Bitcoin ETFs ended past week connected different affirmative enactment with $997.70 cardinal successful nett inflows and demand reaching its highest level successful six months. Undoubtedly, these ETFs person marked the turning constituent for Bitcoin and different cryptocurrencies since the opening of the year, arsenic it opened up the cryptocurrency to inflows from each side.

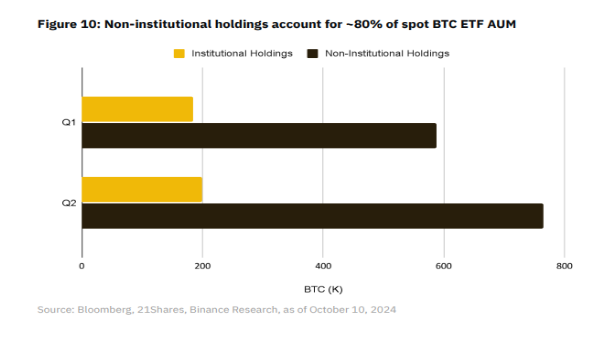

Interestingly, information has shown that retail investors are liable for astir of the request for Spot Bitcoin ETFs, accounting for 80% of the full assets nether management.

Bitcoin ETFs Changing The Narrative

According to Bloomberg data, Bitcoin ETFs person dominated the ETF scenery successful 2024, claiming the apical 4 positions for inflows among each ETFs launched this year. Specifically, retired of the 575 ETFs introduced frankincense far, 14 of the apical 30 are caller funds focusing connected Bitcoin oregon Ethereum. The standout performer is the BlackRock IBIT fund, which has attracted implicit $23 cardinal successful year-to-date inflows.

Last week was different illustration of the affirmative show successful Spot Bitcoin ETFs, contempt the coin’s consolidation beneath the $68,000 terms level. According to flow information from SosoValue, play inflows started connected a affirmative enactment connected Monday, October 21, with $294.29 cardinal entering the funds and ended the week with $402.08 cardinal successful inflows connected Friday, October 25.

Interestingly, Spot Bitcoin ETFs present clasp astir 938,700 BTC successful 10 months since motorboat and are steadily approaching the 1 cardinal BTC mark. Although these ETFs person opened doors for organization investors, a caller study from crypto speech Binance indicates that retail investors are the superior drivers of this surge successful demand, accounting for 80% of the holdings successful Spot BTC ETFs.

Originally intended to supply organization investors entree to BTC, Spot Bitcoin ETFs person present go the preferred prime for galore idiosyncratic investors looking to instrumentality vantage of the regulatory clarity they offer. Nonetheless, determination has been a dependable request from the organization side, with organization holdings rising by 30% since Q1.

Among organization investors, concern advisers person emerged arsenic the fastest-growing party, with their holdings expanding by 44.2% to scope 71,800 BTC this quarter.

What’s Next For Spot Bitcoin ETFs?

Thanks to the accelerated maturation of Bitcoin exchange-traded funds, an awesome 1,179 institutions, including fiscal giants specified arsenic Morgan Stanley and Goldman Sachs, person joined the crypto’s headdress array successful little than a year. For comparison, Gold ETFs were lone capable to pull 95 institutions successful their archetypal twelvemonth of trading.

This upward trajectory of organization investments successful Bitcoin is poised to continue into the foreseeable future, which bodes good for the wide terms outlook of Bitcoin. As these ETFs pull much organization capital, they are apt to nutrient second-order effects similar accrued BTC dominance, improved marketplace efficiency, and reduced volatility that could importantly payment the cryptocurrency ecosystem.

At the clip of writing, Bitcoin is trading astatine $67,100.

Featured representation from Reuters, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)