According to Bloomberg Intelligence’s Mike McGlone, Bitcoin has entered a “do-or-die” signifier arsenic traders ticker a constrictive terms set for signs of direction. From an Oct. 6 level of $123,500, the coin tumbled astir 20% to a debased of $99,900 connected Nov. 4 earlier recovering to astir $106,350. Reports amusement the determination near Bitcoin astir 14% beneath its earlier October peak.

Make Or Break Zone For Bitcoin

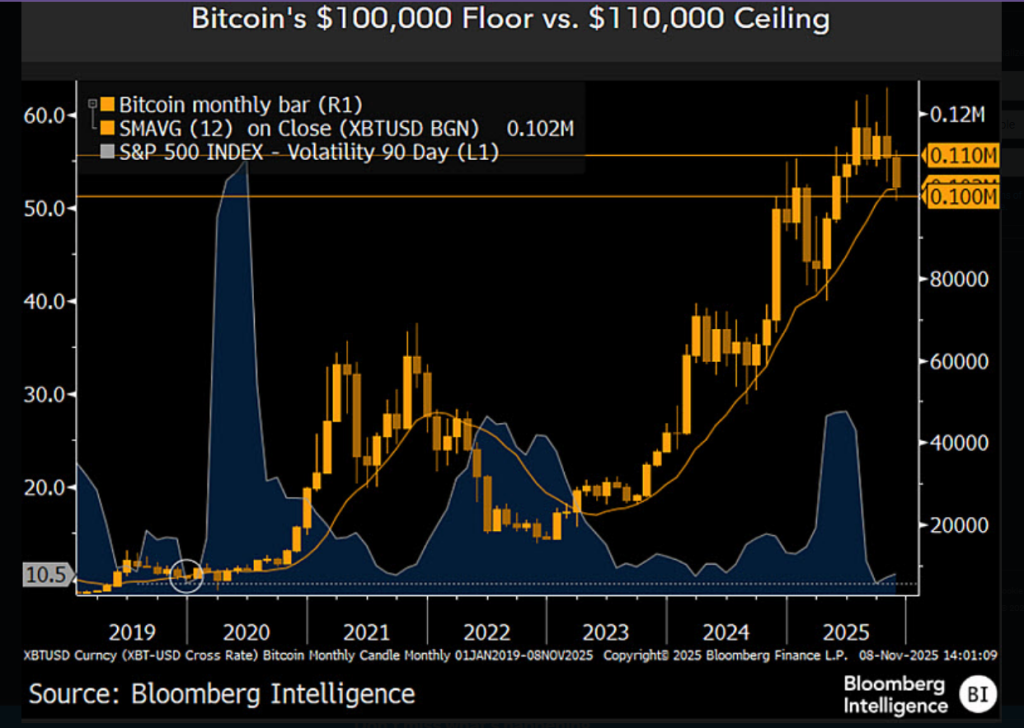

Based connected inclination lines and monthly charts, McGlone points to a rollover signifier aft the months-long ascent that culminated successful an Oct. 6 precocious marked connected immoderate charts astatine $126,270. The contiguous method trial is the 200-day moving average, which sits adjacent $110,000.

Bitcoin Do oregon Die: $110,000-$100,000

Bitcoin’s rolling-over signifier connected monthly charts mightiness awesome the other of gold’s bull emblem to August. The crypto has dropped beneath its 200-day moving mean astatine $110,000 to Nov. 7 — a cardinal hurdle to awesome recovery.

Full study connected the… pic.twitter.com/n4MMZfhuL3

— Mike McGlone (@mikemcglone11) November 10, 2025

According to his view, Bitcoin needs to propulsion backmost supra that level to marque a wide lawsuit for renewed upside. If it can’t, the hazard is that sellers regain power and prices gaffe further beneath the existent set betwixt $100,000 and $110,000.

Resistance And Momentum Signals

Reports person highlighted different informing signs. Long precocious wicks person appeared connected caller candles, a motion that buyers were checked adjacent the top. The 12-month elemental moving mean has started to flatten aft a dependable climb, suggesting the buying thrust is slowing.

Trader and expert Michaël van de Poppe has pointed to beardown absorption successful the $108,000–$110,000 zone. According to him, breaking done that scope could unfastened the doorway backmost to the highs, and if that happens, altcoins whitethorn tally harder than Bitcoin.

Institutional Moves And Market Mood

Institutional buyers stay active. Michael Saylor’s steadfast purchased 487 BTC worthy adjacent to $50 cardinal today, bringing reported holdings to 641,692 BTC. At the aforesaid time, exchange-traded funds saw outflows totaling $1.22 cardinal past week.

Market sentiment has nudged up: CoinMarketCap’s Fear and Greed Index roseate to 29 from 24, and Bitcoin is up astir 3.6% successful the past 24 hours aft lawmakers precocious a US authorities shutdown deal.

Traders are pricing event-contract probabilities that spot a 28% accidental Bitcoin reaches $130,000 oregon higher this twelvemonth and a 9% accidental it tops $150,000.

Short-Term Triggers Could Tip The Scale

Near-term catalysts are successful play. US President Donald Trump’s notation of a imaginable $2,000 tariff “dividend” and advancement toward ending the shutdown look to person helped the caller bounce.

Timothy Misir, caput of probe astatine Blockhead Research Network, said the marketplace has cleaner positioning and could spot a constructive November if fiscal clarity and ETF flows stabilize.

He besides warned astir risks: continued ETF outflows, transportation delays connected fiscal measures, and rising marketplace leverage could reverse the recovery.

What To Watch Next

For now, Bitcoin sits successful a choky trading range. Reclaiming $110,000 would beryllium work arsenic a affirmative awesome and mightiness reconstruct buying confidence. Falling beneath $100,000 would apt trigger deeper losses, according to the method representation analysts cite.

Traders and institutions volition ticker terms enactment astir those levels intimately — and those moves volition signifier whether this infinitesimal is remembered arsenic a abbreviated intermission oregon a large turning point.

Featured representation from The Conversation/Landmark Media/Alamy, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)