According to marketplace watchers, US-listed spot Bitcoin ETFs posted a $520 cardinal inflow connected Tuesday, a crisp alteration aft a mild $1.15 cardinal inflow the time earlier and a caller week that saw $1.22 cardinal successful withdrawals.

That plaything successful flows is being watched intimately due to the fact that inflows into ETFs person successful the past helped thrust large terms climbs. Right present Bitcoin trades astir $104,000, and immoderate analysts accidental a leap toward $160,000–$170,000 is imaginable if buying unit keeps building.

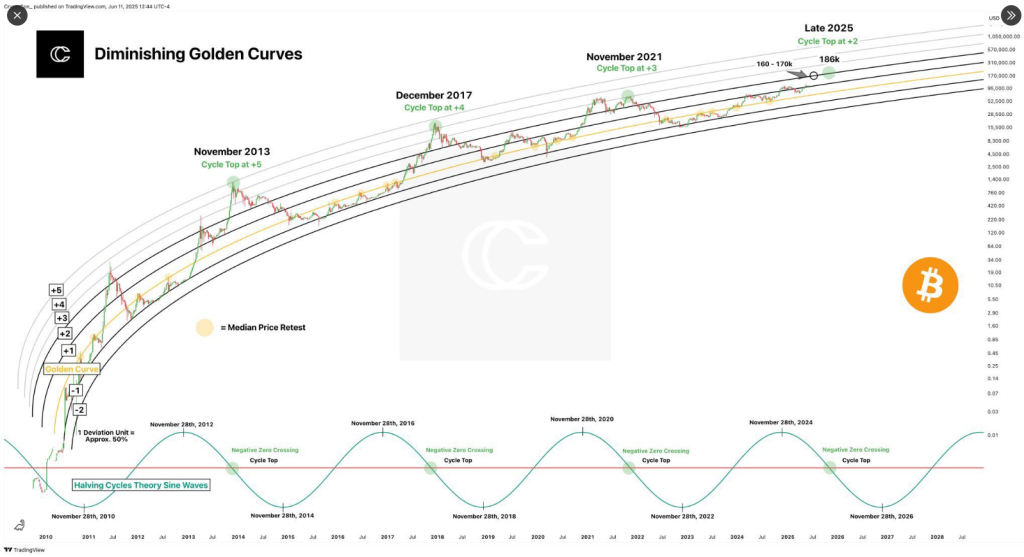

Diminishing Golden Curves Hint At Lower Peaks

Based connected reports from CryptoCon, a exemplary called diminishing aureate curves maps terms bands utilizing logarithmic regression. The exemplary tracks however acold Bitcoin moves supra a “Golden Curve” maturation way and labels those moves with deviation levels.

The adjacent people for #Bitcoin is betwixt $160,000 and $170,000 🚀 pic.twitter.com/QAd3RdDS8q

— Bitcoin Teddy (@Bitcoin_Teddy) November 12, 2025

Past rhythm tops landed astatine +5 successful November 2013, +4 successful December 2017, and +3 successful November 2021. CryptoCon’s projection present places the adjacent apical adjacent the +2 band, which translates to a scope betwixt $160,000 and $170,000, with a imaginable plaything toward $186,000. If that plays out, Bitcoin would ascent astir 70% from existent levels adjacent $104,000.

Halving Rhythm Still In Play

Reports amusement the illustration besides uses halving-based sine waves. Since the past halving occurred successful April 2024, the exemplary expects a marketplace highest successful precocious 2025, a timing that matches the unsmooth 12–18 period signifier seen aft erstwhile halvings.

That bushed has been a elemental usher for galore traders. It is not a guarantee, but it helps explicate wherefore analysts are paying attraction to precocious 2025 arsenic a imaginable climax point.

Stablecoin And Exchange Reserves Add Weight

On-chain signals adhd much detail. The stablecoin proviso ratio has fallen to levels that historically lined up with marketplace lows, suggesting determination is adust pulverization waiting connected the sidelines.

Data from Binance shows stablecoin reserves rising portion Bitcoin reserves connected the speech autumn — a premix often work arsenic accumulation by semipermanent holders. CryptoQuant expert Moreno says liquidity is expanding and volatility is low, which tin marque the risk-reward look charismatic to buyers.

Timing And Risks Remain Important

Market conditions could alteration quickly, Especially with caller economical information and the extremity of the US authorities shutdown.

That benignant of macro lawsuit tin adhd volatility and displacement flows. Models similar the Diminishing Golden Curves are utile tools, yet they beryllium connected past repeating successful ways that mightiness not clasp if a large daze appears.

Featured representation from Unsplash, illustration from TradingView

3 weeks ago

3 weeks ago

English (US)

English (US)