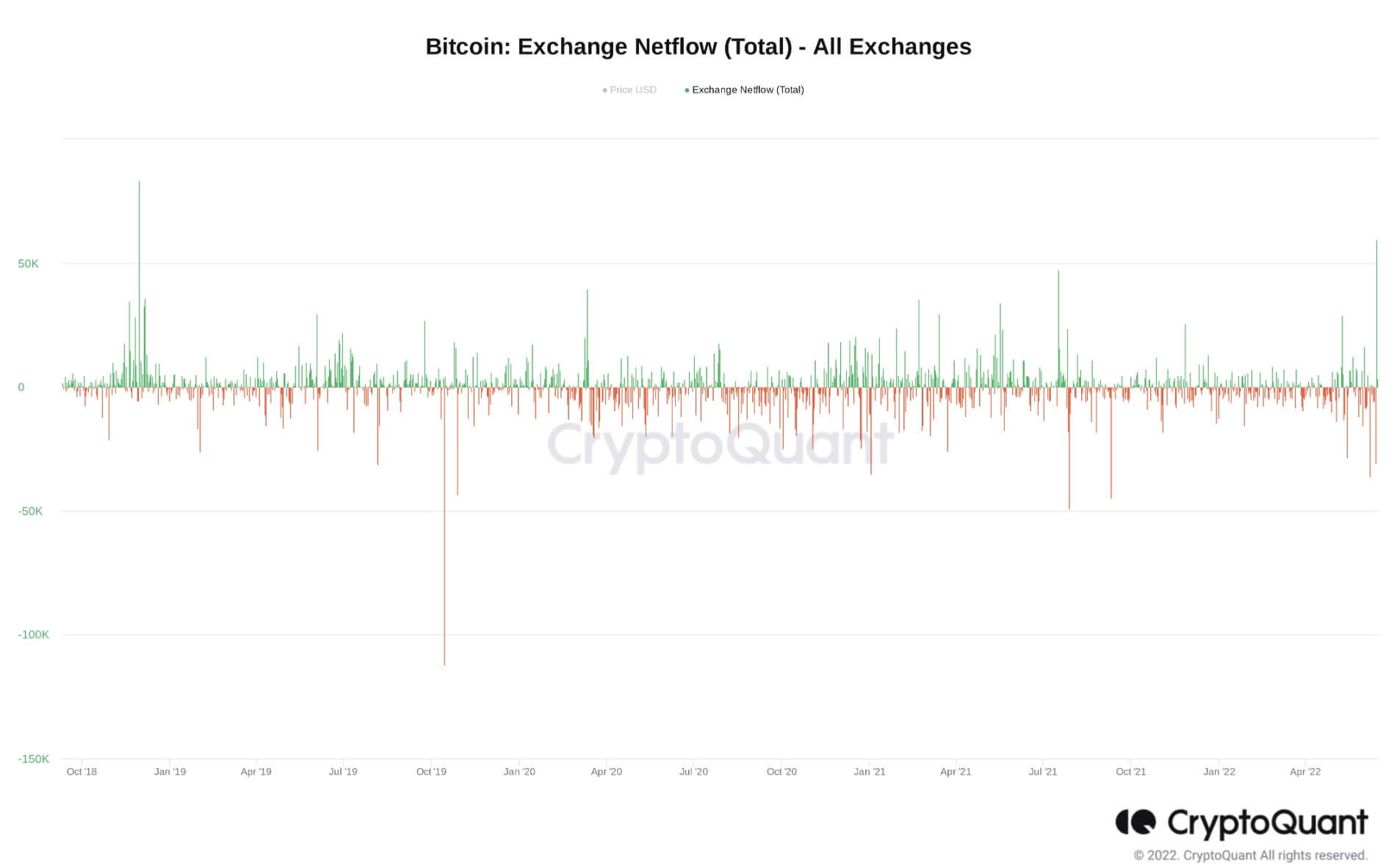

Using information from CryptoQuant, YouTuber Lark Davies tweeted that the fig of Bitcoin flowing into exchanges is astatine its highest “since the carnivore marketplace bottommost of 2018.” Daves added that marketplace lows ever look to beryllium met with panic selling.

#bitcoin conscionable saw the largest speech inflow since the carnivore marketplace bottommost of 2018!

Every clip the marketplace tanks investors unreserved to panic merchantability the lows. pic.twitter.com/tUNMIqo32G

— Lark Davis (@TheCryptoLark) June 15, 2022

U.S complaint hike doesn’t spook the market

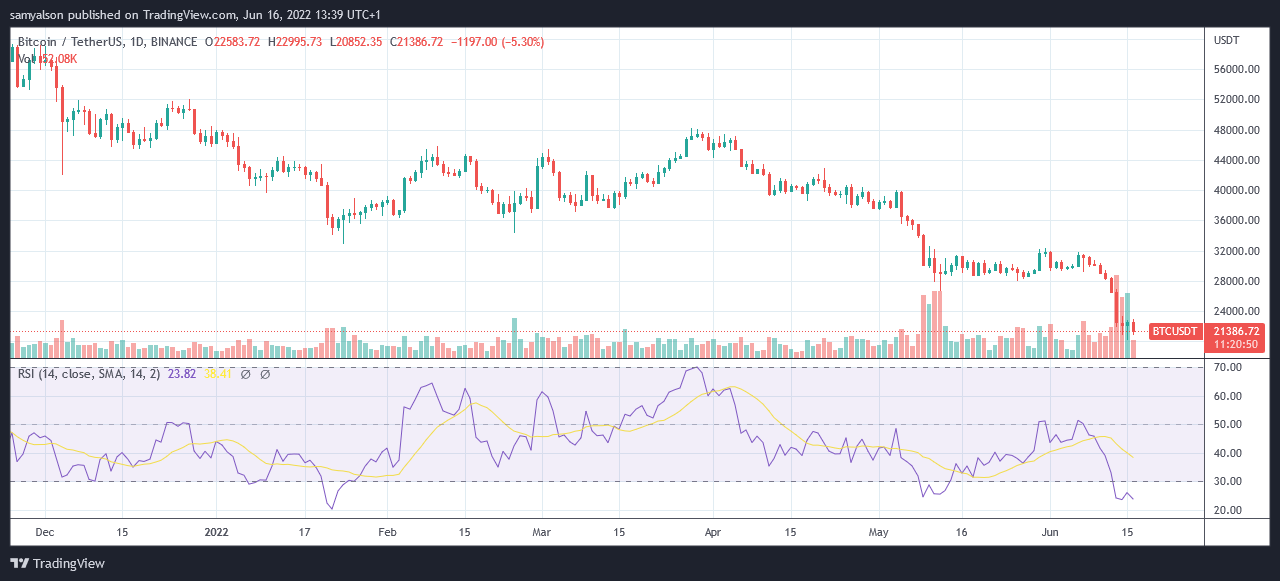

Bitcoin closed beneath $30,000, connected June 10, pursuing the merchandise of information showing U.S user prices for May were astatine a 40-year high.

Since then, the BTC terms has been cascading lower, hitting a bottommost of $20,100 connected Wednesday. Large trading measurement accompanied the ensuing bounce, but regular momentum is anemic arsenic the Relative Strength Index (RSI) remains heavy successful oversold territory.

Source: BTCUSDT connected TradingView.com

Source: BTCUSDT connected TradingView.comWednesday’s Fed argumentation gathering announced a 75-basis-point increase successful the benchmark argumentation rate, taking the superior complaint to 1.75%.

Contrary to expectations of a marketplace sell-off, arsenic a response, Bitcoin roseate to highest astatine $23,000 successful the aboriginal hours of Thursday (GMT).

Bitcoin speech inflows spike amid marketplace uncertainty

Amid this, crypto exchanges saw their highest nett Bitcoin inflows since November 2018, astatine astir 83,000 BTC. This indicates expanding sell-side unit is mounting, which draws concerns implicit whether the section bottom, $20,100, volition clasp successful the coming days and weeks.

Source: @TheCryptoLark connected Twitter.com

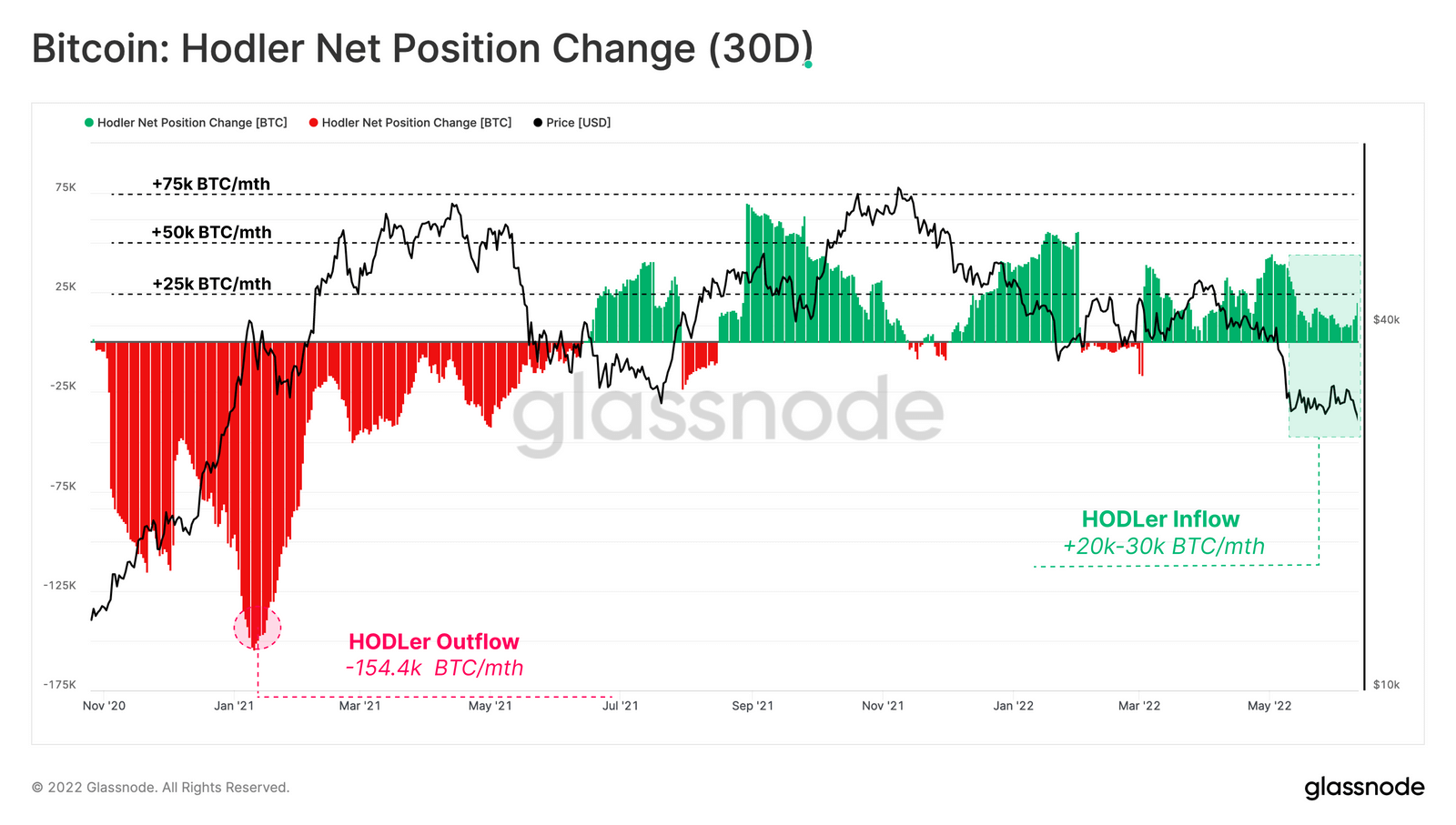

Source: @TheCryptoLark connected Twitter.comMeanwhile, Glassnode data connected the HODLer nett presumption change, which examines the complaint of accumulation oregon organisation by semipermanent investors, suggests weakness successful the accumulation appetite of hodlers.

The illustration beneath shows a existent nett hodler inflows are inactive nett positive. But caller nett inflows are down importantly since the May section top, suggesting “a weakening accumulation response” by hodlers.

“approximately 15k-20k BTC per period are transitioning into the hands of Bitcoin HODLers. This has declined by astir 64% since aboriginal May, suggesting a weakening accumulation response.”

Source: insights.glassnode.com

Source: insights.glassnode.comWhen taken successful conjunction with important speech inflows, the signs bespeak further terms declines for Bitcoin. Glassnode expects BTC to driblet betwixt 40% and 64%.

But, successful a divergence from his accustomed work, on-chain expert Willy Woo brings successful the macroeconomic origin by saying a bottommost comes “when macro markets stabilize.”

“I deliberation it’s simpler than this, IMO we’ll find a bottommost erstwhile macro markets stabilize.“

The station Bitcoin speech inflows spike to 43 period high appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)