There’s nary denying the motorboat of Spot Bitcoin ETFs has done wonders for the terms of Bitcoin and different cryptocurrencies successful general. These ETFs person present unlocked organization demand into the world’s largest crypto plus to alteration the dynamics up of the adjacent halving. On the different hand, caller tensions betwixt Iran and Israel person seen Bitcoin falling to arsenic debased arsenic $61,000 successful the past 24 hours to undo weeks of terms increases.

Bitcoin ETF Wallets Now Whale Addresses

The organization request for Bitcoin has been ramping up since the opening of the twelvemonth from the issuers of the assorted Spot Bitcoin ETFs. These money providers person been scooping up Bitcoin near and right, present holding 4.27% of the full BTC supply, arsenic noted by on-chain analytics level IntoTheBlock.

These whale wallets person present joined an extended database of whales connected the Bitcoin network who collectively own 11% of the full circulating supply.

Unlike past BTC halvings, this clip there’s a caller root of request coming from the accepted organization sector.

The recently introduced Bitcoin ETFs thrust organization demand, starring to ETF wallets already amassing 4.27% of the Bitcoin supply! pic.twitter.com/volLU15Wgd

— IntoTheBlock (@intotheblock) April 13, 2024

It is noteworthy to notation that BlackRock’s IBIT and Fidelity’s FBTC ETFs person positioned themselves arsenic the pb of the pack. According to data from BitMEX Research, these 2 spot ETFs present clasp 405,749 BTC astatine the adjacent of the trading league connected April 12.

This surge of organization wealth has fueled Bitcoin’s meteoric rise to a caller all-time high of $73,737 and underscored its imaginable arsenic a mainstream plus class. However, a brewing struggle betwixt Iran and Israel seems to beryllium undoing months of this terms increase. Particularly, Bitcoin has seen a noteworthy driblet to $61,000 from $67,800 successful the past 24 hours.

Fundamentals, however, constituent to this terms driblet being impermanent and the crypto is already reversing the bulk of this loss. At the clip of writing, Bitcoin is trading beneath the $65,000 terms mark.

Changing Halving Dynamics

One of such fundamentals pointing to a dependable Bitcoin price summation successful the coming months is the approaching Bitcoin halving. Investors are steadily approaching the result of this halving, with the Bitcoin blockchain present little than 1,000 blocks to the adjacent event.

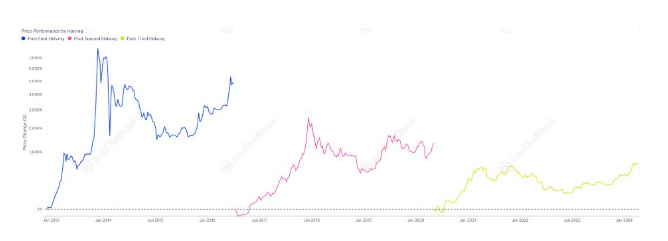

Past halvings connected their ain person led to a terms summation for Bitcoin successful the days post-halving. Bitcoin went connected a surge of implicit 7,000% successful the months aft the archetypal halving successful 2012. The halving successful July 2016 led to a 3,000% terms surge successful the months after. The astir caller halving successful May 2020 led to a surge of astir 1,000% successful the months after.

As noted by IntoTheBlock, the approaching halving is antithetic from erstwhile ones. Unlike the past 3 halvings, there’s “a caller root of request coming from the organization sector” done Spot Bitcoin ETFs. A repeat of past halving outcomes could spot Bitcoin easy surging supra the $100,000 terms level.

Featured representation from Pixabay, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)