The Bitcoin marketplace was swept into a frenzy pursuing an alleged hack of the US Securities and Exchange Commission’s (SEC) X account, falsely claiming the support of 11 spot ETFs. This misinformation led to a rollercoaster successful Bitcoin’s price, which initially soared from $46,800 to $48,000, lone to clang to $45,000 wrong a span of 20 minutes.

This incidental has go a pivotal infinitesimal for marketplace analysts, providing insights into however the marketplace mightiness respond to today’s imaginable Bitcoin spot ETF approvals successful the abbreviated term. So here’s what experts from K33 Research, QCP Capital, and Daan Crypto Trades person to say.

#1 K33 Research: Approval Will Be ‘Sell-The-News” Event

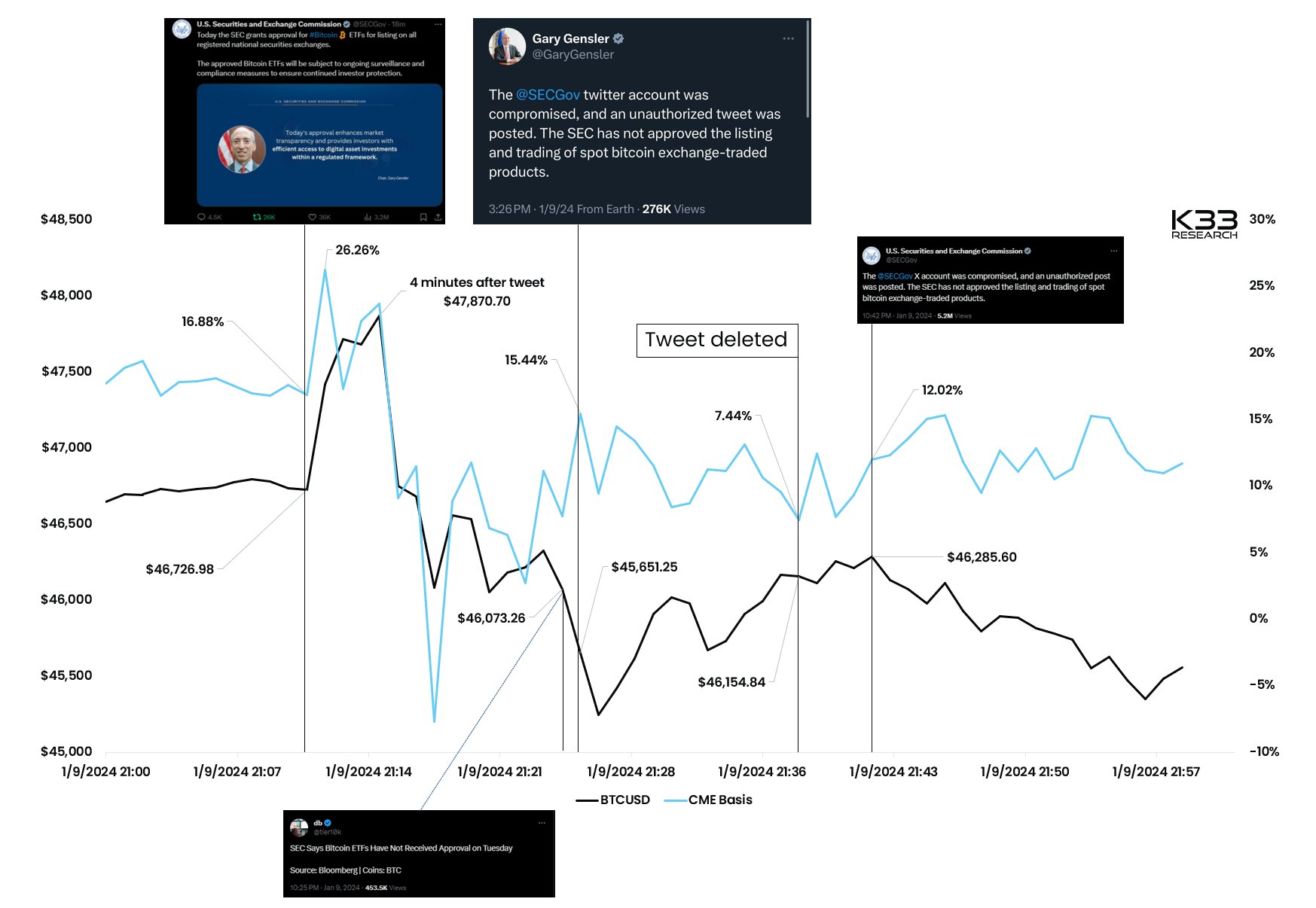

Vetle Lunde, a elder expert astatine K33 Research, provided an in-depth investigation of the market’s absorption to the erroneous announcement. He observed that the market’s contiguous effect was indicative of a inclination towards a ‘sell-the-news’ reaction. The archetypal surge successful Bitcoin’s terms was rapidly met with a flood of agelong positions, causing a important terms fluctuation.

“The marketplace showed its hands yesterday; the ETF support rehearsal favors a sell-the-news reaction. Immediately aft the announcement, longs rapidly crowded the market, enforcing a whipsaw successful the pursuing minutes,” Lunde stated.

Lunde besides pointed retired that until the SEC’s clarification, the marketplace mostly accepted the announcement astatine look value, triggering an integrated reaction. He outlined the series of events, noting a 2.4% summation successful Bitcoin’s terms wrong 4 minutes post-announcement, followed by a 1.4% alteration successful 14 minutes until Bloomberg debunked the support news.

Timeline of the Bitcoin ETF play | Source: X @VetleLunde

Timeline of the Bitcoin ETF play | Source: X @VetleLundeThe marketplace yet stabilized erstwhile Gensler confirmed the hack, highlighting the market’s sensitivity to regulatory quality and rumors.

#2 QCP Capital: Warning Sign For Bitcoin Traders

QCP Capital, successful their “QCP Market Update – 10 Jan 24,” reflected connected the bizarre quality of the lawsuit with a premix of wit and analysis. “We are connected the cusp of a BTC Spot ETF approval, and what transpired successful the past 24 hours is thing you can’t marque up,” their update began.

They pointed retired the lukewarm archetypal absorption to the ‘approval,’ suggesting that the marketplace mightiness person already priced successful the anticipation of an existent ETF approval.

“The archetypal absorption to the ‘approval’ was muted with BTC being incapable to commercialized retired of the absorption area. We instrumentality this arsenic a informing motion that an support is mostly priced successful and determination whitethorn not beryllium a immense rally station the approval,” QCP warned.

QCP Capital besides focused connected the implications of this lawsuit for aboriginal marketplace trends. “The restrained effect to the faux support signals a informing – the existent support of a Bitcoin ETF mightiness not trigger the expected rally,” they observed, besides pointing to the existent marketplace dynamics, specified arsenic the elevated options volatility and spot-futures ground spread. Notably, the steadfast sees Bitcoin’s adjacent enactment astatine $40,000 to $42,000, and absorption astir 48.500.

Daan Crypto Trades: ETH/BTC Could See A Spike

Daan Crypto Trades provided a concise but insightful analysis. “The mendacious ETF support quality was a litmus trial for the market’s post-approval direction,” helium commented. The investigation highlights the signifier of Bitcoin’s terms spiking and past afloat retracing pursuing the fake announcement.

“This signifier could good repetition upon existent ETF approval, but with much pronounced selling pressure,” helium suggested. Daan Crypto Trades besides touched connected the broader marketplace implications, particularly for the ETH/BTC ratio, which started rallying instantly aft the fake announcement.

He further remarked:

ETH/BTC started rallying consecutive distant which is besides what we’ve been looking for. I deliberation contiguous we mightiness get 1 much tiny spike down connected ETH/BTC arsenic BTC spikes up but aft that I don’t spot overmuch holding backmost the ETH/BTC ratio anymore. Especially if BTC cools disconnected station ETF.

At property time, BTC traded astatine $45,346.

BTC terms continues uptrend, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms continues uptrend, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)