Following a week of nett outflows, the spot Bitcoin ETF marketplace has rebounded with awesome nett inflows this week, highlighting a increasing capitalist assurance successful Bitcoin and its associated fiscal products. This week’s marketplace activities person shown a singular reversal from the erstwhile 5-day nett outflow streak, with Tuesday witnessing a important nett inflow of $480 million, followed by $243.5 cardinal connected Wednesday.

Yesterday’s resurgence successful capitalist involvement was notably boosted by Blackrock’s monolithic inflow of $323.8 million, efficaciously offsetting Grayscale GBTC’s $299.8 cardinal outflows. Moreover, Ark Invest’s ARKB reported its champion time yet, with $200 cardinal successful inflows, contempt Fidelity experiencing its worst time with a specified $1.5 cardinal successful outflows. Nevertheless, Fidelity managed to bounce backmost with important inflows of $261 cardinal and $279 cardinal connected Monday and Tuesday, respectively.

Yesterday's ETF flows were affirmative for $243.5 million.

Blackrock yet woke up again for $323.8 cardinal wholly cancelling retired $GBTC's $299.8 cardinal outflows.

Ark had their champion time yet with $200 million. Fidelity had its worst time with $1.5 million.

Price dumped on… pic.twitter.com/LLChkITN7q

— WhalePanda (@WhalePanda) March 28, 2024

1% Down, 99% To Go For Bitcoin ETFs

However, according to Bitwise Chief Investment Officer (CIO) Matt Hougan, this is conscionable the specified opening of what is to travel successful the upcoming months. Hougan’s commentary, portion of his play memo to concern professionals, sheds airy connected the existent marketplace dynamics and the colossal imaginable that lies ahead. “1% Down; 99% to Go,” Hougan wrote, highlighting the nascent yet promising travel of Bitcoin ETFs.

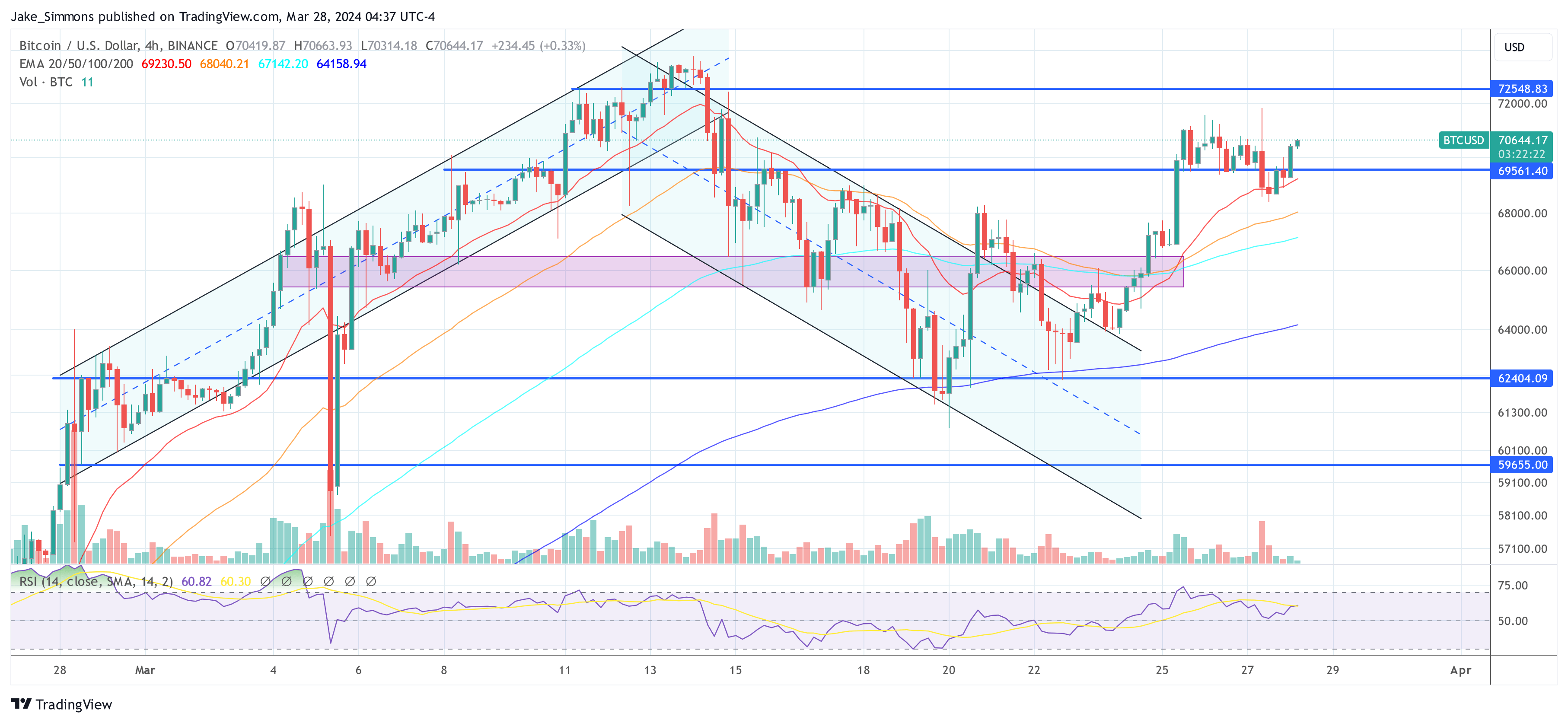

Lately, the marketplace has been characterized by its volatility, with Bitcoin’s terms oscillating betwixt $60,000 and $70,000. Hougan advises a calm and semipermanent position amidst this fluctuation, particularly arsenic the assemblage anticipates the upcoming Bitcoin halving astir April 20, the support of Bitcoin ETFs connected nationalist relationship platforms, and the soon-to-come completion of owed diligence by assorted concern committees.

Despite the existent sideways question of Bitcoin’s price, Hougan remains bullish astir its semipermanent trajectory. “Bitcoin is successful a raging bull market,” helium asserts, noting a astir 300% summation implicit the past 15 months. The motorboat of spot Bitcoin ETFs successful January has marked a important milestone, opening up the Bitcoin marketplace to concern professionals connected an unprecedented scale.

Hougan’s investigation points to a profound displacement arsenic planetary wealthiness managers, who collectively power implicit $100 trillion, statesman to research investments successful the “digital gold.” He suggests that adjacent a blimpish allocation of 1% of their portfolios to Bitcoin could effect successful astir $1 trillion of inflows into the space.

This position is backed by humanities information showing that adjacent a 2.5% allocation to Bitcoin has enhanced the risk-adjusted returns of accepted 60/40 portfolios successful each three-year play of Bitcoin’s history.

The caller inflows into Bitcoin ETFs, though impressive, are seen by Hougan arsenic simply the opening of a overmuch larger movement. “We are each excited astir the $12 cardinal that has flowed into ETFs since January. And it is exciting: Collectively, the astir palmy ETF motorboat of each time..But ideate planetary wealthiness managers allocate conscionable 1% of their portfolios to bitcoin connected average,” Hougan elaborates, emphasizing the standard of imaginable maturation awaiting the cryptocurrency market. He concludes:

Think astir the implications. […] A 1% allocation crossed the committee would mean ~$1 trillion of inflows into the space. Against this, $12 cardinal is hardly a down payment. 1% down, 99% to go.

At property time, BTC traded astatine $70,644.

BTC price, 4.-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4.-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)