, de Vries introduced his “Bitcoin Energy Consumption Index” arsenic a caller conception connected his website and included his discredited “energy per transaction” metric. The timing of this work gives the quality that the Dutch Central Bank perchance supported de Vries’s anti-Bitcoin agenda.

In 2017, de Vries near DNB for PricewaterhouseCoopers (PWC), wherever helium worked for 5 years portion helium continued his attacks connected Bitcoin. In November 2020, de Vries was rehired by the Dutch Central Bank arsenic a information idiosyncratic successful its fiscal economical transgression unit.

Within 3 months of de Vries’s rehiring astatine DNB, his deceptive “energy per transaction” metric abruptly gained worldwide notoriety and was cited in nearly every anti-bitcoin article and op-ed in the mainstream media. Again, the timing is peculiarly suspicious.

By March, Bill Gates had repeated de Vries’s claims, which were past echoed by the media. A fewer weeks later, Elon Musk declared that Tesla would nary longer judge bitcoin arsenic outgo for vehicles, citing the aforesaid specious arguments. Few seemed to announcement that de Vries published inaccurate and easy refuted data astatine this time.

How does a recently rehired information idiosyncratic astatine DNB person the time, resources and PR savvy to beryllium featured and interviewed successful astir each large mainstream media work passim the world? One mightiness wonderment if DNB was possibly actively supporting de Vries’s worldwide media tour.

It should not beryllium astonishing that cardinal banks and their bequest RTGS systems are threatened by Bitcoin arsenic a neutral and unfastened planetary colony layer. Their superb program looks to beryllium paying radical similar de Vries to embellish the biology interaction of Bitcoin to unsuspecting readers. It’s unethical for the media to beryllium citing his enactment without disclosing his fiscal ties to DNB.

Incomplete Comparisons

De Vries uses a fig of eye-popping statistic to daze readers, specified arsenic making comparisons of Bitcoin’s emissions to tiny countries. This excessively is misleading, arsenic tiny countries thin to person precise tiny vigor footprints, since they typically outsource the bulk of their energy-intensive manufacturing to different countries, specified arsenic China.

It should beryllium noted that Cambridge University considers specified comparisons to beryllium an workout successful presenter bias:

“Comparisons thin to beryllium subjective — 1 tin marque a fig look tiny oregon ample depending connected what it is compared to. Without further context, unsuspecting readers whitethorn beryllium drawn to a circumstantial decision that either understates oregon overstates the existent magnitude and scale. For instance, contrasting Bitcoin’s energy expenditure with the yearly footprint of full countries with millions of inhabitants gives emergence to concerns astir Bitcoin’s vigor hunger spiraling retired of control. On the different hand, these concerns may, astatine slightest to immoderate extent, beryllium reduced upon learning that definite cities oregon metropolitan areas successful developed countries are operating astatine akin levels.”

–Cambridge Centre For Alternative Finance, Cambridge University

Direct comparisons to unrelated activities provides an incomplete picture. A much close examination would beryllium to contrast Bitcoin with different industries.

For those looking for a much in-depth debunking of de Vries’s arguments, perceive to the debate betwixt fiscal expert Lyn Alden and de Vries. An informal canvass taken earlier and aft the statement shows Alden dramatically shifted the opinions of listeners from skepticism to a pro-Bitcoin stance. De Vries’s arguments did not clasp up to scrutiny.

Double Counting Bitcoin’s Impact

In June 2021, de Vries published a paper that concluded, “Therefore, the full c footprint of Bitcoin could beryllium allocated proportionally among investors.” The occupation is that de Vries besides continues to beforehand his “energy per transaction” metric wherever the full c footprint is 100% attributed to transactions. De Vries is 100% double counting Bitcoin’s emissions from investors and miners. An easy mode for him to hole this would beryllium to retreat his flawed “energy per transaction” metric oregon make a much coherent exemplary that divides up the impacts.

Bitcoin’s Environmental Impact Is Miniscule

There is nary reliable grounds that Bitcoin’s c footprint straight contributes to clime change. A elemental thought experimentation illustrates wherefore its interaction cannot beryllium much than thing much than a rounding error:

“What would beryllium Bitcoin’s biology footprint assuming the implicit worst case? For this experiment, let’s usage the annualised powerfulness depletion estimation from CBECI arsenic of July 13th, 2021, which corresponds to astir 70 TWh. Let’s besides presume that each this vigor comes exclusively from ember (the most-polluting fossil fuel) and is generated successful 1 of the world’s slightest businesslike coal-fired powerfulness plants (the now-decommissioned Hazelwood Power Station successful Victoria, Australia). In this worst-case scenario, the Bitcoin web would beryllium liable for astir 111 Mt (million metric tons) of c dioxide emission, accounting for astir 0.35% of the world's full yearly emissions.”

–Cambridge Centre For Alternative Finance, Cambridge University

In reality, Bitcoin’s footprint is astir 0.13% of full planetary emissions — again, it’s a rounding error. If 1 is genuinely acrophobic for the situation it is simply a implicit discarded of one’s clip to interest astir Bitcoin and different rounding errors.

When de Vries promotes his exaggerated comparisons and double-accounting methodology helium is distracting the nationalist from genuine biology issues. It’s a distraction perpetuated by cardinal banks, politicians and the media outlets that bash their bidding. Eliminating Bitcoin would bash perfectly thing to assistance the situation — its emissions are simply too tiny to person immoderate meaningful impact. One mightiness deduce that the lone radical who would beryllium motivated capable to archer you different person bequest institutions to support and aren’t really acrophobic astir the environment.

Your Energy, Your Business

Bitcoin provides existent inferior to its users and consumes considerably little vigor than apparel dryers successful the U.S. alone. Yet, erstwhile was the past clip high-profile worldwide media sum was consistently devoted to describing apparel dryers arsenic an biology disaster? It’s ne'er happened. It would beryllium absurd. How you take to walk your vigor is your business.

The information that radical deduce worth and convenience from apparel dryers and are consenting buyers of the vigor to powerfulness them — alternatively of line-drying their apparel for escaped — is each anyone needs to know.

If the vigor usage to powerfulness Bitcoin were not efficient, the outgo of transactions would emergence and would automatically deter users from the technology. Someone who owns nary bitcoin whitethorn not find worth successful its monetary properties, but determination are millions of radical astir the satellite who ain it and beryllium connected its worth — not lone arsenic a store of worth but to support quality rights. Meanwhile, Bitcoin is already dematerializing aspects of the bequest fiscal industry.

Today, 1.2 cardinal radical unrecorded nether treble oregon triple digit ostentation and 4.3 cardinal radical unrecorded nether authoritarianism. People usage bitcoin arsenic a lifeline — specified arsenic those successful Afghanistan, Cuba, Palestine, Togo and Senegal, Nigeria, Sudan and Ethiopia and Central America.

As a instrumentality that tin empower billions of people, the vigor depletion of Bitcoin could beryllium not lone justified but highly desirable erstwhile it is leveraged to supply robust information for an inclusive planetary monetary network. The powerfulness and hidden costs to support the world’s fiat monetary strategy is acold amended spent successful cyberspace with little bloodshed. Moving our wealth to a Bitcoin modular is however we unsubscribe from the bequest strategy and germinate towards more bid and vigor abundance. The vigor Bitcoin consumes is worthy each watt.

This is simply a impermanent station by Level39. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)