Institutional investors progressively sought vulnerability to crypto during the archetypal 4th of the twelvemonth pursuing the motorboat of respective US-based spot Bitcoin exchange-traded funds (ETFs) successful January.

The CoinShares Digital Fund Manager survey revealed that these organization investors person importantly accrued their integer plus allocations, reaching 3% successful their portfolios. This marks the highest level since the survey’s inception successful 2021.

Many of these investors attributed their accrued vulnerability to integer plus investments to distributed ledger technology.

Additionally, they present comprehend integer assets arsenic offering bully worth and an accrued request for investing successful BTC arsenic a diversifier.

Bitcoin shows the astir compelling maturation outlook.

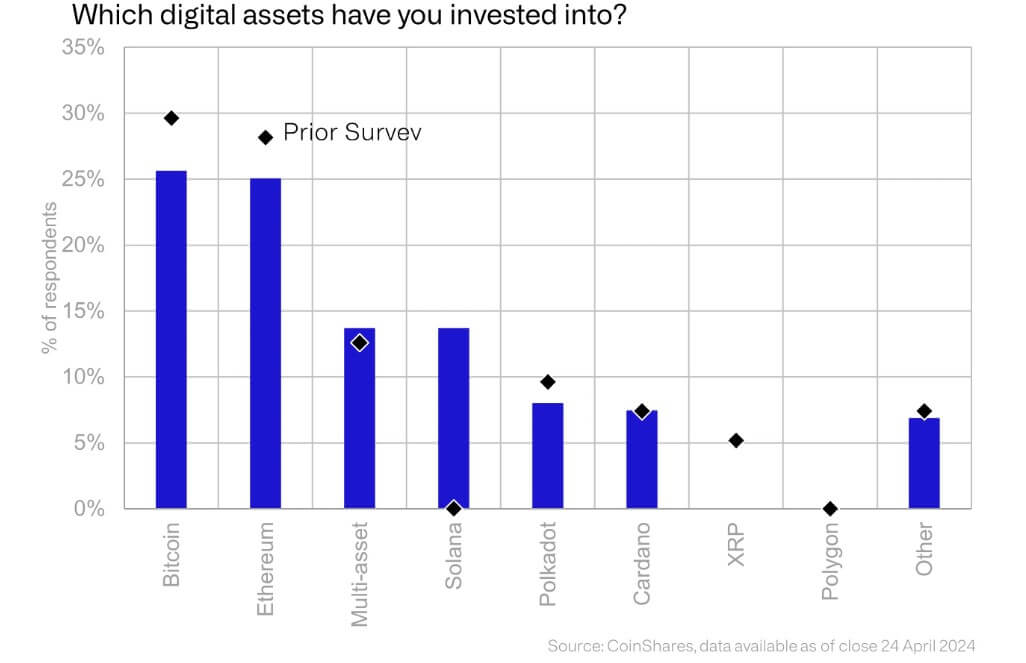

Institutional investors’ portfolios predominantly diagnostic Bitcoin, the premier integer plus successful request among this cohort. According to James Butterfill, caput of probe astatine CoinShares, implicit a 4th of these respondents said their portfolios had exposure to BTC via the spot ETFs.

Following Bitcoin, Ethereum holds the 2nd position, though capitalist involvement has declined since the erstwhile survey.

According to investors, BTC and ETH stay the integer assets with the astir compelling maturation outlook.

Investment Portfolio of Institutional Investors. (Source: CoinShares)

Investment Portfolio of Institutional Investors. (Source: CoinShares)Nevertheless, Solana has seen a surge successful capitalist enthusiasm, evidenced by an uptick successful its allocation to 14%. This summation is chiefly driven by a prime radical of important investors expanding their holdings successful the fast-rising blockchain network, which has enjoyed rapid maturation successful price and adoption implicit the past year.

While different alternate integer assets person struggled, XRP stands retired for its sizeable decline. None of the surveyed investors mentioned holding it.

Investment barriers

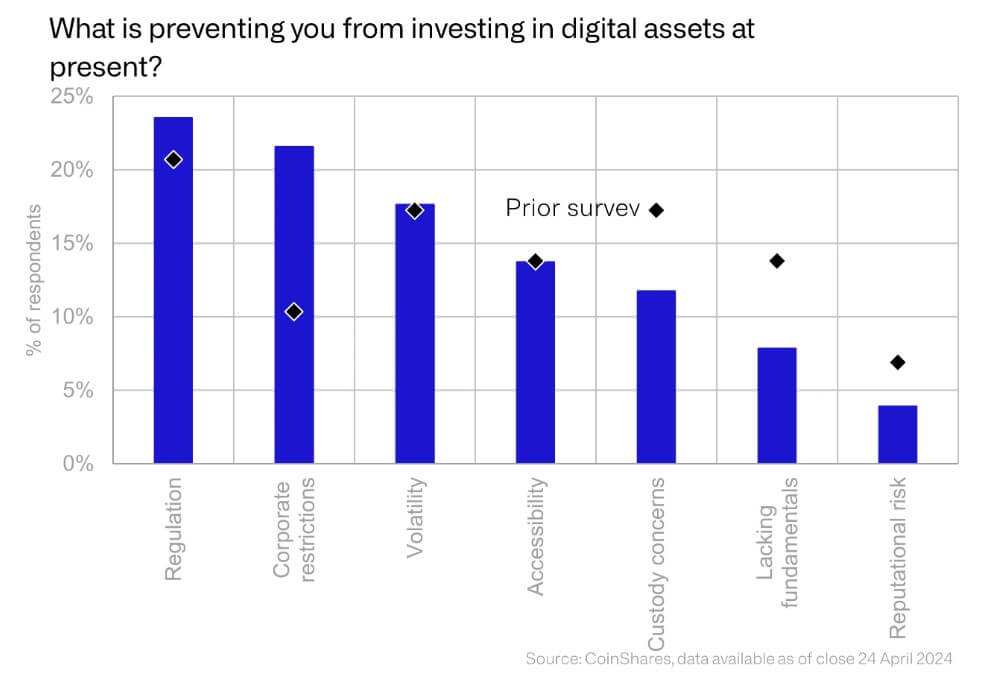

Despite the increasing vulnerability to integer assets and the advent of Bitcoin ETFs, galore investors inactive conflict to entree this plus class.

The CoinShares survey showed that regulatory concerns stay the foremost obstruction for astir investors. The emerging manufacture faces regulatory scrutiny, peculiarly successful the US, wherever fiscal regulators similar the SEC person filed respective legal actions against large players similar Binance and Coinbase.

Barriers to Investing successful Crypto. (Source: CoinShares)

Barriers to Investing successful Crypto. (Source: CoinShares)Meanwhile, the inherent volatility of the emerging assemblage continues to beryllium a important interest for immoderate investors. However, custody issues, estimation risk, and the lack of a cardinal concern lawsuit are becoming little problematic.

The station Bitcoin ETFs successful the US thrust higher crypto allocations among organization investors appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)