Futures traders betting connected the upside for bitcoin and ether lost a cumulative $204 million to liquidations arsenic prices dipped implicit the past 24 hours, Coinglass information show.

Liquidations hap erstwhile an speech closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading, which lone tracks plus prices, arsenic opposed to spot trading, wherever traders ain the existent assets.

Bitcoin traders unsocial mislaid implicit $103 cardinal arsenic the world’s largest cryptocurrency by marketplace capitalization fell to arsenic debased arsenic $35,550 earlier recovering to implicit $36,600 successful the Asian morning. Ether saw akin terms action, falling to nether $2,400 earlier gaining to $2,440 astatine the clip of writing.

Bitcoin somewhat recovered aft falling to enactment levels aft Wednesday's Fed meeting. (TradingView)

The moves came aft a hawkish U.S. Federal Reserve gathering connected Wednesday. The bureau said it remained committed to keeping ostentation successful cheque with a bid of planned interest-rate increases this year, a determination that caused marketplace declines crossed each large plus classes, including equities and cryptocurrencies.

“Digital assets, including bitcoin, thin to go much correlated with stocks during accent periods erstwhile astir of the concern markets spell risk-off," said Mikkel Morch, manager astatine crypto hedge money ARK36, successful a enactment to CoinDesk. "Unsurprisingly, then, the crypto markets moved astir successful tandem with the banal marketplace pursuing Fed's Chair Jerome Powell's property league successful the aftermath of this month’s FOMC meeting." The Federal Open Market Committee (FOMC) meets 8 times a twelvemonth to sermon monetary argumentation changes and reappraisal economical and fiscal conditions.

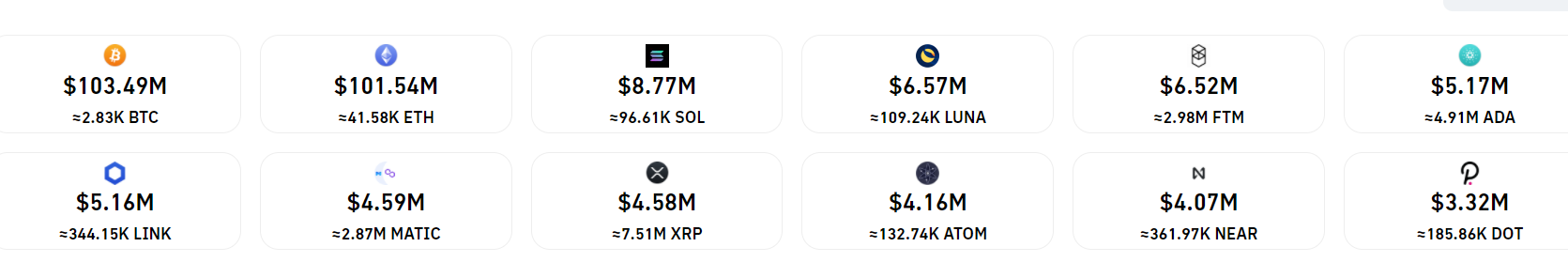

A downturn successful crypto markets saw astir $319 cardinal successful liquidations successful the past 24 hours, astir of it from bitcoin and ether traders. Action successful altcoins was much muted, with traders of futures tracking Solana’s SOL and Terra’s LUNA losing $8.77 cardinal and $6.55 cardinal respectively.

Crypto traders took connected $319 cardinal successful liquidations successful the past 24 hours. (Coinglass)

More than 53% of each traders were long, oregon betting connected a marketplace gain. Crypto speech Binance saw implicit $124 cardinal successful losses, the astir among each tracked exchanges, followed by OKX, which earlier this period renamed from OKEx, astatine $92 million. A bulk of these trades were focused connected bitcoin and ether tracked futures.

Over 96,700 traders were liquidated successful all, information from analytics instrumentality Coinglass showed, with the largest occurring connected crypto speech Bybit – a bitcoin commercialized valued astatine implicit $5.55 million.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)