The accordant retail request for Bitcoin astatine the $100,000 mark, which indicates precocious capitalist confidence, has precocious drawn notice. However, due to the fact that short-term holders are driving the contiguous accumulating trend, marketplace watchers are informing of a imaginable autumn to $95,000.

Retail Investors Accumulate At Record Pace

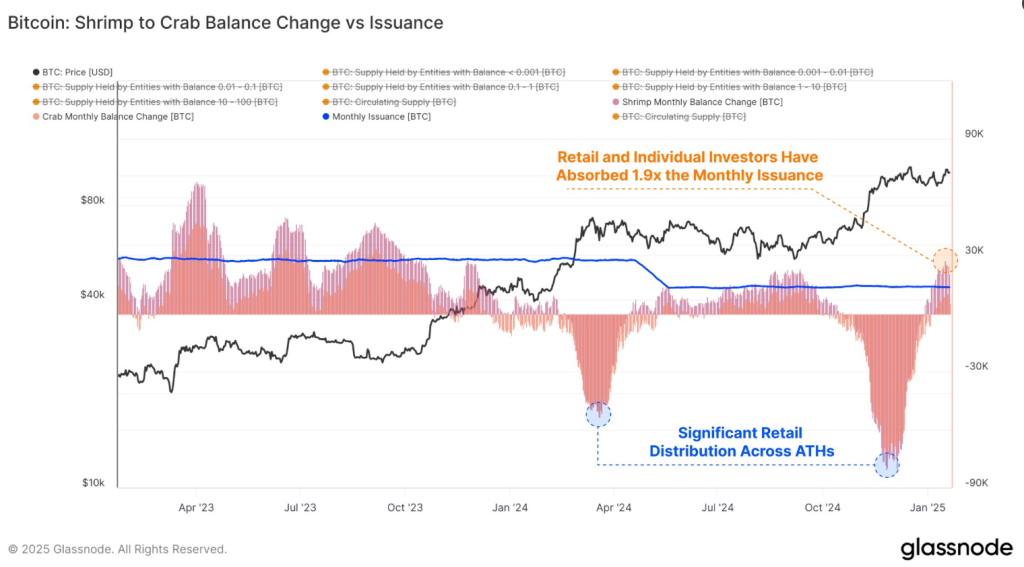

Retail investors, which see smaller holders termed as “Shrimps” and “Crabs,” person been enthusiastically accumulating Bitcoin. In the past month, Glassnode reports that these groups collectively added 25,600 BTC to their portfolios. That’s astir doubly the magnitude of recently mined Bitcoin implicit the aforesaid period, a motion of important request for the “digital gold” astatine its terms peaks.

Demand from retail investors for #Bitcoin astatine prices astir $100K remains beardown – The Shrimp-Crab cohort (up to 1 and 10 #BTC, respectively) absorbed 1.9x the recently mined Bitcoin proviso past month, a full of +25.6k $BTC: https://t.co/l0sjVN2Toi pic.twitter.com/UdzcCWXAGo

— glassnode (@glassnode) January 23, 2025

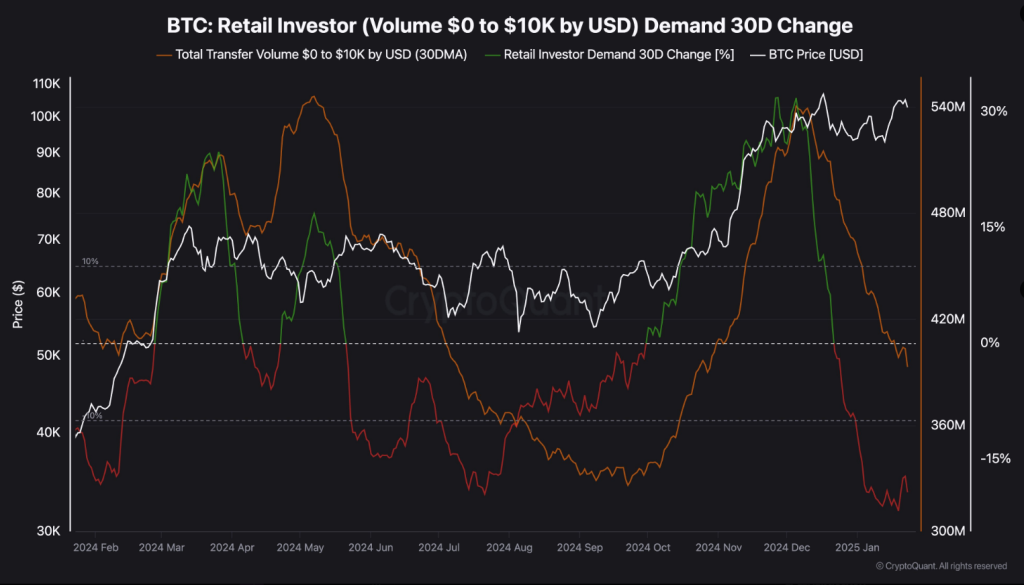

The purchasing enactment of these smaller investors highlights an adjacent much wide retail enthusiasm trend. Nonetheless, experts indispensable inactive workout caution. Although this grade of accumulation is remarkable, the dominance of short-term holders (STHs) successful this surge introduces an constituent of hazard for marketplace stability.

Short-Term Holders Pose A Risk

Often selling disconnected during flimsy declines to warrant gains, STHs are renowned for their accelerated responses to marketplace changes. Particularly successful cases of unexpected volatility for Bitcoin, this reflexive behaviour could acceptable disconnected higher selling pressure. Teddy, a marketplace analyst, underlined that the beingness of STHs mightiness person a large interaction connected impermanent terms swings.

While STHs (Short-Term Holders) person so absorbed a important information of the recently mined Bitcoin supply, it’s important to see the behavioral tendencies of this group. STHs are historically much susceptible to panic during insignificant marketplace fluctuations, often resulting in… pic.twitter.com/dasfRgjOFR

— Teddy (@TeddyVision) January 23, 2025

Historically, the markets are besides much delicate to the downtrends with STH. Analysts consciousness that on with this prevailing trend, astatine specified levels, caution for investors would beryllium prudent.

Glassnode: Narrow Bitcoin Range

Another anomaly which Glassnode picked retired successful the terms enactment of Bitcoin is an unusually choky scope implicit the past 60 days. Such events person been precedents for volatile times ahead.

This coincides with humanities trends, which suggest that the marketplace volition acquisition either a breakout oregon a breakdown soon. While the sustained $100,000 terms level reflects optimism, the market’s constrictive scope adds an aerial of unpredictability.

A Possible Pullback Soon?

Given each of these factors, immoderate experts judge Bitcoin whitethorn beryllium owed for a flimsy terms accommodation successful the adjacent future. Some experts, similar marketplace seasoned Michaël van de Poppe, foretell a retreat to $95,000, chiefly owed to STHs selling successful the look of marketplace uncertainty.

For the clip being, retail request remains a coagulated root of enactment astatine $100,000. Investors should, however, brace themselves for volatility and support an oculus retired for marketplace indicators. As Bitcoin trades adjacent its peak, the enactment of retail euphoria and marketplace risks volition find its adjacent moves.

At the clip of writing, Bitcoin was trading astatine $105,141, up 3.2% and 3.2% successful the regular and play timeframes.

Featured representation from Vecteezy, illustration from TradingView

7 months ago

7 months ago

English (US)

English (US)