Bitcoin BTC climbed backmost supra $104,000 connected Tuesday with invited caller ostentation data, President Trump's bullish outlook connected fiscal markets, and Coinbase's inclusion into the S&P 500 among catalysts for the advance.

April’s Consumer Price Index (CPI) came successful cooler than anticipated, which whitethorn allay unit connected the Federal Reserve anxious astir ostentation owed to tariffs. Fed Chair Jerome Powell's scheduled code connected Thursday could supply further argumentation guidance.

The upbeat temper was further lifted by Donald Trump, who told attendees astatine the Saudi–U.S. Investment Forum successful Riyadh that markets "could spell a batch higher,.".

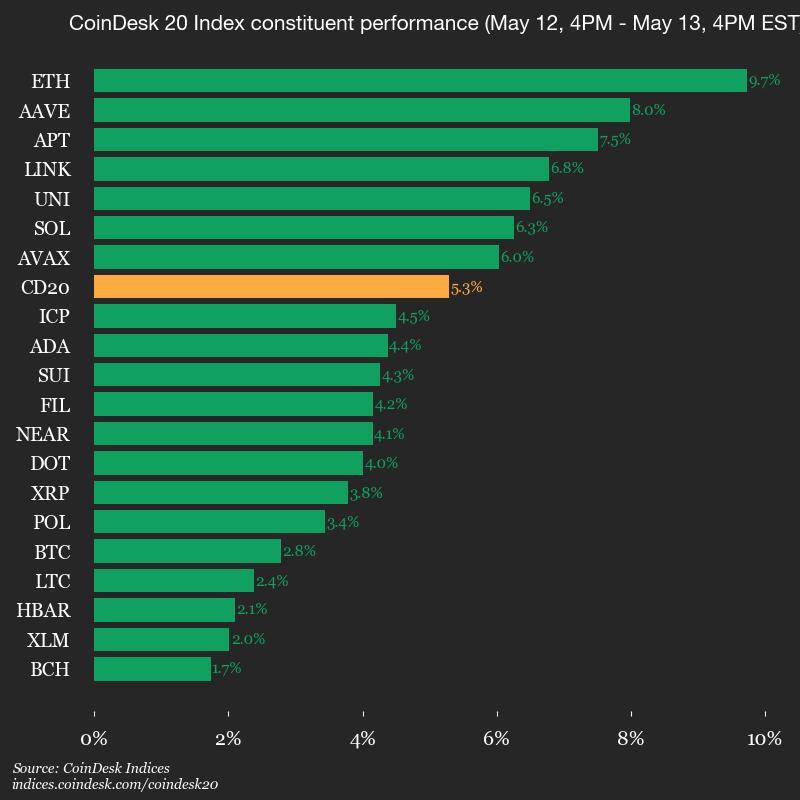

Bitcoin (BTC) astir touched $105,000 earlier pulling back, astatine property clip trading 2.4% higher implicit the past 24 hours astatine astir $104,400. Most altcoins successful the CoinDesk 20 Index outperformed. Ethereum's ether ETH continued its resurgence advancing implicit 9% to $2,700. Restaking protocol Eigenlayer's governance token EIGEN and decentralized concern (DeFi) protocol EtherFi's autochthonal token ETHFI booked much than 20-30% regular gains.

Stocks added to their caller gains, with the Nasdaq and S&P 500 up 1.6% and 0.75%, respectively, astatine the league close. Nasdaq-listed crypto speech Coinbase (COIN) surged 24% during the time arsenic the banal is acceptable to payment from being included successful the S&P 500 index. The alteration could unleash $16 cardinal successful buying pressure for shares, Jefferies forecasted.

Joel Kruger, marketplace strategist astatine LMAX Group, said that the crypto marketplace is inactive digesting past week's gains, but the rally has further momentum. “Currently, the marketplace appears to beryllium pausing for breath, yet the prevailing sentiment successful caller headlines suggests this rally inactive has country to grow,” Kruger said.

He pointed to a rebound successful planetary hazard appetite and a increasing fig of organization tailwinds. “One notable origin is the expanding mainstream adoption of cryptocurrency, arsenic evidenced by developments successful U.S. fiscal markets. Coinbase’s inclusion successful the S&P 500 marks a historical milestone, establishing it arsenic the archetypal crypto-native institution to articulation this prestigious index,” Kruger said.

He besides cited improving sentiment astir regulation. SEC Chair Paul Atkins has pledged to marque the U.S. a hub for cryptocurrency innovation, which Kruger believes could unlock a caller question of organization involvement if followed by meaningful argumentation clarity.

Paul Howard, elder manager astatine trading steadfast Wincent, echoed that view, saying that portion altcoins are tracking the broader rally, organization superior is apt to go much selective. “This evolving scenery appears to beryllium laying the groundwork for accrued organization participation,” helium said successful a Telegram message. “The much resilient altcoin projects could benefit, portion weaker ones whitethorn gradually signifier out.”

New BTC grounds adjacent month?

While bitcoin is little than 5% from its January grounds prices, Bitfinex analysts noted that neutral backing rates and unchangeable trading volumes amusement nary signs of marketplace froth.However, BTC is facing absorption astatine astir the $104,000-$106,000 zone, making a short-term consolidation apt with cardinal enactment level astatine astir $98,000, they added."BTC has moved up sharply successful the past fewer weeks and we expect a play of consolidation, meaning a caller all-time precocious could beryllium delayed to June arsenic supply/demand stabilises supra $100,000," Bitfinex analysts wrote.

Zooming retired for the adjacent months, Bitfinex analysts said mean and semipermanent setups stay decisively bullish, mounting a $150,000-$180,000 terms people for 2025-2026.

"Bitcoin’s semipermanent outlook is the strongest it has ever been," they wrote. "With sovereign and organization adoption advancing, ETF rails expanding globally, and the US framing crypto argumentation much positively, BTC is evolving into a planetary macro reserve asset."

7 months ago

7 months ago

English (US)

English (US)