The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Liquidity Is In The Driver Seat

By far, 1 of the astir important factors successful immoderate marketplace is liquidity — which tin beryllium defined successful galore antithetic ways. In this piece, we screen immoderate ways to deliberation astir planetary liquidity and however it impacts bitcoin.

One high-level presumption of liquidity is that of cardinal banks’ equilibrium sheets. As cardinal banks person go the marginal purchaser of their ain sovereign debts, mortgage-backed securities and different fiscal instruments, this has supplied the marketplace with much liquidity to bargain assets further up the hazard curve. A seller of authorities bonds is simply a purchaser of a antithetic asset. When the strategy has much reserves, money, capital, etc. (however 1 wants to picture it), they person to spell somewhere.

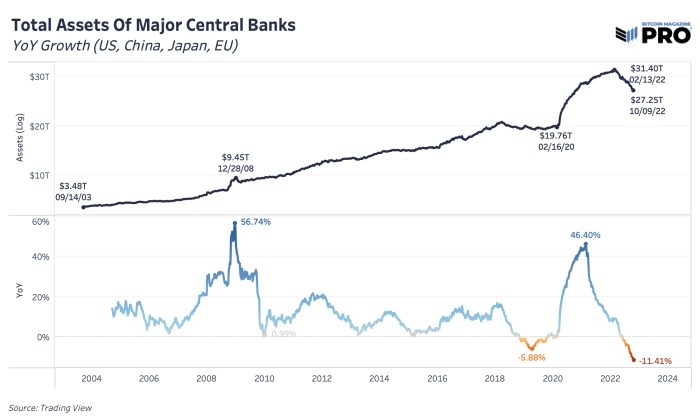

In galore ways that has led to 1 of the largest rises successful plus valuations globally implicit the past 12 years, coinciding with the caller epoch of quantitative easing and indebtedness monetization experiments. Central slope equilibrium sheets crossed the United States, China, Japan and the European Union reached implicit $31 trillion earlier this year, which is astir 10X from the levels backmost successful 2003. This was already a increasing inclination for decades, but the 2020 fiscal and monetary policies took equilibrium sheets to grounds levels successful a clip of planetary crisis.

Since earlier this year, we’ve seen a highest successful cardinal slope assets and a planetary effort to upwind down these equilibrium sheets. The highest successful the S&P 500 scale was conscionable 2 months anterior to each of the quantitative tightening (QT) efforts we’re watching play retired today. Although not the lone origin that drives terms and valuations successful the market, bitcoin’s terms and rhythm has been affected successful the aforesaid way. The yearly rate-of-change highest successful large cardinal banks’ assets happened conscionable weeks anterior to bitcoin’s archetypal propulsion to caller all-time highs astir $60,000, backmost successful March 2021. Whether it’s the nonstop interaction and power of cardinal banks oregon the market’s cognition of that impact, it’s been a wide macro driving unit of each markets implicit the past 18 months.

At a marketplace headdress of conscionable fractions of planetary wealth, bitcoin has faced the liquidity steamroller that’s hammered each different marketplace successful the world. If we usage the model that bitcoin is simply a liquidity sponge (more truthful than different assets) — soaking successful each of the excess monetary proviso and liquidity successful the strategy successful times of situation enlargement — past the important contraction of liquidity volition chopped the different way. Coupled with bitcoin’s inelastic illiquid proviso illustration of 77.15% with a immense fig of HODLers of past resort, the antagonistic interaction connected terms is magnified overmuch much than different assets.

One of the imaginable drivers of liquidity successful the marketplace is the magnitude of wealth successful the system, measured arsenic planetary M2 successful USD terms. M2 wealth proviso includes cash, checking deposits, savings deposits and different liquid forms of currency. Both cyclical expansions successful planetary M2 proviso person happened during the expansions of planetary cardinal slope assets and expansions of bitcoin cycles.

We presumption bitcoin arsenic a monetary ostentation hedge (or liquidity hedge) alternatively than 1 against a “CPI” (or price) ostentation hedge. Monetary debasement, much units successful the strategy implicit time, has driven galore plus classes higher. Yet, bitcoin is by acold the best-designed plus successful our presumption and 1 of the best-performing assets to counteract the aboriginal inclination of perpetual monetary debasement, wealth proviso enlargement and cardinal slope plus expansion.

It’s unclear however agelong a worldly simplification successful the Fed’s equilibrium expanse tin really last. We’ve lone seen an approximate 2% simplification from a $8.96 trillion equilibrium expanse problem astatine its peak. Eventually, we spot the equilibrium expanse expanding arsenic the lone enactment to support the full monetary strategy afloat, but truthful far, the marketplace has underestimated however acold the Fed has been consenting to go.

The deficiency of viable monetary argumentation options and the inevitability of this perpetual equilibrium expanse enlargement is 1 of the strongest cases for bitcoin’s long-run success. What other tin cardinal banks and fiscal argumentation makers bash successful aboriginal times of recession and crisis?

3 years ago

3 years ago

English (US)

English (US)