Bitcoin’s bearish momentum has since reached a cool-off state, arsenic terms maintains supra the past plaything debased established precocious November. However, though determination has been a dependable uptrend, signs of a bullish reversal stay weak. Interestingly, a caller valuation has been published, which delves into the factors that whitethorn impact Bitcoin’s adjacent large move.

Analyst Points To Key Support, Resistance Zones Using MVRV Metric

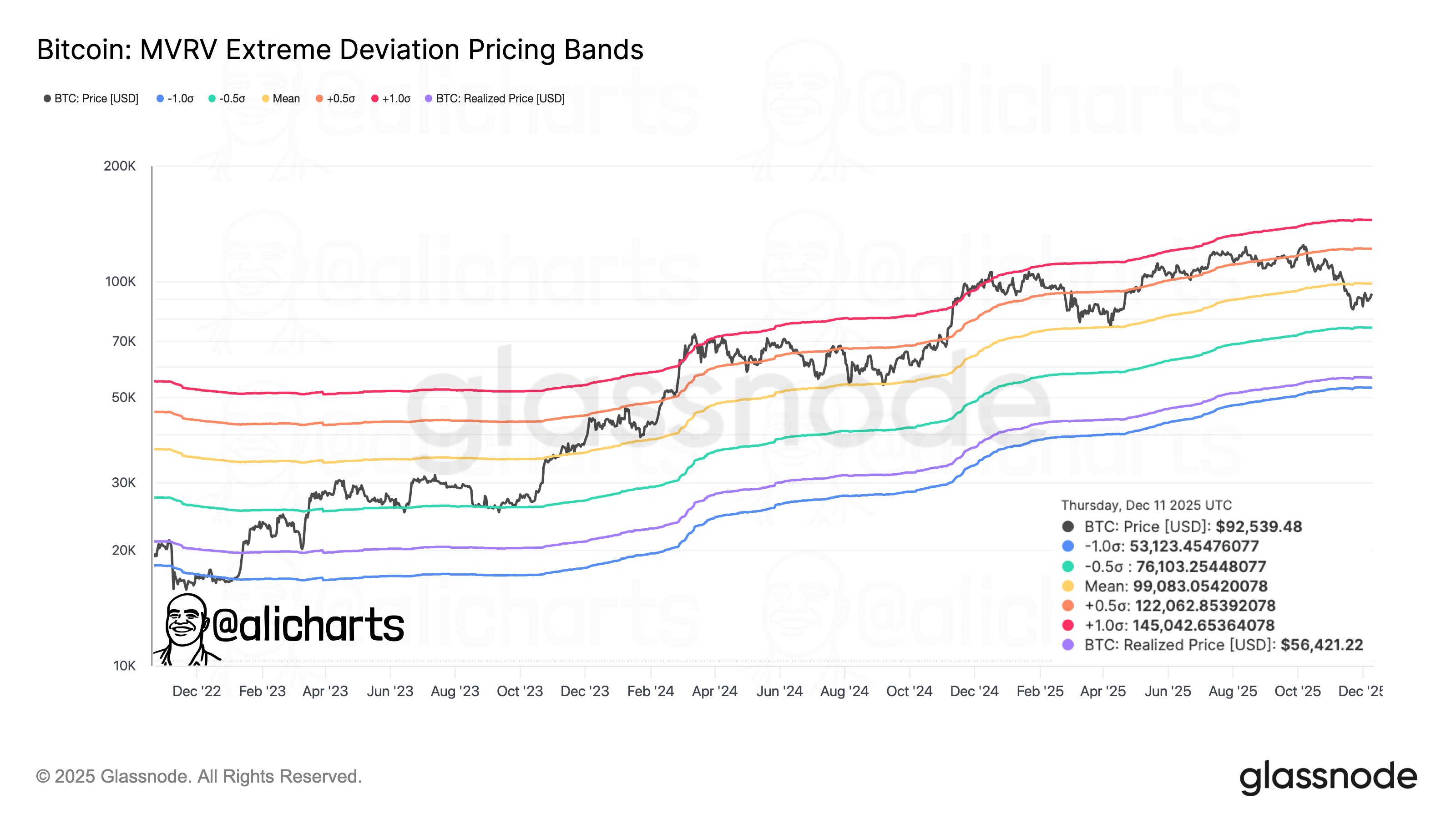

In an X post released connected December 12, marketplace expert Ali Martinez shares that Bitcoin’s adjacent important determination depends connected however the terms acts astir a acceptable of identified captious levels utilizing information from the MVRV Extreme Deviation Pricing Bands. For context, this metric is utilized to place erstwhile Bitcoin is undervalued oregon overvalued, with past enactment astir definite levels being a defining factor. It serves this relation by comparing Bitcoin’s marketplace terms to its Realized Price and plotting utmost levels of apt deviation, specified arsenic ±0.5 and ±1.0, astir the realized price.

From the illustration below, $99,000 stands successful correspondence to the +0.5 modular deviation band. This terms level has historically functioned arsenic a section top, particularly successful absorption against short-term bullish momentum. This happens due to the fact that determination is an summation successful profit-taking among sellers, arsenic they are prone to exiting successful the beingness of immoderate existent opposition. Interestingly, a important interruption supra this $99,000 absorption level could beryllium a motion of awakening bullish interest, perchance causing the inflow of bullish momentum upon its retest.

Source: @alicharts connected X

Source: @alicharts connected XOn the flipside, the astir contiguous enactment portion is seen to prevarication astir the $76,000 price. Notably, this portion corresponds to the –0.5 deviation band, suggesting that it is simply a terms level wherever Bitcoin would go undervalued if reached.

Past marketplace cycles besides uncover that pullbacks into this terms portion person often preceded accrued upward momentum, owing to the ‘buy-the-dip’ mentality that indispensable person prevailed. Expectedly, a gaffe beneath this cardinal enactment portion would beryllium a effect of intensified merchantability unit wrong the market. When this improvement occurs, the Bitcoin terms could spot an adjacent deeper correction towards the southbound broadside of the price.

Metric Suggests $122,000 And $53,000 Are Next Crucial Zones To Watch

Notably, Bitcoin is expected to look different conflict successful the script wherever it breaks supra the $99,000 resistance. Readings from the metric uncover that the +1 modular deviation set stands astir astatine $122,000. Bullish rallies person often reached this terms region, with important absorption met to nonstop prices sharply downwards. A interruption supra the +1.0 deviation could truthful precede the enactment of a caller all-time-high price.

Also, the –1.0 deviation stands astatine the $53,000 terms level. If the –0.5 deviation were to fail, the Bitcoin terms could statesman a bearish rhythm towards $53,000, arsenic it stands arsenic the adjacent important support. This is truthful due to the fact that it has historically functioned arsenic a beardown accumulation zone, wherever a spot of sideways question was seen earlier large terms expansions followed. At property time, Bitcoin stands astatine astir $90,400, with a nonaccomplishment of %1.24 recorded since the past day, per CoinMarketCap data.

Featured representation from Pexels, illustration from Tradingview

1 month ago

1 month ago

English (US)

English (US)