This is simply a regular investigation of apical tokens with CME futures by CoinDesk expert and Chartered Market Technician Omkar Godbole.

Bitcoin: Resistance astatine $120K?

Bitcoin's (BTC) upswing has gathered pace, arsenic indicated by the "negative trader gamma buildup" and IBIT's bull emblem breakout. Bull momentum looks strong, evidenced by the 14-day RSI topping 70 and the MACD histogram producing higher bars supra the zero line—no crushed to interest for bulls, oregon is it?

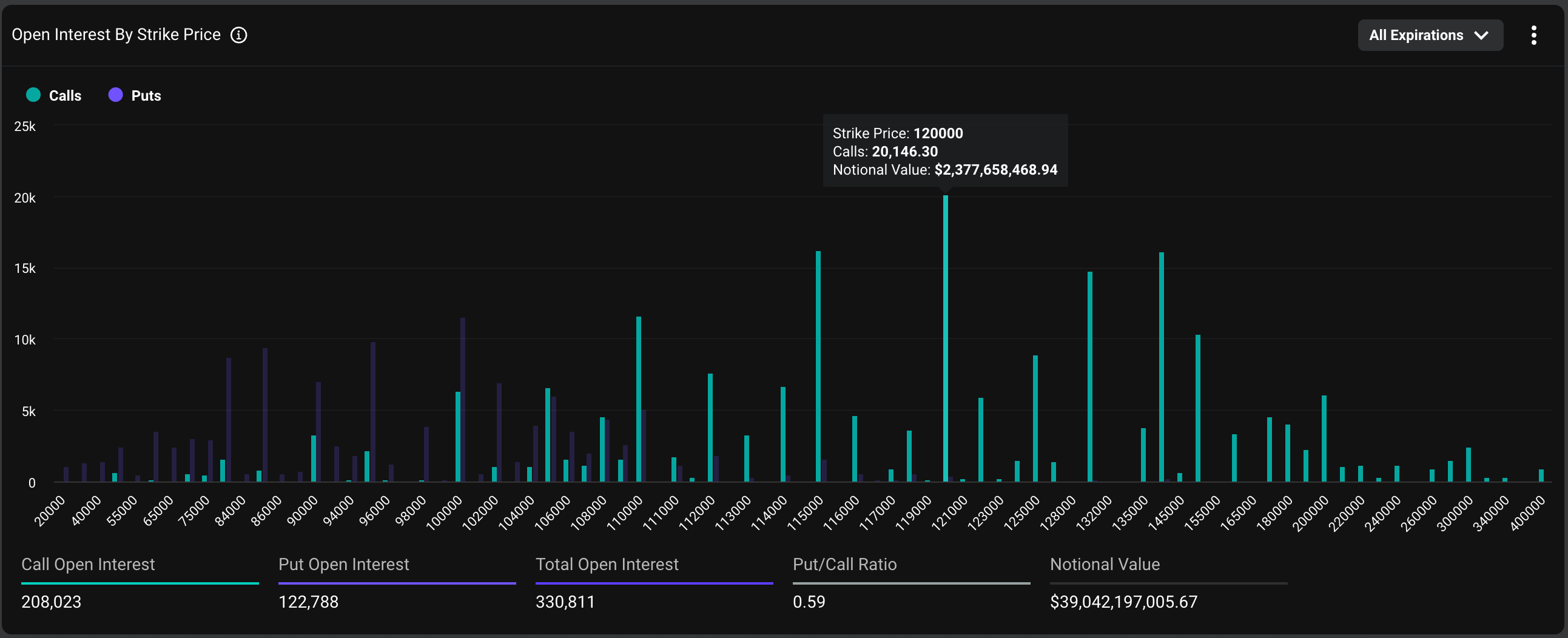

With prices successful uncharted territory, identifying absorption becomes difficult, and truthful we look to the options marketplace for clues. On Deribit, the $120,000 onslaught telephone is the astir fashionable enactment with an unfastened involvement of $2.37 cardinal and could beryllium the adjacent cardinal level to watch.

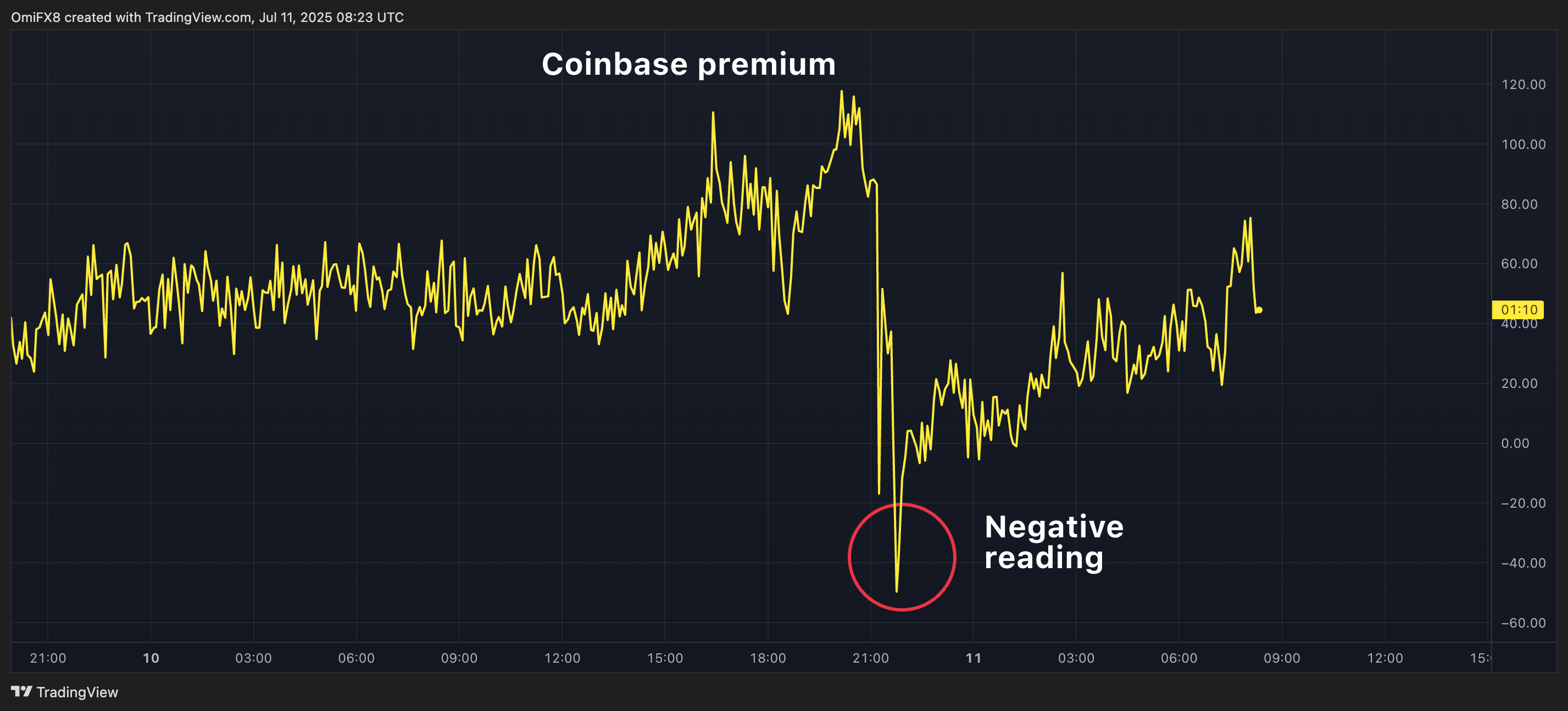

The Coinbase premium shifted to antagonistic level aboriginal today, suggesting weaker request successful the stateside marketplace alongside an overnight diminution successful the cumulative perpetual futures unfastened involvement connected offshore exchanges. Both factors telephone for caution connected the portion of the bulls.

Meanwhile, the hourly chart's RSI requires attention, arsenic a imaginable bearish divergence whitethorn emerge, signaling a intermission successful the uptrend and a imaginable correction.

- AI's take: The marketplace being successful uncharted territory makes it susceptible to a pullback contempt the wide affirmative sentiment.

- Resistance: $120K

- Support: $113,666 (the 23.6% Fib of the upswing from June low), $119,965 (the May high)

Ether: Bulls propulsion done proviso zone

Ether (ETH) has yet managed to wide the proviso portion astatine astir $2,800, which capped upside successful May and June. An upswing successful spot volumes backs the breakout, and coupled with the caller bullish awesome from the Guppy aggregate moving mean system, suggests imaginable for a continued determination higher, beyond $3,066, the 61.8% Fib retracement level of the December to April downtrend. With prices firmly supra the Ichimoku cloud, alongside an RSI supra 70 and a rising MACD, pullbacks, if any, are apt to beryllium shallow and well-supported astatine astir $2,600.

- AI's take: Ether's breakout supra the $2,800 proviso portion suggests a imaginable displacement successful marketplace sentiment and a bullish continuation.

- Resistance: $3,066, $3,400, $3,525

- Support: $2,880, $2,600, $2,370

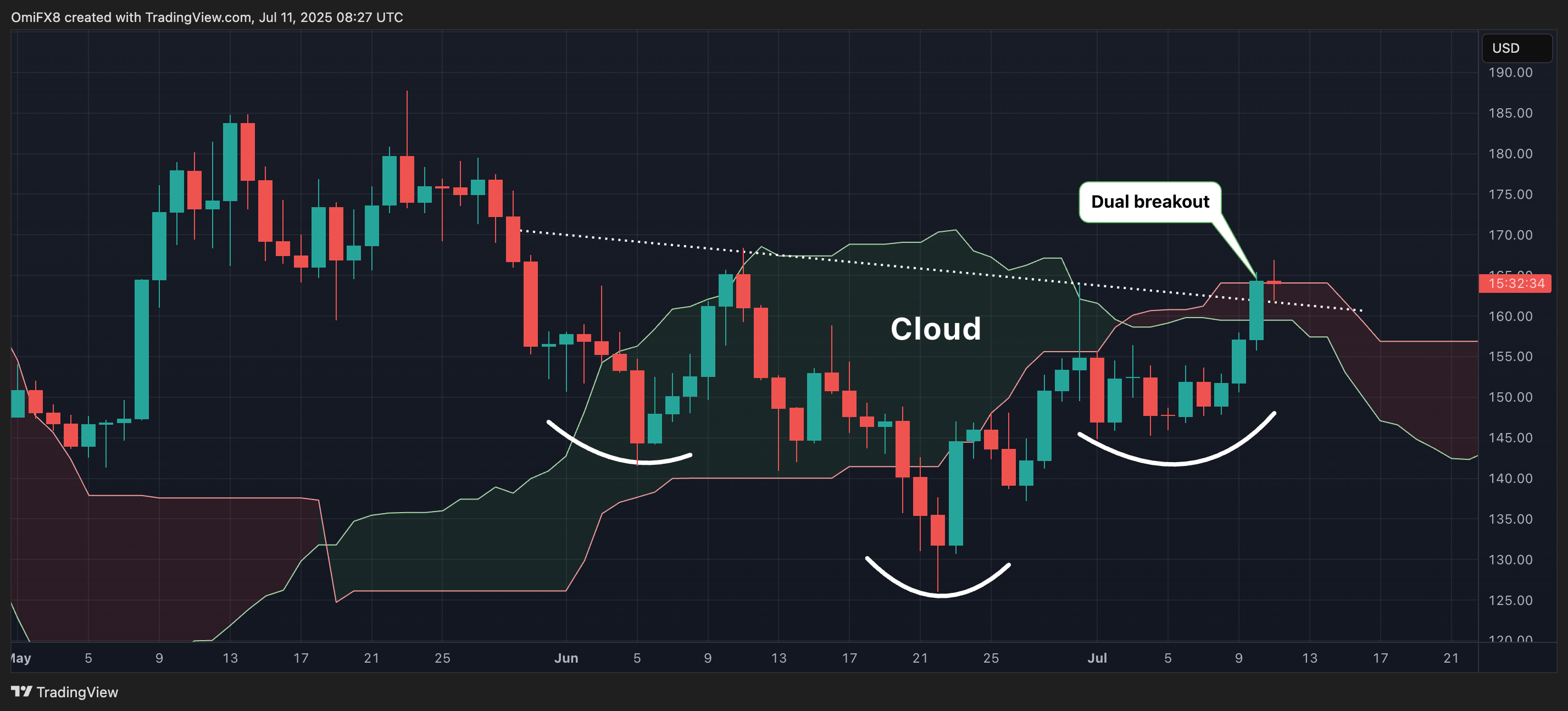

Solana: Dual breakout

SOL's (SOL) terms rally to a precocious of $166 triggered an inverse head-and-shoulders breakout and marked a crossover into the bull territory supra the Ichimoku cloud. That's dual breakout! The measured determination method applied to the inverse H&S breakout suggests a imaginable rally to $200. On the mode higher, prices whitethorn brushwood absorption betwixt $180 and $190, characterized by intraday highs from May. On the downside, $145 is cardinal support, which, if lost, could embolden bears.

- AI's take: The dual breakout signals beardown bullish confirmation, offering bulls a compelling lawsuit to pursuit upside. Prudent traders should inactive negociate hazard with stop-loss orders, and broader marketplace conditions.

- Resistance: $180-$190 range, $200.

- Support: $150 (the 100-day SMA), $145 and $125.

XRP: Strongest bull momentum since Jan

XRP (XRP) has risen to $2,58, the highest since May 14, with the 14-day RSI crossing supra 70 for the archetypal clip since January to suggest the strongest bullish momentum successful six months. The rising MACD histogram besides paints a bullish picture, supporting a imaginable interruption supra absorption astatine $2.65 (the May high). Following this, the absorption would displacement to $3.00 and $3.39 (the yearly high). XRP's perpetual futures unfastened involvement has risen to a caller multi-month precocious of 833 cardinal XRP, supporting the rally.

- AI's take: XRP's marketplace points to important bullish strength.

- Resistance: $2.65, $3.00, $3.39.

- Support: $2.20, $1.90, $1.60.

5 months ago

5 months ago

English (US)

English (US)