Bitwise CIO Matt Hougan highlighted a notable summation successful organization investments successful Bitcoin exchange-traded funds (ETFs) during the 2nd 4th contempt BTC worth declining 12% implicit the 3 months.

Hougan highlighted the accrued involvement successful his latest Aug. 20 note to investors, wherever helium stated:

“Bitcoin’s terms fell 12% successful Q2 2024 and galore wondered if that would spook institutions retired of the market. The reply was a resounding ‘no.'”

Historic adoption rate

Hougan emphasized that institutional adoption of Bitcoin ETFs is occurring astatine an unprecedented pace.

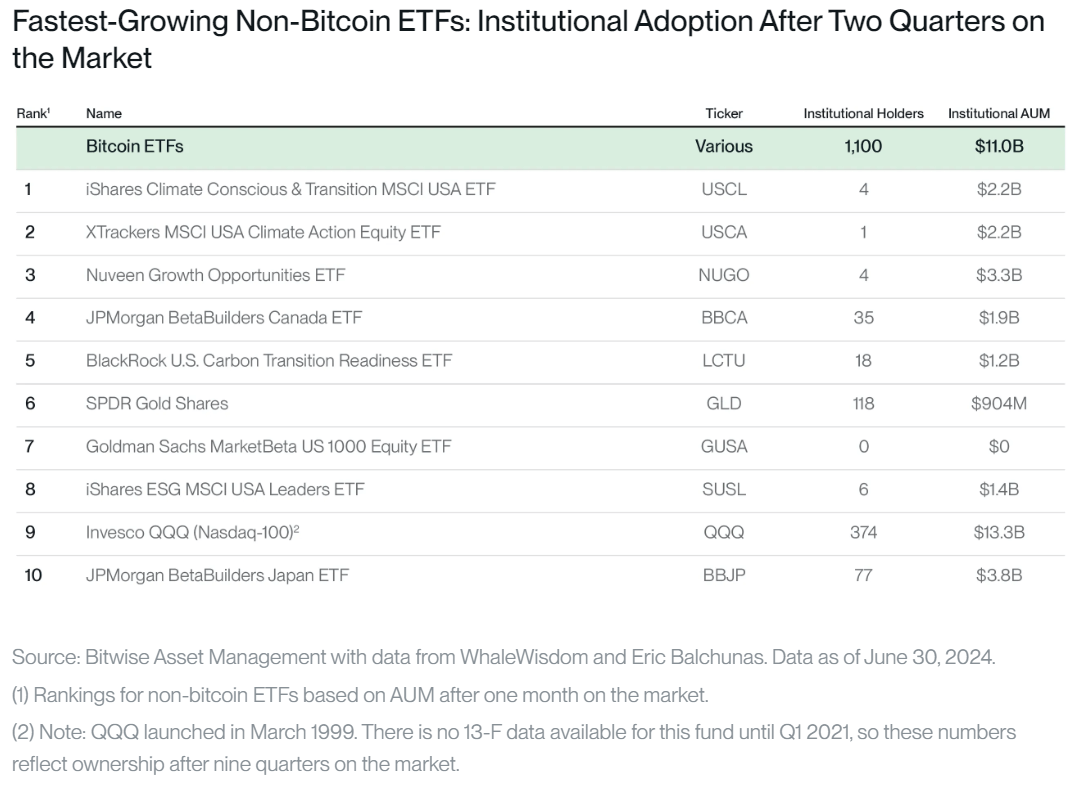

According to him, the fig of organization investors holding Bitcoin ETFs grew by 14% quarter-over-quarter, rising to 1,100 from 965. These investors present power 21.15% of the full assets nether absorption (AUM) successful Bitcoin ETFs, up from 18.74%. By the extremity of Q2, organization holdings successful Bitcoin ETFs totaled $11 billion.

Despite 112 investors exiting their Bitcoin ETF positions during Q2, 247 caller firms entered the market, resulting successful a nett summation of 135 organization investors.

Bitcoin ETF Institutional Holdings (Source: Bitwise)

Bitcoin ETF Institutional Holdings (Source: Bitwise)Hougan noted that the level of adoption of Bitcoin ETFs is comparable to the aboriginal maturation of Invesco’s QQQ ETF, which launched successful March 1999. Notably, the BTC ETFs person attracted 3x arsenic galore organization buyers wrong conscionable 2 quarters.

Hougan addressed concerns astir comparing Bitcoin ETFs arsenic a radical to idiosyncratic ETFs, stating that idiosyncratic Bitcoin ETFs inactive dominate. For example, Bitwise’s Bitcoin ETF — ranked 4th by AUM astatine the extremity of June — had much organization holders (139) than SPDR’s GLD ETF (118) astatine the aforesaid signifier successful its development.

Considering these numbers, Hougan concluded:

“We shouldn’t fto the historical adoption of Bitcoin ETFs by retail investors obscure the information that they are besides gaining organization traction faster than immoderate different ETF successful history.”

Portfolio expansion

The Bitwise CIO predicted that organization vulnerability to the flagship integer plus would summation implicit the years.

According to him, portion the median organization capitalist presently allocates lone 0.47% of their portfolio to Bitcoin, this fig could transcend 1% wrong a year. He explained that nonrecreational investors thin to gradually summation their crypto exposure, often starting with 1% oregon little but yet raising it to 2.5% oregon adjacent 5% implicit time.

Hougan added:

“Year 1 tin beryllium a challenge, but momentum tends to physique into Years 2, 3, 4, and 5. I expect the aforesaid happening to hap here.”

The station Bitcoin ETFs spot 14% maturation successful organization involvement during Q2 contempt downturn appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)