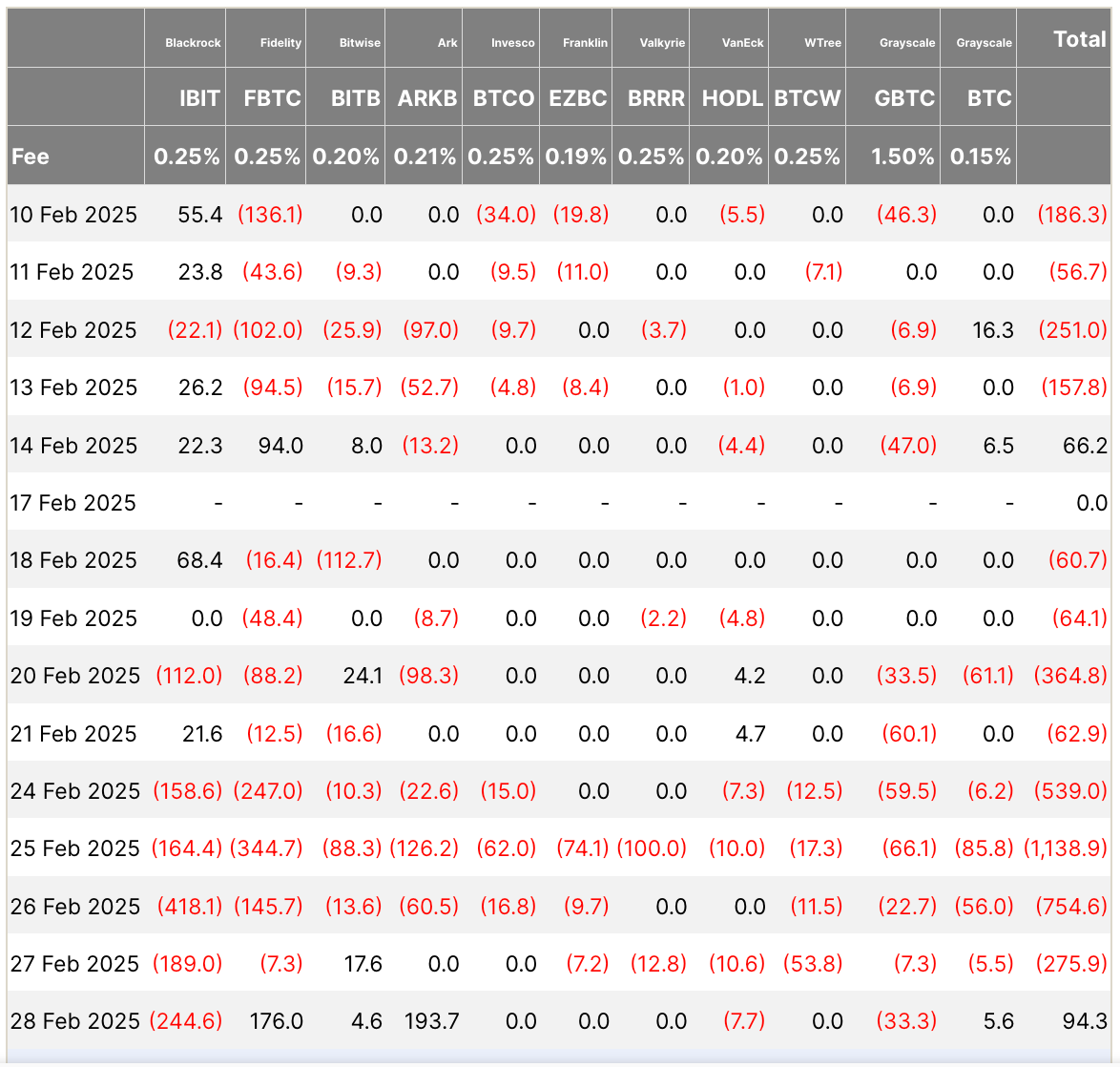

Spot bitcoin exchange-traded funds (ETFs) successful the U.S. saw $94.3 cardinal of full inflows connected the past time of February arsenic crypto's worst period successful 3 years came to an end.

The fig capped an eight-day streak of outflow during which investors pulled implicit $3.2 cardinal from these funds arsenic integer plus prices fell.

BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot bitcoin ETF by assets nether management, was 1 of the outliers that saw $244.6 cardinal successful outflows connected Friday. Meanwhile, different ample ETFs, including Fidelity’s FBTC, brought successful $176 cardinal from investors, portion the ARK 21Shares Bitcoin ETF saw the largest inflows, bringing successful $193.7 million, according to Farside Investors data.

The inflows came arsenic the cryptocurrency market started showing signs of recovery aft the terms of bitcoin deed a $78,000 debased successful the aboriginal hours of Feb. 28. Bitcoin is present trading astir $84,900 aft rising 1.6% successful the past 24 hours, portion the broader CoinDesk 20 Index roseate 0.3% to 2,705.

Over the past week, BTC is inactive down by astir 12%, portion the broader crypto market, arsenic measured by the CoinDesk 20 Index, fell by 15.8%. Spot bitcoin ETFs had been enduring a important outflow streak since Feb. 14, a time successful which these funds saw $66.2 cardinal inflows.

Spot ether ETFs, connected the different hand, person maintained an ongoing outflow streak connected the past time of February, with $41.9 cardinal leaving these funds. Since their past time with a affirmative nett flow, $357.5 cardinal exited these funds, according to information from Farside.

The caller marketplace betterment comes arsenic the White House announced that U.S. President Donald Trump volition host a crypto acme on March 7 and aft the world’s largest plus manager, BlackRock, added a 1% to 2% allocation of its spot bitcoin ETF to 1 of its exemplary portfolios.

Read more: BlackRock's Bitcoin ETF Sees Record Daily Outflow arsenic the Basis Trade Starts to Unwind

9 months ago

9 months ago

English (US)

English (US)