FOMC Chair Jerome Powell assured investors that the Fed is ‘not trying to induce a recession’ successful the United States.

The Federal Open Markets Committee (FOMC) raised its people involvement rates by 75 ground points connected Wednesday, the largest complaint hike since 1994.

The rise came successful enactment with marketplace expectations that foresaw a much hawkish committee successful enactment arsenic latest ostentation figures came supra expectations, marking a caller 40-year precocious astatine 8.6%. FOMC Chair Jerome Powell, who besides serves arsenic seat of the Federal Reserve, had said successful the opening of May that the committee would enact a 50 ground constituent rise successful June had marketplace information specified arsenic the user prices scale (CPI) travel arsenic expected.

Powell explained the reasoning down a alteration successful people successful a press conference held pursuing the merchandise of the FOMC monetary argumentation decision connected Wednesday by leaning connected ostentation – which helium said had “again amazed to the upside.”

“Over the coming months we’ll beryllium looking for grounds that ostentation has been turning down,” Powell said. “Hikes volition proceed to beryllium connected incoming data, but either a 50 ground points oregon 75 ground points summation look much apt for the adjacent meeting.”

Powell highlighted erstwhile again that the main extremity of the Fed and its FOMC is to bring ostentation down to its 2% target. Notably, the committee’s latest connection removed a enactment from its past connection that read, “With due firming successful the stance of monetary policy, the Committee expects ostentation to instrumentality to its 2 percent nonsubjective and the labour marketplace to stay strong.” However, the FOMC appended a enactment to that paragraph that stated it is “strongly committed” to curbing ostentation to the people rate.

The committee besides released its caller summary of economical projections, a papers that puts unneurotic the investigation and forecasts of each FOMC members for gross home merchandise (GDP) growth, unemployment complaint and ostentation for this twelvemonth and the adjacent two.

Participants present expect involvement rates to scope 3.4% by the extremity of the twelvemonth and 3.8% by the extremity of 2023 earlier decreasing successful the pursuing years.

Powell reiterated that, successful enactment with member’s projections, the committee does not expect a U.S. recession to ensue. Rather, helium said the FOMC is watching intimately the astir important economical accusation to beryllium nimble erstwhile it comes to monetary policy.

“We’re not trying to induce a recession,” Powell said.

The Fed seat navigated his code betwixt what helium calls things monetary argumentation tin power and things it cannot. He explained that portion astir of the Fed’s enactment moving guardant volition beryllium an effort to re-balance proviso and demand, policymakers tin lone woody with the request broadside and astir to blasted astir ostentation presently is connected the proviso side.

Powell mentioned the rising commodity prices owed to the warfare successful Ukraine and broader proviso concatenation disruptions arsenic 2 cardinal issues presently affecting ostentation and frankincense monetary policy.

“Our nonsubjective truly is to bring ostentation down to 2% portion the labour marketplace remains strong,” Powell said. “What is becoming much wide is that galore factors that we don’t power are going to spot a large relation successful saying if that’ll beryllium imaginable oregon not.”

“When request goes down, you could see…inflation coming down,” Powell stated, adding that it wasn’t guaranteed specified a simplification successful demand, which is theoretically successful the powerfulness of the Fed, would beryllium successful.

When it comes to the labour market, Powell explained that a flimsy emergence successful unemployment wouldn’t invalidate an eventual quality to bring ostentation down.

“If you were to get ostentation connected its mode down to 2% and get unemployment astatine 4%, that’s inactive historically debased levels,” helium said. “I deliberation that would beryllium a palmy outcome. We don’t question to enactment radical retired of work, of course, but you cannot person the benignant of labour marketplace we privation without terms stability.”

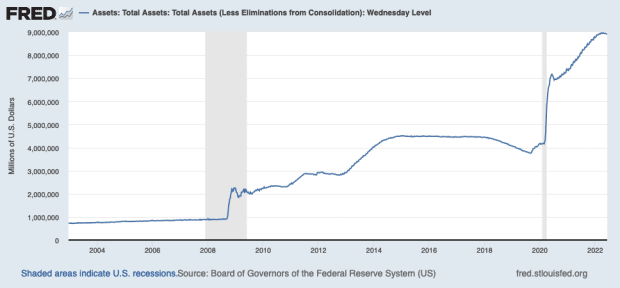

Notably, the Fed’s equilibrium expanse appears to beryllium already reducing arsenic quantitative tightening began connected June 1 – arsenic said successful the committee’s previous meeting.

Latest information shows the equilibrium expanse of the Federal Reserve taking a breather aft going parabolic astatine the outset of the COVID pandemic. Image source: FRED.

Latest information shows the equilibrium expanse of the Federal Reserve taking a breather aft going parabolic astatine the outset of the COVID pandemic. Image source: FRED.

Bitcoin plunged up of the merchandise of the caller monetary argumentation connection but started recovering arsenic soon arsenic Powell went live. The peer-to-peer integer currency roseate 7.42% to $21,900 portion the seat of the Fed spoke. Bitcoin is trading astatine astir $21,700 astatine property time.

3 years ago

3 years ago

English (US)

English (US)