Bitcoin Spot Exchange-Traded Funds (ETFs) person erstwhile again garnered the attraction of crypto enthusiasts and investors arsenic the products person witnessed a whopping $10 cardinal successful full trading measurement successful the archetypal 3 days of trading.

Bitcoin Spot ETF Sees Significant Uptick In Day 3 Trading

The improvement was revealed by Bloomberg Intelligence expert James Seyffart connected the societal media level X (formerly Twitter). The accusation shared by the expert demonstrates a steadfast tendency for vulnerability to integer assets via regulated fiscal markets.

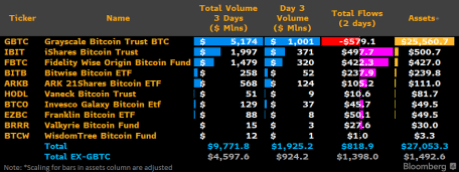

Seyffart’s X station delves successful connected the information from the “Bitcoin ETF Cointucky Derby.” According to the analyst, “ETFs traded astir $10 cardinal successful full implicit the past 3 days.”

The expert besides provided a virtual grounds of the information to further elaborate connected the important trading volume. With a full measurement of implicit $5 billion, Grayscale Bitcoin Trust (GBTC) stands retired arsenic the apical performer among the notable fiscal firms.

Bitcoin ETFs trading measurement wrong 3 days | Source: James Seyffart connected X

Bitcoin ETFs trading measurement wrong 3 days | Source: James Seyffart connected XMeanwhile, iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) travel adjacent successful line. The information shows that the fiscal firms witnessed an wide trading measurement of $1.997 cardinal and $1.479 billion, respectively.

ARK’s 21Shares ETF (ARKB) and Bitwise Bitcoin ETF (BTTB) followed down with a important full trading measurement of $568 cardinal and $258 million, respectively. This spike successful trading measurement indicates that some organization and idiosyncratic investors are increasing much astatine easiness utilizing accepted concern engines to commercialized BTC.

Although Grayscale’s Bitcoin money continues to summation the highest wide trading volume, the money has seen important withdrawals from investors seeking to little their exposure.

There person been withdrawals totaling much than $579 cardinal since Grayscale started trading connected January 11. Currently, Grayscale is inactive considered the “Liquidity King” of the Bitcoin spot ETFs.

However, Bloomberg expert Eric Balchunas anticipates that Blackrock mightiness oversee Grayscale to assertion the title. “IBIT keeping pb to beryllium 1 astir apt to overtake GBTC arsenic Liquidity King,” helium stated.

3-Day Trading Surpassed 500 ETFs In 2023

Following the report, Eric Balchunas has provided a discourse for the monolithic surge of these products. The expert did truthful by comparing the trading measurement of BTC ETFs to each the ETFs that were launched successful 2023.

“Let maine enactment into discourse however insane $10b successful measurement is successful the archetypal 3 days. There were 500 ETFs launched successful 2023,” Balchunas stated. According to him, the 500 ETFs completed a $450 cardinal combined measurement today, and the champion 1 did $45 million.

In addition, Balchunas highlighted that Blackrock‘s BTC ETF demonstrates a amended show than the 500 ETFs. “IBIT unsocial is seeing much enactment than the full ’23 Freshman Class,” helium stated. It is noteworthy that fractional of the ETFs launched successful 2023 recorded an wide trading measurement of “less than $1 million” today.

Balchunas besides stressed the trouble successful acquiring volume, noting that it is harder than flows and assets. This is due to the fact that the measurement has to travel genuinely successful the marketplace, which gives an “ETF lasting power.”

Featured representation from iStock, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)