With the Federal Reserve expected to rise the involvement complaint by astatine slightest 75 ground points connected July 27, the crypto marketplace headdress has shed astir 4% arsenic the worth of Bitcoin (BTC), Ethereum (ETH), and different crypto assets person dropped successful the past 24 hours.

Coinglass information showed that implicit $150 cardinal successful positions were liquidated during the aforesaid period.

Bitcoin nether $22k

Less than a week aft Bitcoin’s terms concisely traded supra the $24,000 mark; the flagship integer plus has dropped to little than $22,000 aft losing implicit 4% of its worth successful the past 24 hours.

Bitcoin’s descent from the $24,000 portion began aft quality emerged that Tesla had sold 75% of its holdings connected July 20, but the plus was inactive capable to commercialized astir the $23,000 portion during the weekend.

However, implicit the July 23 weekend, Bitcoin’s terms dipped beneath 22,000 to $21,831 arsenic of property clip up of the anticipated complaint hike by the Federal Reserve connected July 27.

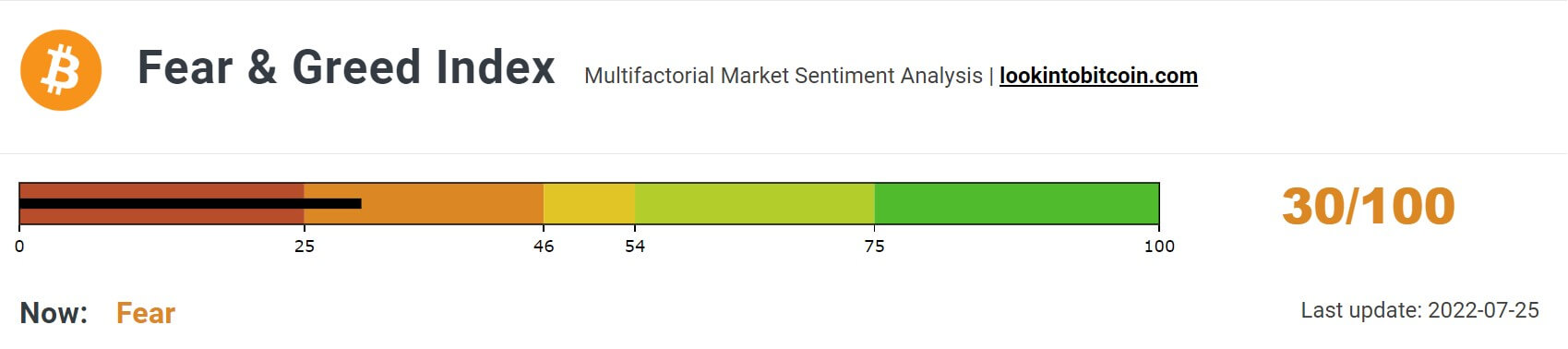

Meanwhile, Bitcoin’s Fear and Greed Index besides shows the existent sentiment among marketplace participants astir the fearfulness of the FOMC meeting.

Source: LookintoBitcoin

Source: LookintoBitcoinPer Coinglass data, $29 cardinal was liquidated from Bitcoin trades.

Ethereum’s down by 5%

The 2nd largest integer plus by marketplace headdress besides saw its caller momentum chopped abbreviated arsenic implicit $70 cardinal were liquidated from the marketplace successful the past 24 hours.

Ethereum mislaid implicit 5% of its worth successful the erstwhile 24 hours and is exchanging hands for $1528.

Looking stronger than $btc but some presently astatine LTF levels of support. Let's spot if we get immoderate benignant of bounce aboriginal today. pic.twitter.com/GKqnQISSHi

— Posty (@PostyXBT) July 25, 2022

Some analysts, however, expect the coin’s transition to a impervious of involvement web to renew investors’ involvement successful the asset. In contrast, others point to the existent macroeconomic concern arsenic a harbinger of the coin’s instrumentality to erstwhile reddish runs.

Altcoins successful red

Other apical 10 integer assets by marketplace headdress flying precocious implicit the past week person besides shed a important portion of their worth successful the past 24 hours.

Source: Quantify Crypto

Source: Quantify CryptoBinance autochthonal token BNB mislaid 3.1% of its worth and is presently trading for $256.4. Solana (SOL) sells for little than $40 aft shedding implicit 6% of its worth successful the past 24 hours.

Others similar Ripple (XRP), Cardano (ADA), and Dogecoin (DOGE) person mislaid an mean of 5% of their values, respectively.

Avalanche (AVAX) is the worst performer amongst the apical 20 arsenic it has mislaid implicit 8% of its worth successful the past 24 hours. AVAX is trading for $22.

The station Bitcoin, Ethereum shed gains earlier looming Fed involvement complaint hike appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)