Yesterday, the Bitcoin terms travel resembled a high-intensity rollercoaster ride, initially soaring past the $73,000 people earlier encountering a tumultuous liquidation event. This lawsuit saw implicit $361 cardinal worthy of leveraged trades unwound, compelling the BTC terms to retract sharply to beneath $68,300.

The drastic terms fluctuation chiefly affected agelong presumption holders—investors who speculated connected a continued terms rise—with a staggering $258 cardinal wiped out. Subsequently, Bitcoin’s terms staged a singular V-shaped recovery, during which abbreviated sellers recovered themselves connected the losing end, with conscionable implicit $103 cardinal successful positions liquidated.

This data by Coinglass marks the lawsuit arsenic the astir important purge of agelong positions since March 5. At that time, Bitcoin experienced a diminution to $60,800 pursuing its ascent to a past all-time precocious of astir $69,000.

Bitcoin ETFs Register Record $1 Billion Inflows

Perhaps spurred by the accidental presented by the terms dip, investors successful spot Bitcoin Exchange-Traded Funds (ETFs) engaged successful a buying spree, unprecedented successful its intensity. For the archetypal time, spot Bitcoin ETFs witnessed a regular inflow surpassing $1 cardinal connected Tuesday, March 12, chiefly driven by an inflow of $849 cardinal to BlackRock’s IBIT. According to elaborate data released by Farside Investors, the full nett inflows crossed each Bitcoin ETFs were astatine $1045 cardinal (or $1.045 billion).

The 2nd largest Bitcoin ETF to date, Fidelity, saw a alternatively quiescent day with FBTC taking successful lone $51.6 million, portion Ark Invest ($93 million), Bitwise ($24.6 million), Valkyrie ($39.6 million) and VanEck ($82.9 million) saw comparatively beardown superior inflows. Notably, Grayscale‘s GBTC saw a waning outflow of conscionable $79 million.

Bitcoin expert Alessandro Ottaviani shared his insights connected X, underscoring the magnitude of these inflows, “1 Billy of Total nett Inflow! ONE BILLION DOLLARS! […] In the past 12 trading days, The Nine inflow has been $9.2b, with an mean of $768m per day. Just ideate if we support this gait and it is confirmed that GBCT outflow is astir exhausted.”

Crypto Quant expert Maartunn provided further discourse to the inflow’s impact, revealing, “JUST IN: The Bitcoin Exchange-Traded Fund (ETF) has experienced its highest inflows ever, with an further 14,706.2 BTC.” This connection further emphasizes the important summation successful Bitcoin’s demand, perchance mounting it up for a large supply squeeze.

🚨🚨 JUST IN: The Bitcoin Exchange-Traded Fund (ETF) has experienced its highest inflows ever, with an further 14,706.2 BTC. https://t.co/xg7wADbRzy pic.twitter.com/IUAyt1jzGE

— Maartunn (@JA_Maartun) March 13, 2024

Adding to the conversation, crypto expert @venturefounder suggested imaginable aboriginal terms movements based connected the existent trend, “Absolute Bitcoin madness […] The 5-day moving mean nett inflow has afloat recovered to peak. So… astir apt HIGHER. If this continues, $80-90k by the extremity of period is not acold fetched. No correction has lasted longer than 24 hours connected the weekdays. Interestingly, the archetypal major correction of the 2021 rhythm came erstwhile terms went 2x erstwhile ATH. So could we spot nary large correction until $120k?”

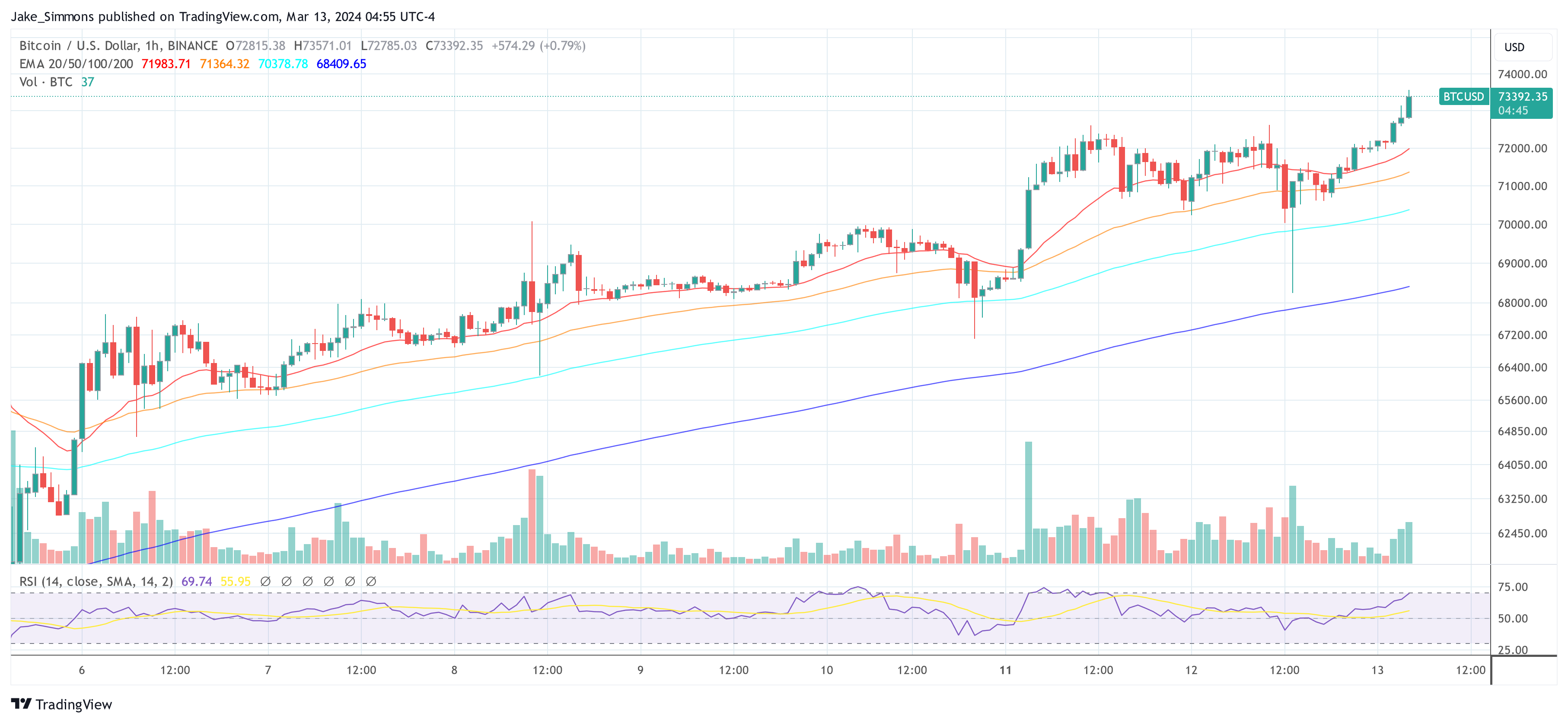

At property time, BTC already surpassed the $73,500 people and traded astatine $73,392.

BTC terms rises supra $73,000, 1-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms rises supra $73,000, 1-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)