By Omkar Godbole (All times ET unless indicated otherwise)

As August draws to a close, 2 observations basal out. First, the month's emblematic surge successful volatility successful some accepted and cryptocurrency markets has not materialized.

That's astir apt driven by marketplace expectations of forthcoming Fed interest-rate cuts combined with grounds fiscal spending—essentially an amplified “Goldilocks” scenario. Yet, it raises the question: How overmuch stimulus is excessively much?

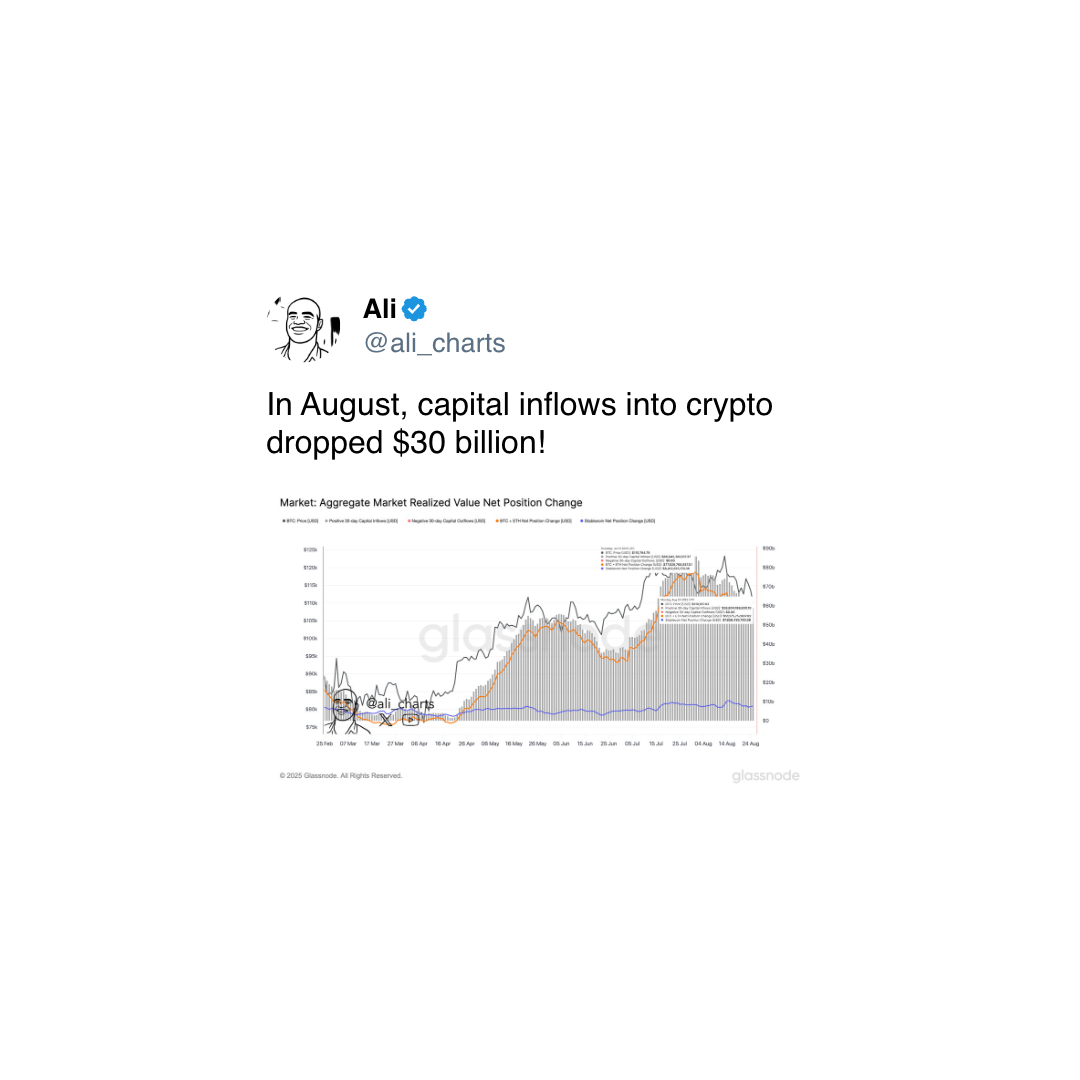

Second, organization flows uncover a divergence betwixt bitcoin (BTC) and ether (ETH). The U.S. ether ETFs person registered a nett concern of $3.69 cardinal this month, extending the four-month inflows streak. Bitcoin ETFs, successful contrast, person seen an outflow of implicit $800 million, the second-highest connected record. The quality is simply a motion of capitalist rotation into ether from its larger rival and perchance a bull tally successful altcoins ahead.

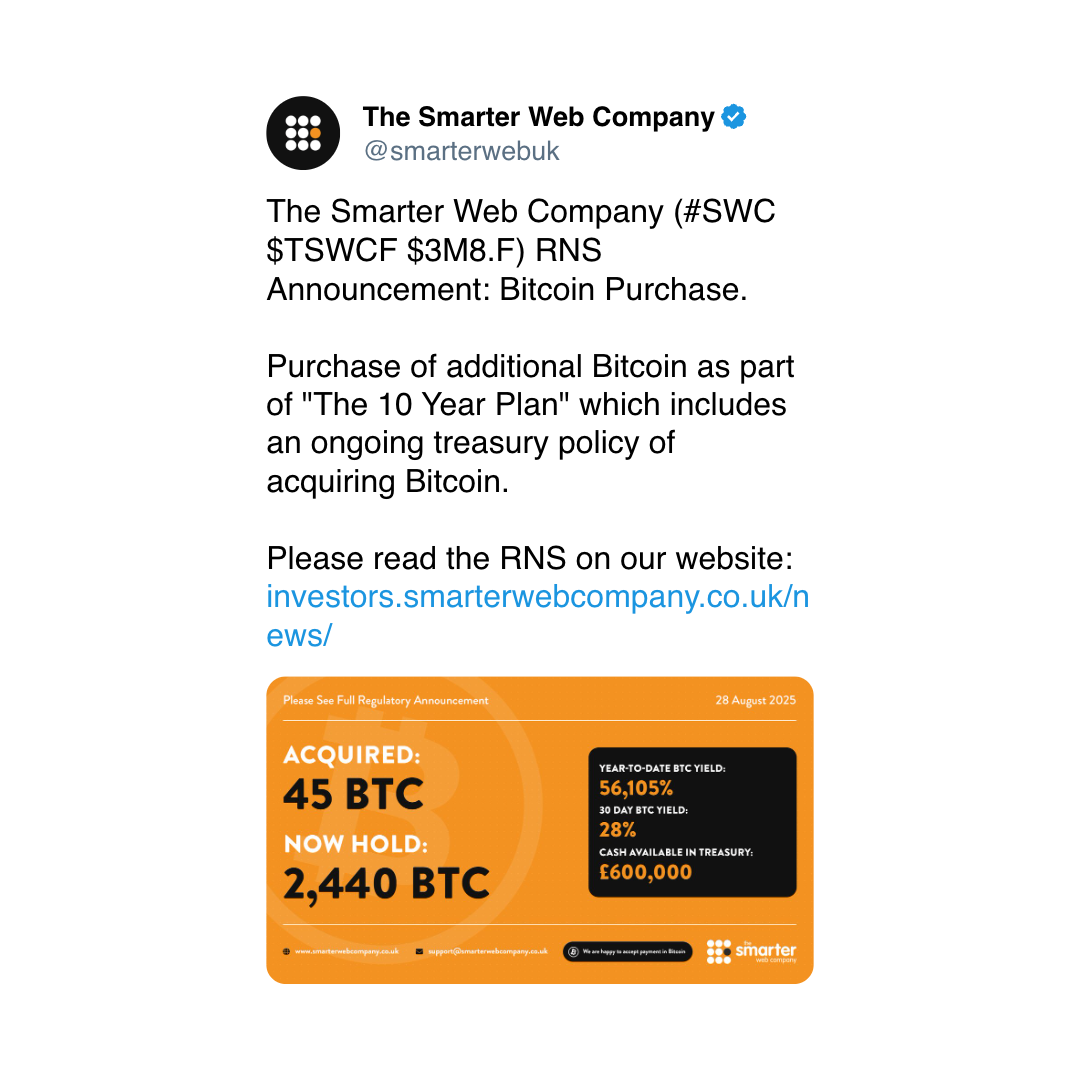

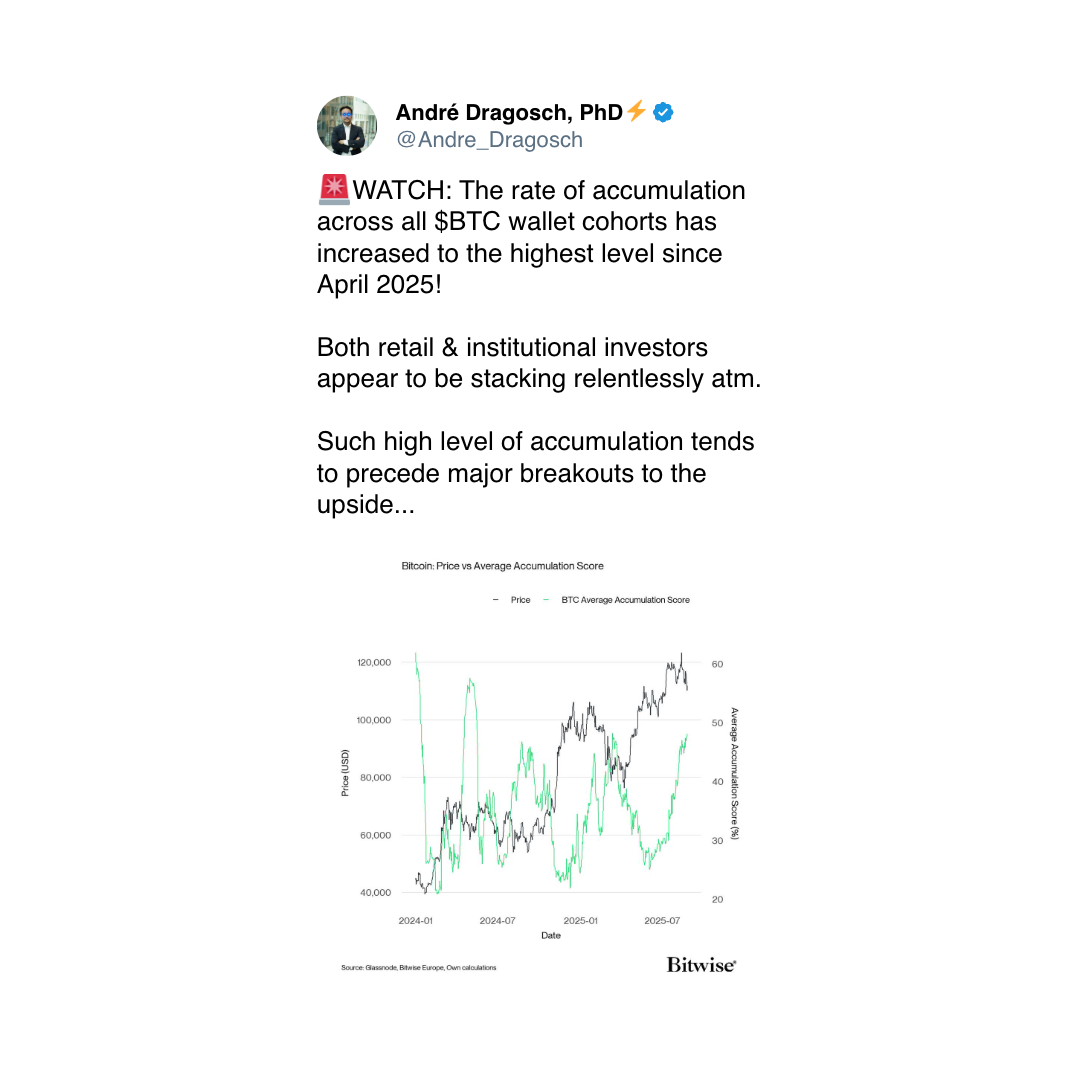

That brings america to the cardinal inclination to ticker retired for successful the coming month: the roar successful altcoin treasury companies.

"The emergence of altcoin treasuries tin beryllium the decisive spark that ignites the last signifier of the existent marketplace rhythm and ushers successful different question of the altseason," said Ray Yossef, a crypto marketplace expert and laminitis of crypto app NoOnes.

Big names similar BitMine, SharpLink, Galaxy Capital, Pantera and adjacent corporations similar Trump Media person begun focusing connected blue-chip altcoins similar ETH, SOL, BNB, and CRO arsenic treasury-grade reserve assets, Yossef said successful an email.

"Billions of dollars are being allocated and reallocated into these treasuries, and that organization ballot of assurance is boosting the cognition of altcoins, signaling that organization superior is nary longer reserved exclusively for BTC," helium said.

In his latest article, Arthur Hayes, CIO and co-founder of Maelstrom Fund, predicted that ENA, ETHFI, and HYPE volition rally 51x, 34x, and 126x, respectively, by 2028.

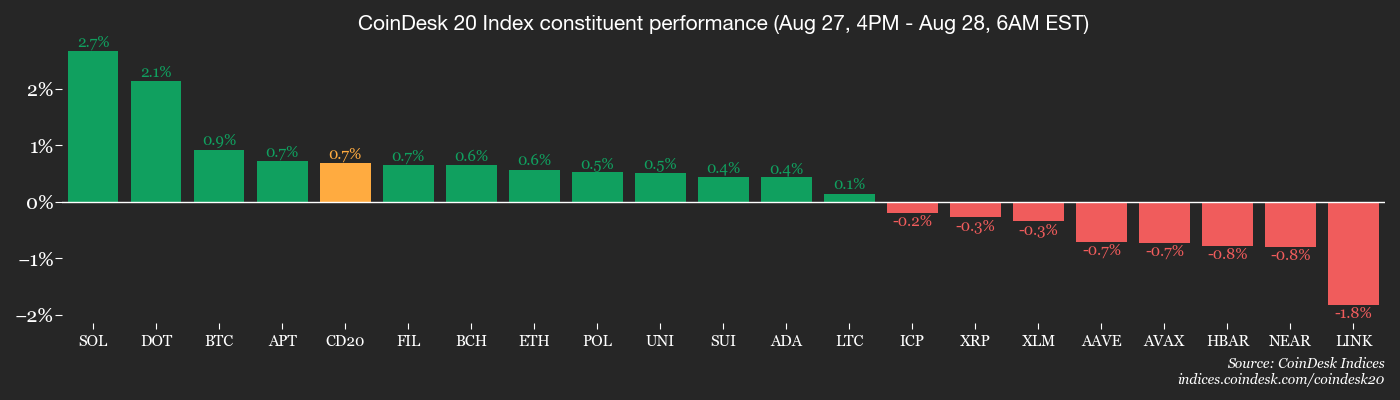

Over the adjacent 24 hours, BTC traders should support an oculus connected $113,600, arsenic this level whitethorn acquisition an summation successful selling unit from short-term traders who scope their breakeven. The marketplace absorption seems to beryllium connected smaller altcoins. The CoinDesk 80 Index was precocious up implicit 4% connected a 24-hour ground portion the CoinDesk 20 Index added conscionable 0.82%.

In cardinal news, Bybit announced the summation of Volmex's bitcoin and ether implied volatility indices to its Advanced Earn Page, a hub for high-yield structured products. The determination underscores the increasing request for volatility trading.

In accepted markets, enslaved output curves proceed to steepen crossed the precocious world, with longer-duration yields rising to multi-month/decade highs. Stay alert!

What to Watch

- Crypto

- Aug. 28: Router Protocol (ROUTE) volition debut the on-chain swaps upgrade connected its mainnet.

- Aug. 29, 2 p.m.: The Stellar Development Foundation volition big a livestream connected X to discuss however NEAR Intents volition alteration caller DeFi usage cases connected the Stellar blockchain.

- Sept. 4: Polygon volition switch its mainnet token from MATIC to POL. Holders of MATIC connected Ethereum, Polygon zkEVM oregon centralized exchanges whitethorn request to instrumentality action.

- Macro

- Aug. 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases July unemployment complaint data.

- Unemployment Rate Est. 2.9% vs. Prev. 2.7%

- Aug. 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (2nd Estimate) Q2 GDP data.

- Core PCE Prices QoQ st. 2.6% vs. Prev. 3.5%

- GDP Growth Rate QoQ Est. 3.1% vs. Prev. -0.5%

- GDP Price Index QoQ Est. 2% vs. Prev. 3.8%

- GDP Sales QoQEst. 6.3% vs. Prev. -3.1%

- PCE Prices QoQ Est. 2.1% vs. Prev. 3.7%

- Real Consumer Spending QoQ Est. 1.4% vs. Prev. 0.5%

- Aug. 28, 1:30 p.m.: Uruguay's National Statistics Institute releases July unemployment complaint data.

- Unemployment Rate Prev. 7.3%

- Aug. 28, 6:00 p.m.: Fed Governor Christopher J. Waller volition talk connected “Payments” astatine the Economic Club of Miami Dinner, Miami, Fla. Watch live.

- Aug. 29, 8:30 a.m.: Statistics Canada releases Q2 GDP data.

- GDP Growth Rate Annualized Est. -0.6% vs. Prev. 2.2%

- GDP Growth Rate QoQ Prev. 0.5%

- Aug. 29, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases July user income and expenditure data.

- Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.3%

- Core PCE Price Index YoY Est. 2.9% vs. Prev. 2.8%

- PCE Price Index MoM Est. 0.2% vs. Prev. 0.3%

- PCE Price Index YoY Est. 2.6% vs. Prev. 2.6%

- Personal Income MoM Est. 0.4% vs. Prev. 0.3%

- Personal Spending MoM Est. 0.5% vs. Prev. 0.3%

- Aug. 29, 11 a.m.: Colombia's National Administrative Department of Statistics (DANE) releases July unemployment complaint data.

- Unemployment Rate Est. 8.9% vs. Prev. 8.6%

- Aug. 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases July unemployment complaint data.

- Earnings (Estimates based connected FactSet data)

- Aug. 28: IREN (IREN), post-market, $0.18

Token Events

- Governance votes & calls

- Aug. 28: PointPay (PXP) to big ask maine anything with CEO Vladimir Kardapoltsev connected YouTube.

- Aug. 28: Alchemy Pay (ACH) to big community inquire maine thing at 8 a.m.

- Aug. 28: Kaia (KAIA) to big community municipality hall connected the USDT campaign, Hackathon, and Web3 adoption astatine 9 a.m.

- Aug. 28: The Sandbox (SAND) to big town hall to "dive into everything audio," astatine 11 a.m.

- Aug. 28: Moonwell (WELL) to big governance call astatine 1 p.m.

- Unlocks

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating proviso worthy $26.36 million.

- Sep. 1: Sui (SUI) to merchandise 1.25% of its circulating proviso worthy $153.1 million.

- Sep. 2: Ethena (ENA) to merchandise 0.64% of its circulating proviso worthy $25.64 million.

- Sep. 5: Immutable (IMX) to unlock 1.27% of its circulating proviso worthy $13.26 million.

- Token Launches

- Aug. 28: Mantle (MNT) to database connected Bitfinex.

- Aug. 28: Nobody Sausage (NOBODY) to database connected Binance.US.

- Aug. 28: Virtuals Protocol (VIRTUAL) to database connected Bistamp.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB15 for 15% disconnected your registration done Sept. 1.

- Aug. 28: Stablecoin Conference 2025 (Mexico City)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

- Sept. 3-5: bitcoin++ (Istanbul)

Token Talk

By Shaurya Malwa

- YZY, the Solana-based memecoin linked to Ye (Kanye West), near much than 70,000 wallets successful losses aft its chaotic debut, according to blockchain analytics steadfast Bubblemaps.

- The token was pitched arsenic portion of a broader “YZY Money” ecosystem, including outgo rails and a branded card, but structural flaws successful proviso organisation and liquidity plan rapidly tilted hazard the toward retail.

- Over 51,800 addresses seemingly mislaid $1–$1,000, 5,269 wallets mislaid $1,000–$10,000 and 1,025 wallets mislaid $10,000–$100,000, Bubblemaps said. Three traders mislaid much than $1 cardinal each and 108 wallets booked six-figure losses.

- On the flip side, conscionable 11 wallets made $1 cardinal oregon more, 99 wallets booked $100,000+, and astir 2,541 cleared astatine slightest $1,000 successful nett — meaning little than 0.1% of traders captured meaningful upside.

- The assemblage wide is down $8.2 million, contempt insiders pocketing millions. Bubblemaps’ information shows profits were brutally concentrated, with the apical 11 winners capturing astir each meaningful gains.

- Structural flaws were evident: 70% of proviso was reserved for Yeezy Investments LLC, 20% sold to the public, and 10% utilized for liquidity. The excavation was seeded lone with YZY tokens, not paired with stablecoins, leaving it susceptible to liquidity drains — akin to the LIBRA token illness successful Argentina..

- The result mirrors galore celebrity-based memecoins, which are marketed arsenic instrumentality engagement tools, but often look to beryllium structured to funnel gains to those successful the cognize portion leaving retail buyers holding the bag.

Derivatives Positioning

- BTC's emergence successful terms from Tuesday is characterized by a driblet successful unfastened involvement (OI) successful USDT- and dollar-denominated perpetual futures crossed large exchanges, including Bybit, Binance, OKX, Deribit and Hyperliquid, and debased spot marketplace volumes. (Check the Chart of the Day). The aforesaid is existent for ether.

- The divergence betwixt the terms show and trends successful OI and volumes, raises a question astir the sustainability of the gains.

- In the past 24 hours, SOL, DOGE and ADA person registered an summation successful futures OI, portion the different large cryptocurrencies person seen superior outflows. Funding rates (calculated connected an 8-hour basis) for astir majors person receded to adjacent zero, indicating a neutral sentiment.

- On the CME, BTC futures OI remains good beneath December highs portion the annualized three-month ground remains nether 10%. However, options OI has accrued to 42.89K BTC, the highest since May 29.

- In ETH's case, the CME futures OI has risen to a grounds 2.2 cardinal ETH, signaling robust organization participation.

- On Deribit, BTC enactment options proceed to commercialized astatine a higher premium than calls crossed each tenors, indicating a bearish authorities shift. BTC's implied volatility (IV) word operation remains upward-sloping with September expiry options trading astatine mid-to-high 30 IVs.

- In ETH's case, the telephone bias has notably weakened since aboriginal this week.

- Block flows connected OTC web Paradigm featured butterfly enactment strategies successful BTC and an outright acquisition of the Aug. 30 expiry ether telephone astatine the $5,000 strike.

Market Movements

- BTC is up 0.45% from 4 p.m. ET Wednesday astatine $112,929.44(24hrs: +1.78%)

- ETH is down 0.12% astatine $4,589.62.94 (24hrs: +0.31%)

- CoinDesk 20 is unchanged astatine 4,168.55 (24hrs: +0.83%)

- Ether CESR Composite Staking Rate is down 3 bps astatine 2.9%

- BTC backing complaint is astatine 0.008% (8.7688% annualized) connected Binance

- DXY is down 0.16% astatine 98.08

- Gold futures are up 0.18% astatine $3,454.80

- Silver futures are up 0.72% astatine $38.99

- Nikkei 225 closed up 0.73% astatine 42,828.79

- Hang Seng closed down 0.81% astatine 24,998.82

- FTSE is down 0.36% astatine 9,221.86

- Euro Stoxx 50 is up 0.28% astatine 5,407.94

- DJIA closed connected Wednesday up 0.32% astatine 45,565.23

- S&P 500 closed up 0.24% astatine 6,481.40

- Nasdaq Composite closed up 0.21% astatine 21,590.14

- S&P/TSX Composite closed up 0.33% astatine 28,433.00

- S&P 40 Latin America closed up 0.96% astatine 2,741.35

- U.S. 10-Year Treasury complaint is down 0.8 bps astatine 4.23%

- E-mini S&P 500 futures are unchanged astatine 6,499.00

- E-mini Nasdaq-100 futures are unchanged astatine 23,623.00

- E-mini Dow Jones Industrial Average Index are up 0.19% astatine 45,729.00

Bitcoin Stats

- BTC Dominance: 58.26% (-0.06%)

- Ether-bitcoin ratio: 0.04062 (0.26%)

- Hashrate (seven-day moving average): 969 EH/s

- Hashprice (spot): $55.16

- Total fees: 3.65 BTC / $407,212

- CME Futures Open Interest: 138,700 BTC

- BTC priced successful gold: 33.2 oz.

- BTC vs golden marketplace cap: 9.45%

Technical Analysis

- BTC's terms is looking to found a foothold supra the precocious extremity of the falling transmission that marks the pullback from grounds highs.

- A convincing breakout would mean that the impermanent bull breather has ended, opening the doors for a renewed rally to $120,000 and higher.

- The 50-, 100- and 200-hour elemental moving averages are bottoming retired arsenic good successful a motion of imaginable terms gains ahead.

Crypto Equities

- Coinbase Global (COIN): closed connected Wednesday astatine $308.97 (+0.16%), +0.63% astatine $310.92 successful pre-market

- Circle (CRCL): closed astatine $127.4 (-1.28%), +0.58% astatine $128.14

- Galaxy Digital (GLXY): closed astatine $24.41 (-1.25%), +1.27% astatine $24.72

- Bullish (BLSH): closed astatine $63.98 (-3.18%), -0.14% astatine $63.89

- MARA Holdings (MARA): closed astatine $15.85 (+0.06%), +1.14% astatine $16.03

- Riot Platforms (RIOT): closed astatine $13.55 (-1.02%), +1.03% astatine $13.69

- Core Scientific (CORZ): closed astatine $14.2 (+1.14%), +0.92% astatine $14.33

- CleanSpark (CLSK): closed astatine $9.58 (-1.03%), +1.67% astatine $9.74

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $29.31 (-0.27%)

- Exodus Movement (EXOD): closed astatine $27.25 (+1%), +2.68% astatine $27.98

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $342.06 (-2.65%), +1.21% astatine $346.21 successful pre-market

- Semler Scientific (SMLR): closed astatine $30.56 (-0.75%)

- SharpLink Gaming (SBET): closed astatine $19.27 (-3.26%), +1.19% astatine $19.50

- Upexi (UPXI): closed astatine $8.22 (-3.92%), +6.45% astatine $8.75

- Mei Pharma (MEIP): closed astatine $5.16 (-2.27%)

ETF Flows

Spot BTC ETFs

- Daily nett flows: $81.4 million

- Cumulative nett flows: $54.16 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $307.2 million

- Cumulative nett flows: $13.65 billion

- Total ETH holdings ~6.53 million

Source: Farside Investors

Chart of the Day

- BTC's terms betterment is marked by a diminution successful unfastened involvement successful USD- and USDT-denominated perpetual futures connected large exchanges.

- Furthermore, the spot measurement has stayed debased passim the recovery.

- The divergence indicates debased information of some derivatives and spot traders successful the terms recovery.

While You Were Sleeping

- As Bitcoin Bounces, On-Chain Data Point to Selling Pressure Near $113.6K (CoinDesk): Glassnode information suggests short-term holders whitethorn merchantability adjacent $113.6K and highlights $107K arsenic the cardinal enactment level, portion analysts accidental ETF inflows and firm buying supply a bullish counterweight.

- Ether Futures Open Interest connected CME Hits Record $10B, Hinting astatine Institutional Resurgence (CoinDesk): The speech said the fig of ample unfastened involvement holders — those holding astatine slightest 25 ETH contracts astatine a clip — deed a grounds 101 aboriginal this month.

- The Sandbox Cuts Half of Its Staff, Restructures arsenic Animoca Brands Take Control (CoinDesk): The Sandbox is reportedly facing sweeping cuts, dwindling users and a token crash, with power shifting to bulk shareholder Animoca Brands and questions looming implicit its nine-figure crypto treasury.

- American Bitcoin, Backed by Trump’s Sons, Aims to Start Trading successful September (Reuters): Hut 8 CEO Asher Genoot said American Bitcoin’s merger with Gryphon Digital Mining volition soon close, allowing for a Nasdaq listing nether the ticker ABTC. The Trump brothers and Hut 8 volition clasp 98% of the company.

- Denmark Summons U.S. Envoy Over Suspected American Influence Campaign successful Greenland (The Wall Street Journal): Investigators accidental U.S.-linked operatives are compiling lists of sympathetic Greenlanders and stoking separatist sentiment to weaken Denmark's grip, an unprecedented determination among allies arsenic Washington eyes strategical power of the island.

- China Won the Rare Earths Race. Can It Stay connected Top? (Financial Times): China has kept prices debased to artifact rivals, controlling 70% of mining, 90% of processing and astir each magnet output, leaving occidental efforts struggling to physique viable alternatives.

In the Ether

3 months ago

3 months ago

English (US)

English (US)